- South Korea

- /

- Food

- /

- KOSE:A000070

3 Reliable Dividend Stocks Offering Yields Up To 6.5%

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes approaching record highs and broad-based gains, investors are navigating a landscape marked by geopolitical tensions and evolving economic policies. In such an environment, dividend stocks can offer stability and income potential, making them appealing options for those seeking reliable returns amid market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.44% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.55% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.67% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.25% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.45% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.35% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.10% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.78% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1957 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

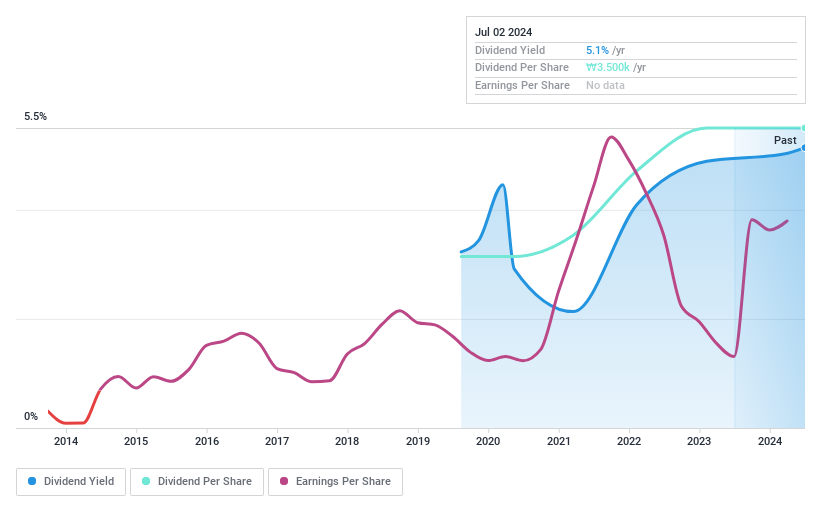

Samyang Holdings (KOSE:A000070)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samyang Holdings Corporation, along with its subsidiaries, operates in the chemical, food, packaging, pharmaceutical, and various other sectors across South Korea and internationally, with a market cap of approximately ₩532.96 billion.

Operations: Samyang Holdings Corporation generates revenue through its operations in the chemical, food, packaging, and pharmaceutical sectors across South Korea and various international markets.

Dividend Yield: 5%

Samyang Holdings' dividend payments are well-supported by cash flows, with a cash payout ratio of 27.3% and an earnings payout ratio of 65.2%. Its dividend yield is competitive in the Korean market, ranking in the top quartile. Despite recent profit margin declines and only five years of dividend history, dividends have been stable and growing with little volatility. The stock trades at a discount to its estimated fair value, suggesting potential value for investors.

- Take a closer look at Samyang Holdings' potential here in our dividend report.

- Our valuation report unveils the possibility Samyang Holdings' shares may be trading at a premium.

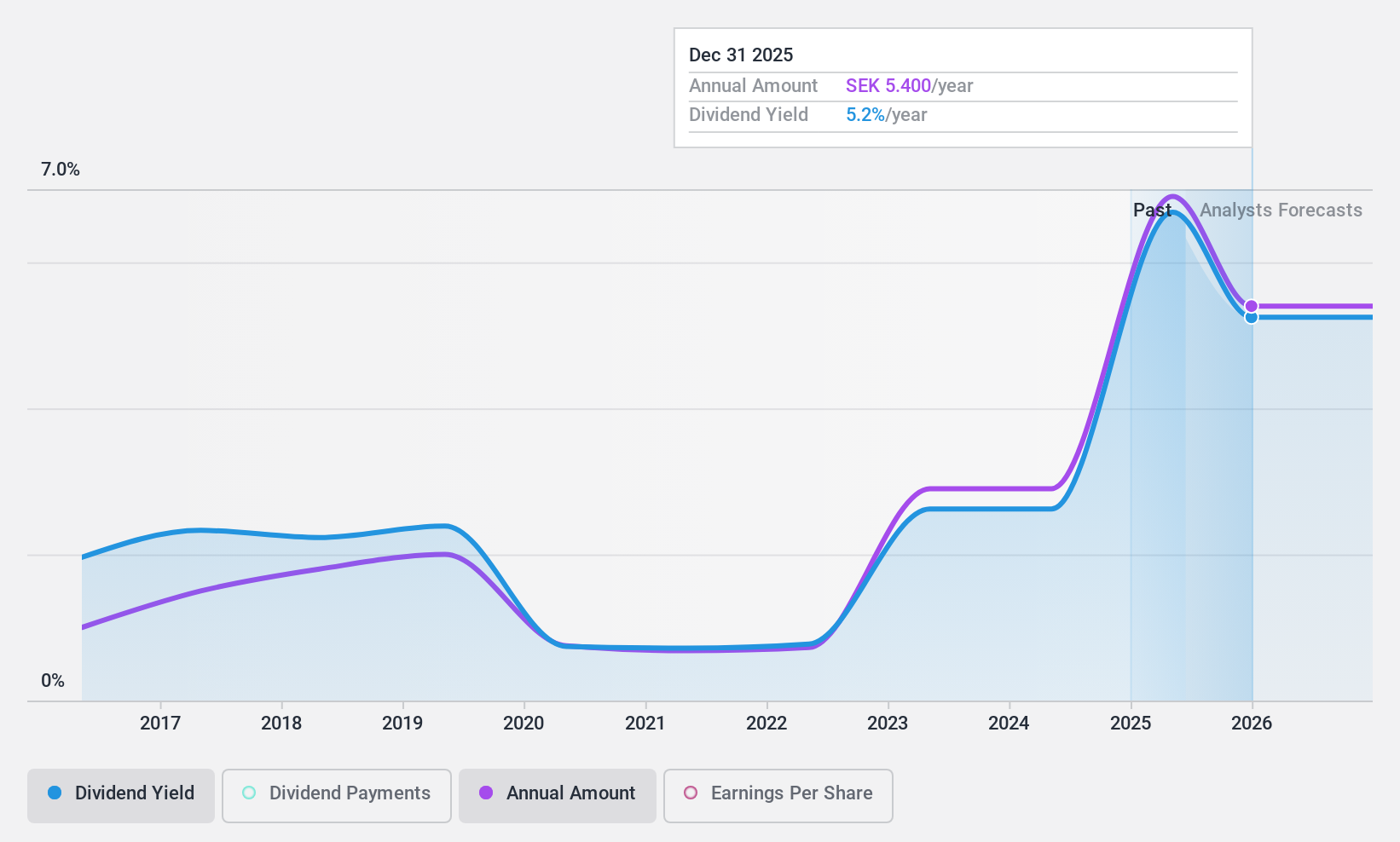

BioGaia (OM:BIOG B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BioGaia AB (publ) is a healthcare company that offers probiotic products globally, with a market cap of SEK10.66 billion.

Operations: BioGaia AB generates revenue through its key segments, Pediatrics and Adult Health, with SEK1.04 billion from Pediatrics and SEK306.08 million from Adult Health.

Dividend Yield: 6.5%

BioGaia's dividend yield is among the top 25% in Sweden, but its sustainability is questionable due to a high cash payout ratio of 191.2%, indicating dividends aren't well-covered by cash flows. Earnings cover the dividend with a reasonable payout ratio of 57%, yet payments have been unreliable and volatile over the past decade. Recent earnings show decreased net income for Q3, impacting overall financial stability and potentially affecting future dividend reliability.

- Navigate through the intricacies of BioGaia with our comprehensive dividend report here.

- The valuation report we've compiled suggests that BioGaia's current price could be inflated.

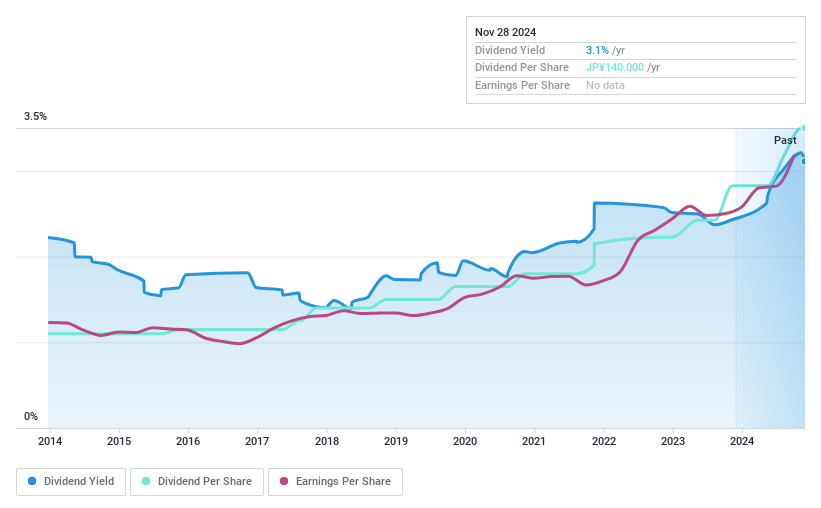

Kato Sangyo (TSE:9869)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kato Sangyo Co., Ltd. operates in the general food wholesaling business both in Japan and internationally, with a market cap of ¥141.13 billion.

Operations: Kato Sangyo Co., Ltd.'s revenue segments include the Room Temperature Distribution Business at ¥717.02 billion, Liquor Logistic Business at ¥245.21 billion, Low Temperature Logistic Business at ¥114.36 billion, and Overseas Segment at ¥89.33 billion.

Dividend Yield: 3.1%

Kato Sangyo's dividend payments have been stable and reliable over the past decade, supported by a low payout ratio of 25.8%, ensuring coverage by both earnings and cash flows. Despite a yield of 3.09% being below Japan's top quartile, strong earnings growth of 20.5% last year enhances sustainability prospects. The company trades at a significant discount to fair value, although large one-off items may affect financial results interpretation in the short term.

- Delve into the full analysis dividend report here for a deeper understanding of Kato Sangyo.

- Our valuation report unveils the possibility Kato Sangyo's shares may be trading at a discount.

Make It Happen

- Navigate through the entire inventory of 1957 Top Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000070

Samyang Holdings

Together its subsidiaries, engages in chemical, food, packaging, pharmaceutical, and other businesses in South Korea, China, Japan, Other Asian countries, Europe, and internationally.

Excellent balance sheet average dividend payer.