- Japan

- /

- Food and Staples Retail

- /

- TSE:8267

Aeon (TSE:8267) One-Off ¥59.3B Loss Challenges Bullish Growth Narrative

Reviewed by Simply Wall St

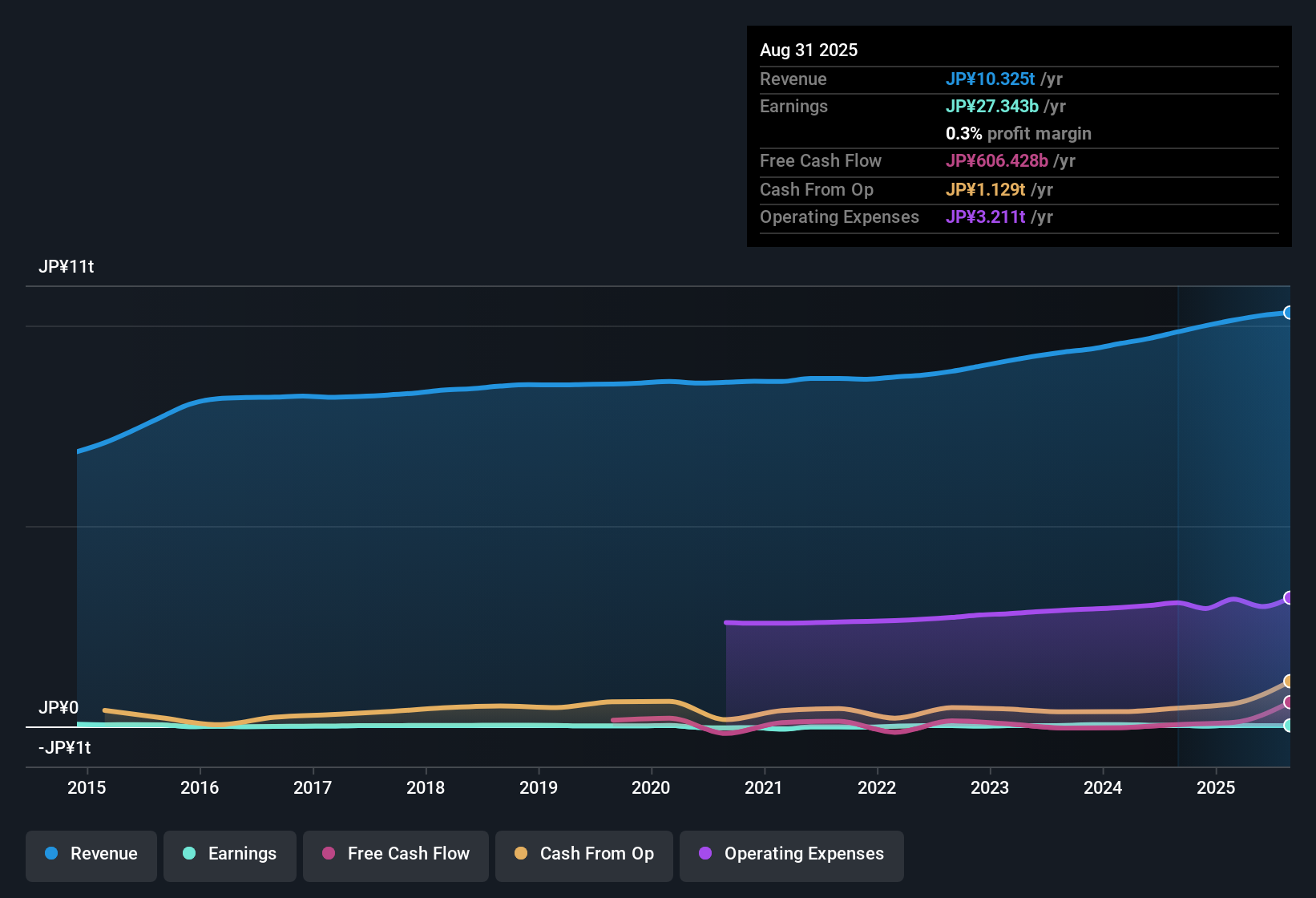

Aeon (TSE:8267) reported a significant one-off loss of ¥59.3 billion for the twelve months ending 31 August 2025, which weighed on the overall results. Net profit margins remained stable at 0.3%, matching the previous year. Earnings grew by 8.4%, underperforming the five-year average growth of 55.7% per year. Looking ahead, Aeon is forecasting robust annual earnings growth of 25.3% and revenue expansion of 4.9%. Both of these projections outpace the broader Japanese market, but valuation concerns and recent financial quality issues could shape how investors view the outlook.

See our full analysis for Aeon.Next, let’s see how these results compare to the prevailing market narratives and where expectations might get reset.

See what the community is saying about Aeon

Margins Remain Thin Despite Digital Push

- Net profit margins are holding at 0.3%, unchanged from last year, indicating stability but leaving little room for error in a competitive landscape.

- Consensus narrative highlights that while digital transformation and private label growth are driving modest improvements in margins, persistent cost pressures from labor and energy, along with fierce price competition, are capping any gains.

- Analysts expect profit margins to grow to just 0.6% in three years, which remains far below industry leaders.

- Slow adaptation to e-commerce and the ongoing need for heavy investment in automation limit the pace at which margins can expand.

Expansion Into Riskier Markets Raises Questions

- Aeon's aggressive entry into Southeast Asia, especially Vietnam, has led to governance issues and a notable ¥59.3 billion one-off loss, underlining the operational risks of growth outside Japan.

- Consensus narrative stresses that international diversification is becoming a double-edged sword. While growth markets like Vietnam and Malaysia offer upside, they also expose Aeon to volatile earnings and the potential for further write-downs.

- Unexpected losses at the Vietnam subsidiary and continued heavy expansion investments mean profit volatility could persist.

- Despite recent rebounds, management will need to show a steady track record in newer markets before investors reward the stock with a higher valuation.

Valuation Premium Outpaces Business Momentum

- With shares trading at 2055.0, Aeon's current price is not only 46.7% above the consensus target of 1342.86 but also far above its DCF fair value of 719.09. This suggests optimism has outrun underlying improvements.

- According to the consensus narrative, analysts expect underlying business trends to improve, but the market's current pricing factors in aggressive future gains that may be tough to achieve.

- Even by 2028, projected earnings growth implies a price-to-earnings ratio of 48.1x, well over the sector's average of 13.6x.

- In contrast, the relatively sluggish pace of margin expansion and steady share dilution cast doubt on the reward for shareholders at this valuation.

- For investors questioning whether these valuation gaps reflect justified optimism, analysts invite a closer look at how Aeon's business fundamentals stack up against what the price implies. 📊 Read the full Aeon Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Aeon on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to interpret the results through your own lens? Take just a couple of minutes to shape your personal market view and add your perspective. Do it your way.

A great starting point for your Aeon research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Aeon's lofty valuation, thin margins, and unpredictable earnings from global expansion make it hard to justify the current optimism reflected in the share price.

If you’re troubled by expensive stocks that lack strong fundamentals, discover better-priced opportunities with strong upside using these 877 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8267

Aeon

Operates in the retail industry in Japan, China, ASEAN countries, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives