- Japan

- /

- Hospitality

- /

- TSE:3563

How S&P Japan Mid Cap 100 Inclusion Could Shape Food & Life Companies' (TSE:3563) Investment Appeal

Reviewed by Sasha Jovanovic

- Food & Life Companies Ltd. (TSE:3563) was recently added to the S&P Japan Mid Cap 100 index, elevating its presence among Japanese public companies.

- This inclusion often prompts increased activity from index-tracking funds and institutional investors, potentially amplifying liquidity and attention for the company.

- With Food & Life Companies now part of the S&P Japan Mid Cap 100, we’ll examine how index inclusion influences its investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Food & Life Companies' Investment Narrative?

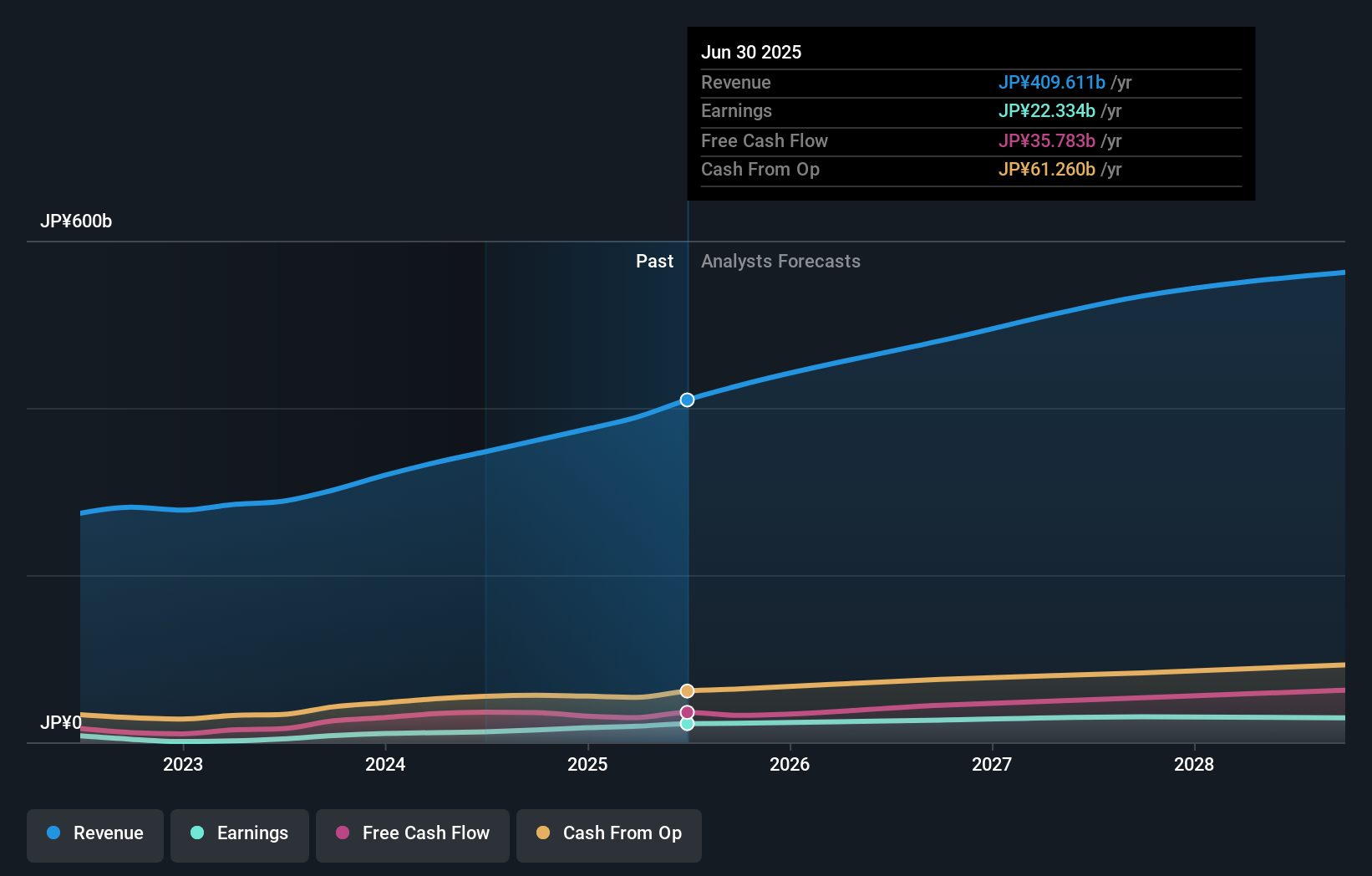

For anyone considering Food & Life Companies, the appeal often lies in its consistent profit expansion, high return on equity, and robust revenue growth that has outpaced both the Japanese hospitality sector and the broader market in recent years. The recent addition to the S&P Japan Mid Cap 100 marks a meaningful milestone, possibly attracting more institutional interest and increasing liquidity. This change could support momentum behind existing catalysts such as rising earnings guidance, a higher dividend, and ongoing share buybacks. That said, recent price moves suggest the index inclusion was at least partly anticipated, so the immediate impact may be limited. The most relevant risks remain the company's premium valuation and short-term share price volatility, which could be amplified if institutional flows raise expectations and then subside. On the flipside, investors should keep an eye on valuation risks if this momentum slows.

Food & Life Companies' shares have been on the rise but are still potentially undervalued by 37%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Food & Life Companies - why the stock might be worth as much as 59% more than the current price!

Build Your Own Food & Life Companies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Food & Life Companies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Food & Life Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Food & Life Companies' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3563

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives