- Japan

- /

- Consumer Services

- /

- TSE:4714

Riso Kyoiku Group (TSE:4714) Margin Pressure Challenges Bullish Growth Narrative in Latest Earnings

Reviewed by Simply Wall St

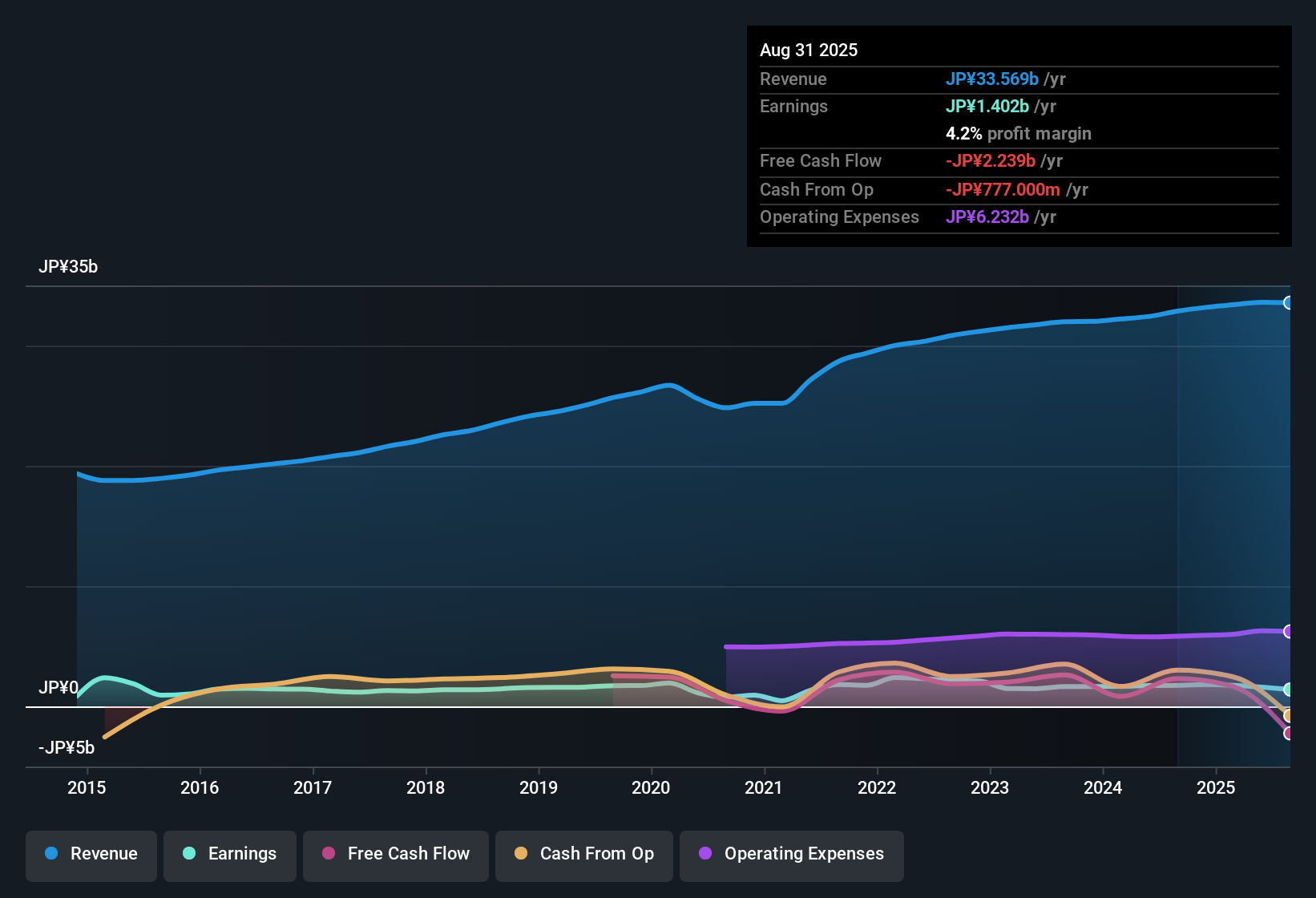

Riso Kyoiku Group (TSE:4714) is forecasting robust expansion, with earnings projected to grow 15.88% per year and revenue expected to rise 5.9% annually, both outpacing Japan’s broader market trends. Still, net profit margin slipped to 4.2% from 5.3% last year, snapping the five-year stretch of 6% annual earnings growth and introducing some near-term margin pressure. As growth forecasts stay positive and the stock’s valuation signals both premium pricing and discounted cash flow upside, investors face a nuanced landscape of potential rewards and highlighted risks.

See our full analysis for Riso Kyoiku Group.Next, we’ll see how these headline numbers compare with the prevailing Simply Wall St narratives and where those stories might get confirmed or challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Slides to 4.2% Amid Ongoing Growth

- The company’s net profit margin dropped to 4.2% from 5.3% a year ago, marking a break from five straight years of 6% per year earnings growth and highlighting a new pocket of margin pressure.

- This supports the prevailing market view that, while growth initiatives are in motion, profitability faces short-term headwinds.

- Bulls frequently point to strong growth in earnings and revenue forecasts; however, the recent negative earnings growth and margin compression show delivering on these forecasts may be more challenging as the expense base grows.

- The narrative around durable growth is tested by this margin drop, as sustained profitability will be key if Riso Kyoiku wants to maintain a premium sector multiple.

P/E Ratio at 25.2x Stands Above Industry and Peers

- Riso Kyoiku is trading at a Price-To-Earnings ratio of 25.2x, outpacing both the industry (17.4x) and peer group (17.1x), illustrating a significant premium from the market.

- This challenges the bullish enthusiasm by signaling that while growth rates are strong, the market is already pricing in much of the upside.

- Bullish investors reference above-average sales and profit forecasts, but this elevated P/E means the company will need to surpass already high expectations for meaningful further re-rating.

- What is notable is that despite the negative earnings growth in the last year, the market continues to assign a substantial premium, suggesting investor focus is on long-term earnings potential over near-term setbacks.

Share Price Discount to DCF Fair Value Despite Premium Multiples

- Despite trading at 25.2x earnings, Riso Kyoiku shares sit at ¥208.00, meaning the current share price is below the DCF fair value of ¥254.20 and presenting a potential valuation gap for investors focused on cash flows.

- This supports the prevailing market view that Riso Kyoiku offers a nuanced mix of risk and opportunity, with premium multiples reflecting optimism but the DCF value indicating possible upside.

- Investors weighing near-term margin pressure against long-term growth prospects may see justification for this discount, especially as profit margin softness and peer valuation gaps persist.

- The stock’s position below DCF fair value gives some credence to the growth thesis, yet how fast margins recover will determine if the cash-flow opportunity can be unlocked.

Have a read of the narrative in full and understand what's behind the forecasts.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Riso Kyoiku Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Riso Kyoiku is priced for strong growth, its shrinking profit margins and earnings setback raise concerns about how stable that trajectory will be.

If you want to prioritize consistency in performance, use our stable growth stocks screener to uncover companies delivering steady earnings and revenue even as others hit turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4714

Riso Kyoiku Group

Operates TOMAS private study Juku schools for elementary, middle, and high school students in Japan.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives