- United Arab Emirates

- /

- Hospitality

- /

- ADX:AMR

December 2025's Global Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

As global markets navigate a landscape marked by dovish Federal Reserve signals and mixed economic indicators, investors are eyeing opportunities amid the shifting tides. With U.S. jobless claims at their lowest since April and consumer confidence on a downturn, identifying undervalued stocks becomes crucial for those looking to capitalize on potential market inefficiencies. In this context, seeking stocks trading below fair value can be an effective strategy to potentially benefit from future market corrections or growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥81.78 | CN¥161.84 | 49.5% |

| Truecaller (OM:TRUE B) | SEK23.04 | SEK46.05 | 50% |

| Morimatsu International Holdings (SEHK:2155) | HK$8.08 | HK$16.11 | 49.8% |

| Micro Systemation (OM:MSAB B) | SEK63.40 | SEK126.73 | 50% |

| Meitu (SEHK:1357) | HK$7.29 | HK$14.56 | 49.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.392 | €0.77 | 49.4% |

| Exail Technologies (ENXTPA:EXA) | €81.90 | €161.83 | 49.4% |

| China Ruyi Holdings (SEHK:136) | HK$2.41 | HK$4.82 | 50% |

| Atea (OB:ATEA) | NOK151.00 | NOK300.55 | 49.8% |

| Aker BioMarine (OB:AKBM) | NOK88.70 | NOK175.95 | 49.6% |

We're going to check out a few of the best picks from our screener tool.

Americana Restaurants International (ADX:AMR)

Overview: Americana Restaurants International PLC operates a chain of restaurants across several countries in the Middle East and North Africa, with a market cap of AED14.87 billion.

Operations: The company's revenue segments include $1.78 billion from the Major Gulf Cooperation Council (GCC) and $240.72 million from the Lower Gulf, along with $209.83 million generated in North Africa.

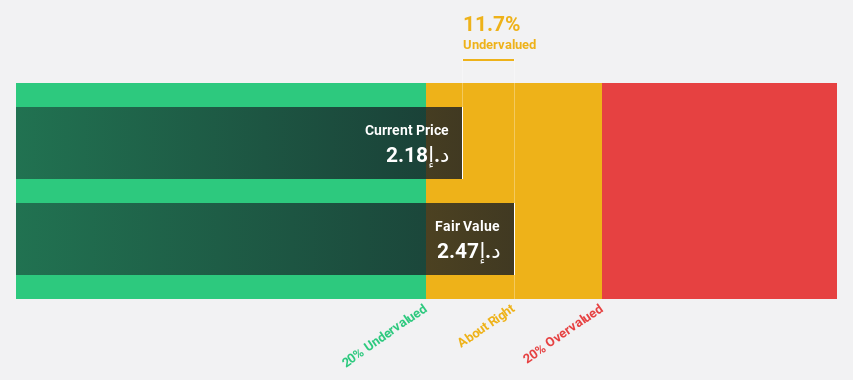

Estimated Discount To Fair Value: 27.3%

Americana Restaurants International is trading at AED1.77, significantly below its estimated fair value of AED2.43, indicating potential undervaluation based on cash flows. Despite earnings growth not being significant, the company's revenue is forecast to grow 9.3% annually, outpacing the AE market's 7.9%. Recent earnings reports show a consistent increase in sales and net income compared to last year, supporting its strong cash flow position amidst high forecasted Return on Equity of 44.4%.

- Our growth report here indicates Americana Restaurants International may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Americana Restaurants International stock in this financial health report.

Kakao Games (KOSDAQ:A293490)

Overview: Kakao Games Corp. operates a mobile and PC online game service platform for gamers worldwide, with a market cap of ₩1.46 trillion.

Operations: The company's revenue segments include Computer Graphics, generating ₩499.35 million.

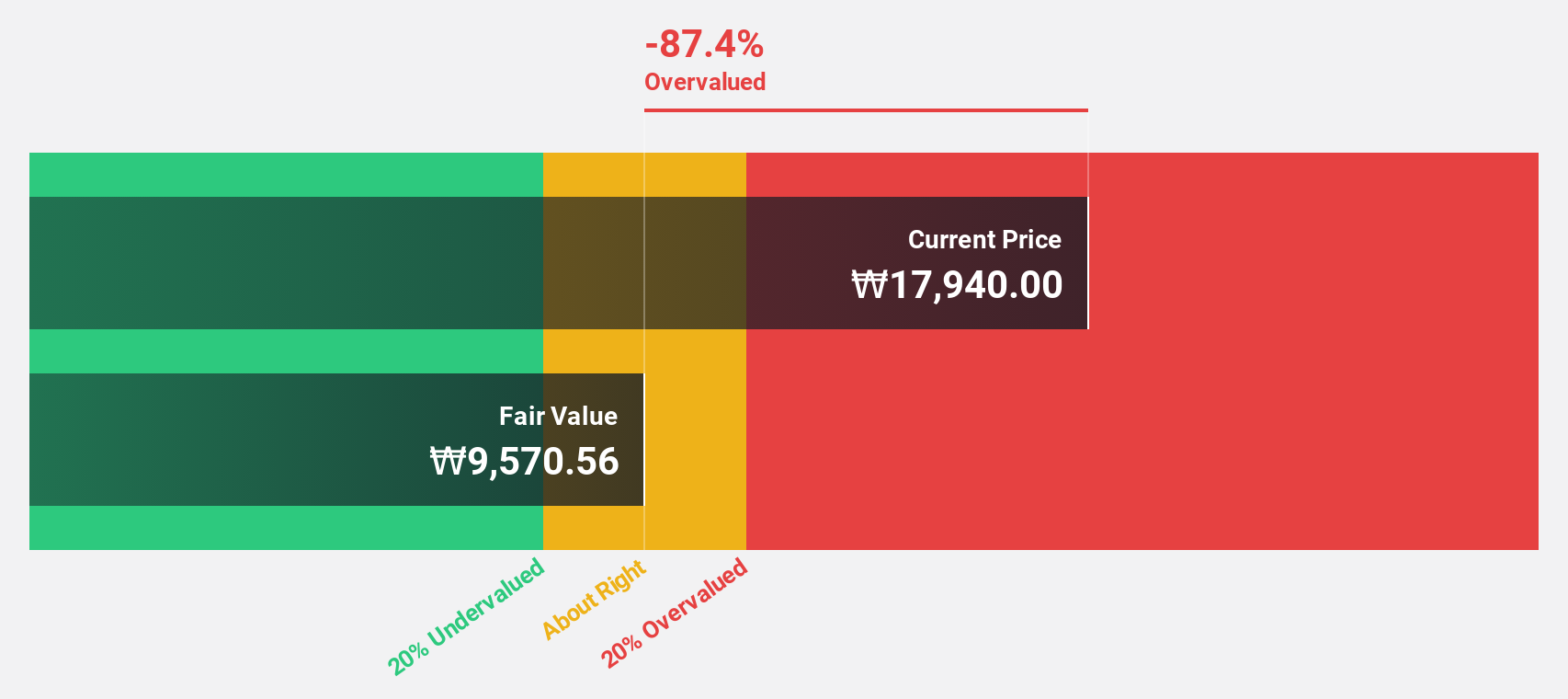

Estimated Discount To Fair Value: 26.6%

Kakao Games is trading at ₩16,680, significantly below its estimated fair value of ₩22,733.26, indicating potential undervaluation based on cash flows. Revenue is projected to grow 23.1% annually, surpassing the KR market's 10.4%. Despite a low forecasted Return on Equity of 4.1%, the company is expected to become profitable within three years with earnings growth forecasted at over 120% per year. Recent strategic alliances and private placements enhance its growth prospects further.

- In light of our recent growth report, it seems possible that Kakao Games' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Kakao Games' balance sheet health report.

Round One (TSE:4680)

Overview: Round One Corporation operates indoor leisure complex facilities and has a market cap of ¥256.35 billion.

Operations: The company's revenue is primarily generated from its operations in Japan, amounting to ¥105.46 billion, and the United States, contributing ¥76.22 billion.

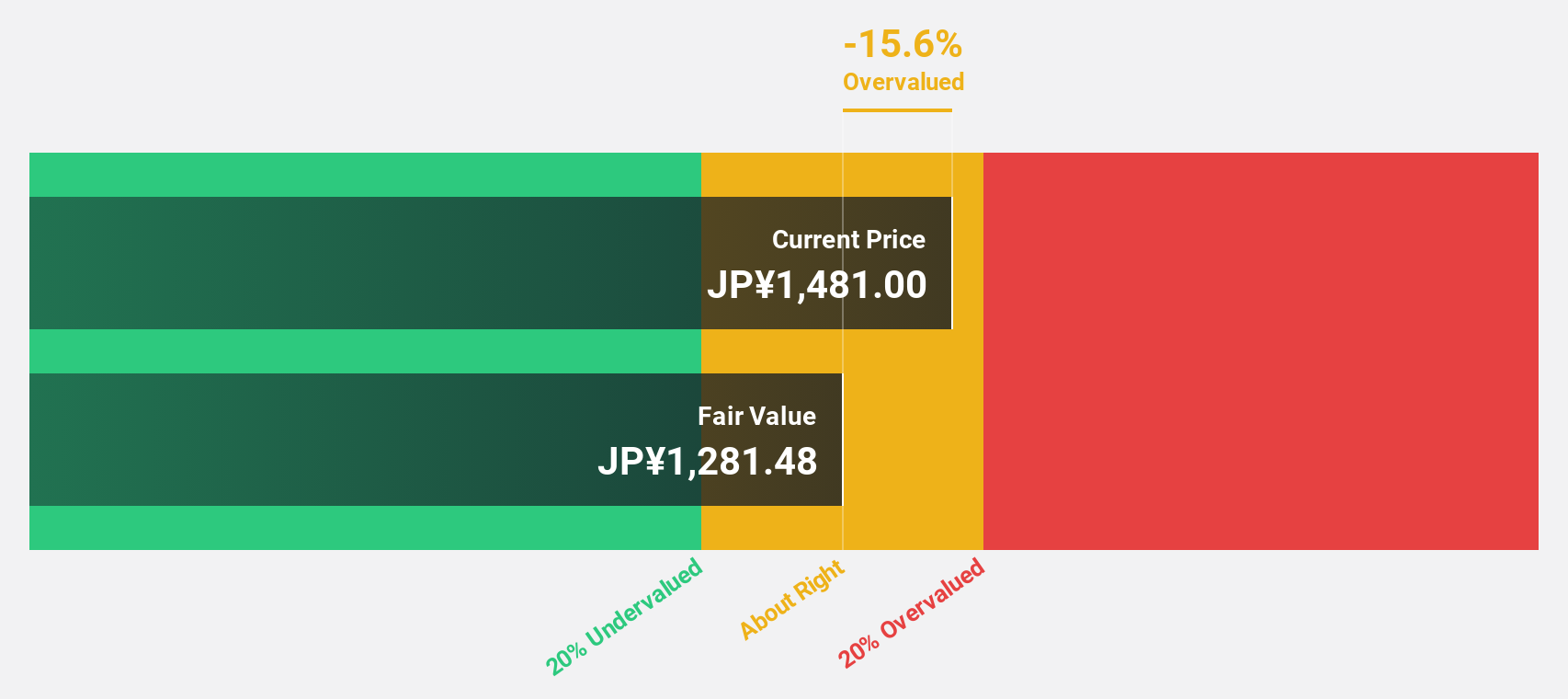

Estimated Discount To Fair Value: 28.5%

Round One Corporation is trading at ¥1,090, below its estimated fair value of ¥1,525.1, suggesting undervaluation based on cash flows. The company's earnings are expected to grow 13.4% annually, outpacing the JP market's 8.3%, with a projected high return on equity of 25% in three years. Despite recent volatility in share price and mixed sales performance across regions, analysts anticipate a potential stock price increase of 34.4%.

- According our earnings growth report, there's an indication that Round One might be ready to expand.

- Click here to discover the nuances of Round One with our detailed financial health report.

Summing It All Up

- Explore the 502 names from our Undervalued Global Stocks Based On Cash Flows screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:AMR

Americana Restaurants International

Operates a chain of restaurant in the United Arab Emirates, Saudi Arabia, Kuwait, Egypt, Qatar, Kazakhstan, Bahrain, Jordan, Oman, Lebanon, Morocco, North Africa, and Iraq.

Solid track record with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026