- Japan

- /

- Hospitality

- /

- TSE:4680

Is Round One (TSE:4680) Quietly Building a Durable Entertainment Moat With Its Japan-Led Sales Mix?

Reviewed by Sasha Jovanovic

- Round One Corporation reported past sales growth for November 2025, with total sales in Japan rising 10.1% year-on-year and U.S. sales increasing 2.9%, supported by strength in karaoke, bowling and amusement.

- The figures highlight how Round One’s mix of entertainment formats across Japan and the U.S. is currently driving broad-based revenue momentum rather than relying on a single segment.

- We’ll now look at how this Japan-led strength in karaoke and bowling could influence Round One’s broader investment narrative for investors.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Round One's Investment Narrative?

For Round One to make sense as a holding, you need to believe in its ability to convert growing foot traffic in bowling, karaoke and amusement into sustainably higher profits in both Japan and the U.S., while keeping returns on equity and capital attractive. The November sales update, with double digit growth in Japan and a smaller uplift in the U.S., reinforces the near term revenue story, but does not on its own remove key questions around margin pressure and earnings volatility that contributed to recent share price swings and a year to date decline. It does, however, strengthen the backdrop for upcoming quarterly results, where management’s guidance, dividend continuity and any comments on U.S. expansion economics remain the critical catalysts. The biggest risk is that cost inflation or weaker utilization erodes returns just as expectations reset higher on this stronger sales print.

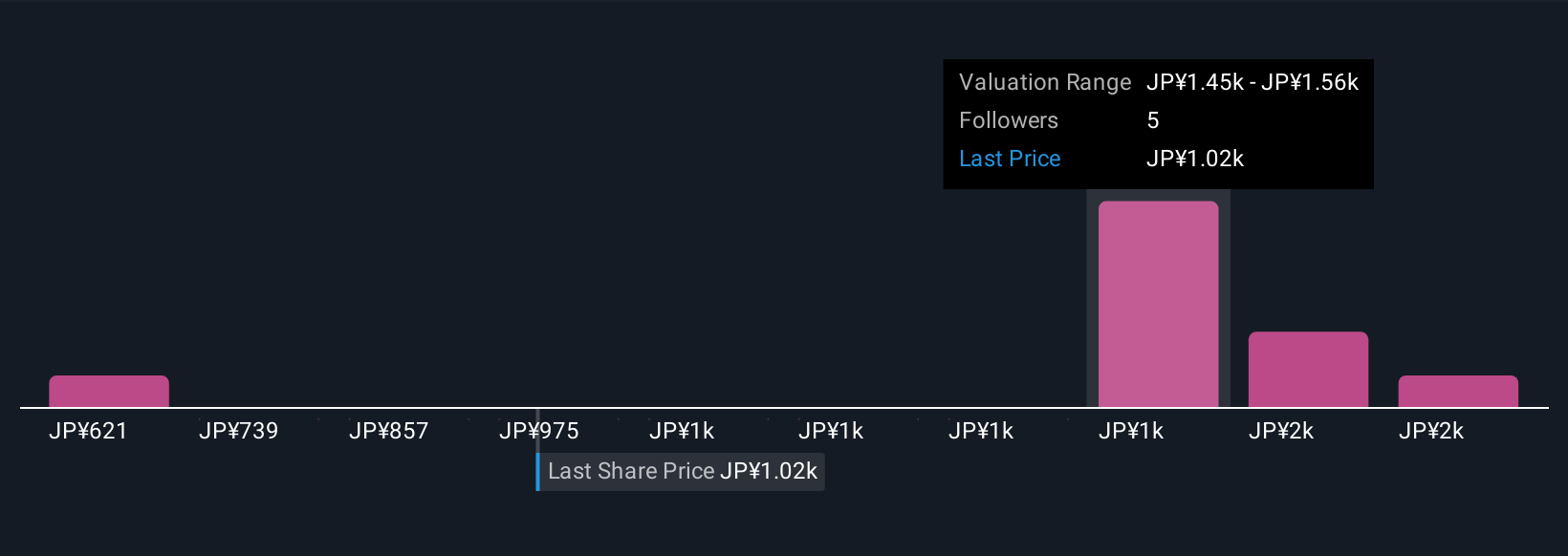

However, investors also need to consider one operational risk that the sales strength doesn’t fully address. Round One's shares have been on the rise but are still potentially undervalued by 29%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on Round One - why the stock might be worth as much as 65% more than the current price!

Build Your Own Round One Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Round One research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Round One research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Round One's overall financial health at a glance.

No Opportunity In Round One?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4680

Very undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026