- Japan

- /

- Hospitality

- /

- TSE:2157

3 Growth Companies With Insider Ownership Up To 32%

Reviewed by Simply Wall St

As global markets navigate a mixed landscape of fluctuating consumer confidence and economic indicators, major stock indexes have shown moderate gains, particularly driven by large-cap growth stocks. In this environment, companies with high insider ownership can be appealing to investors as they often signal strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Foosung (KOSE:A093370)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Foosung Co., Ltd., along with its subsidiaries, manufactures and sells chemical products for various industries including automotive, iron and steel, semiconductor, construction, and environmental sectors in South Korea, with a market cap of ₩519.65 billion.

Operations: The company's revenue is primarily derived from the Fluorine Compounds Sector, contributing ₩288.93 billion, and the Chemical Engineering Division, which adds ₩162.84 billion.

Insider Ownership: 32.9%

Foosung's revenue is forecast to grow at 16.8% annually, outpacing the KR market's 9%. Despite past shareholder dilution and a high debt level, the company is expected to achieve profitability within three years with earnings growth of 73.63% per year. Recent results show improved financial performance, with nine-month sales rising to KRW 2.08 billion from KRW 1.14 billion and net income reaching KRW 6.54 billion compared to a significant loss previously.

- Dive into the specifics of Foosung here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Foosung's current price could be inflated.

Norva24 Group (OM:NORVA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Norva24 Group AB (Publ) offers underground infrastructure maintenance services in Northern Europe and has a market cap of SEK4.94 billion.

Operations: The company generates revenue primarily from its Waste Management segment, which amounts to NOK3.50 billion.

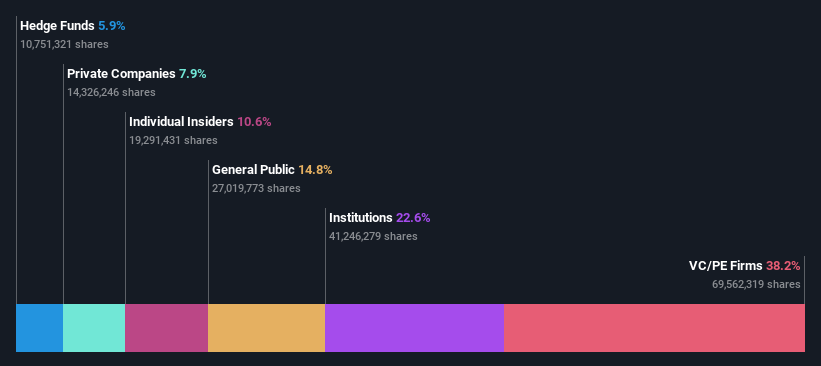

Insider Ownership: 10.6%

Norva24 Group shows strong growth potential, with revenue expected to rise 7.7% annually, surpassing the Swedish market's average. Insider confidence is evident as substantial shares were bought recently without significant sales. Despite a dip in net income to NOK 49 million for Q3 2024, analysts anticipate a stock price increase of 30.4%. However, its return on equity forecast remains modest at 11.7%, and profit growth is projected at an impressive 21.2% annually.

- Take a closer look at Norva24 Group's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Norva24 Group's share price might be too pessimistic.

Koshidaka Holdings (TSE:2157)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Koshidaka Holdings Co., Ltd. operates a karaoke business and a bath house business both in Japan and internationally, with a market cap of ¥93.22 billion.

Operations: The company's revenue segments include ¥61.25 billion from karaoke and ¥1.59 billion from real estate management.

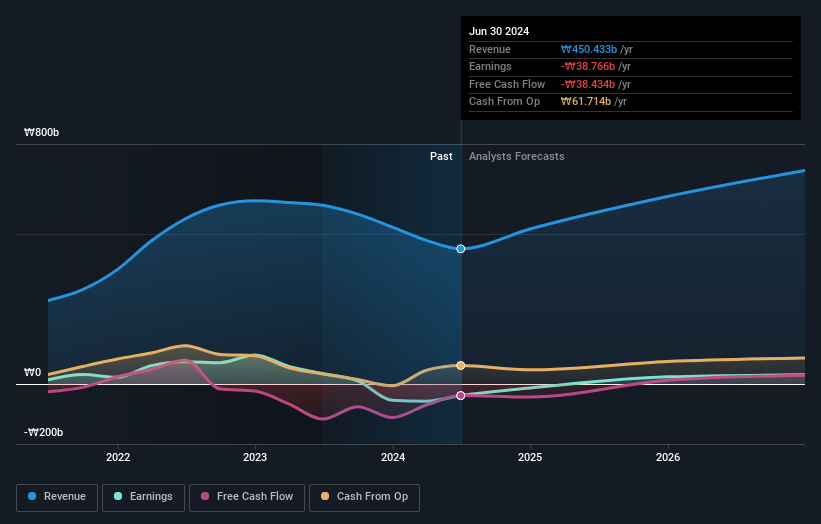

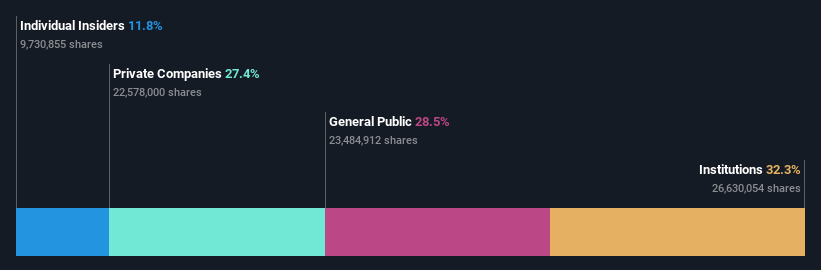

Insider Ownership: 11.8%

Koshidaka Holdings is poised for growth with forecasted annual earnings and revenue increases of 13.9% and 14.1%, respectively, outpacing the Japanese market averages. The company offers a competitive price-to-earnings ratio of 13.8x, below the industry average, indicating good value relative to peers. Despite an unstable dividend history, recent guidance suggests increased payouts for fiscal 2025. Insider activity remains stable with no significant buying or selling reported recently, but share price volatility persists.

- Click here to discover the nuances of Koshidaka Holdings with our detailed analytical future growth report.

- Our expertly prepared valuation report Koshidaka Holdings implies its share price may be lower than expected.

Where To Now?

- Discover the full array of 1497 Fast Growing Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Koshidaka Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2157

Koshidaka Holdings

Operates a karaoke business and a bath house business in Japan and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives