- Japan

- /

- Hospitality

- /

- TSE:4680

Round One Corporation (TSE:4680) Soars 27% But It's A Story Of Risk Vs Reward

Round One Corporation (TSE:4680) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 55% in the last year.

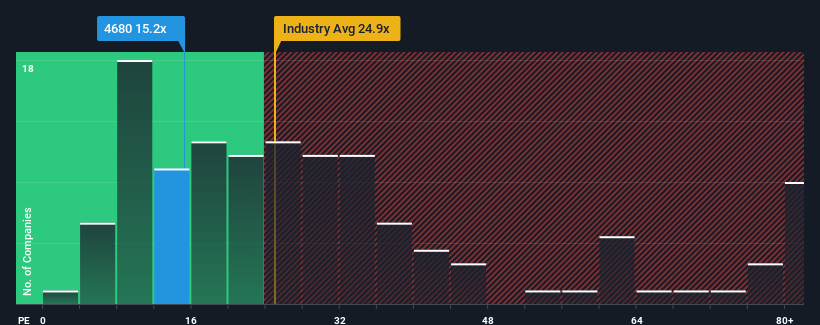

In spite of the firm bounce in price, there still wouldn't be many who think Round One's price-to-earnings (or "P/E") ratio of 15.2x is worth a mention when the median P/E in Japan is similar at about 15x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been advantageous for Round One as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Round One

Is There Some Growth For Round One?

The only time you'd be comfortable seeing a P/E like Round One's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 70% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 13% each year during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 9.6% each year, which is noticeably less attractive.

In light of this, it's curious that Round One's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Round One appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Round One currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Round One with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4680

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives