- Japan

- /

- Food and Staples Retail

- /

- TSE:8142

Toho (TSE:8142) Q3: Margin Gain to 1.8% Challenges Low-Profitability Narrative

Reviewed by Simply Wall St

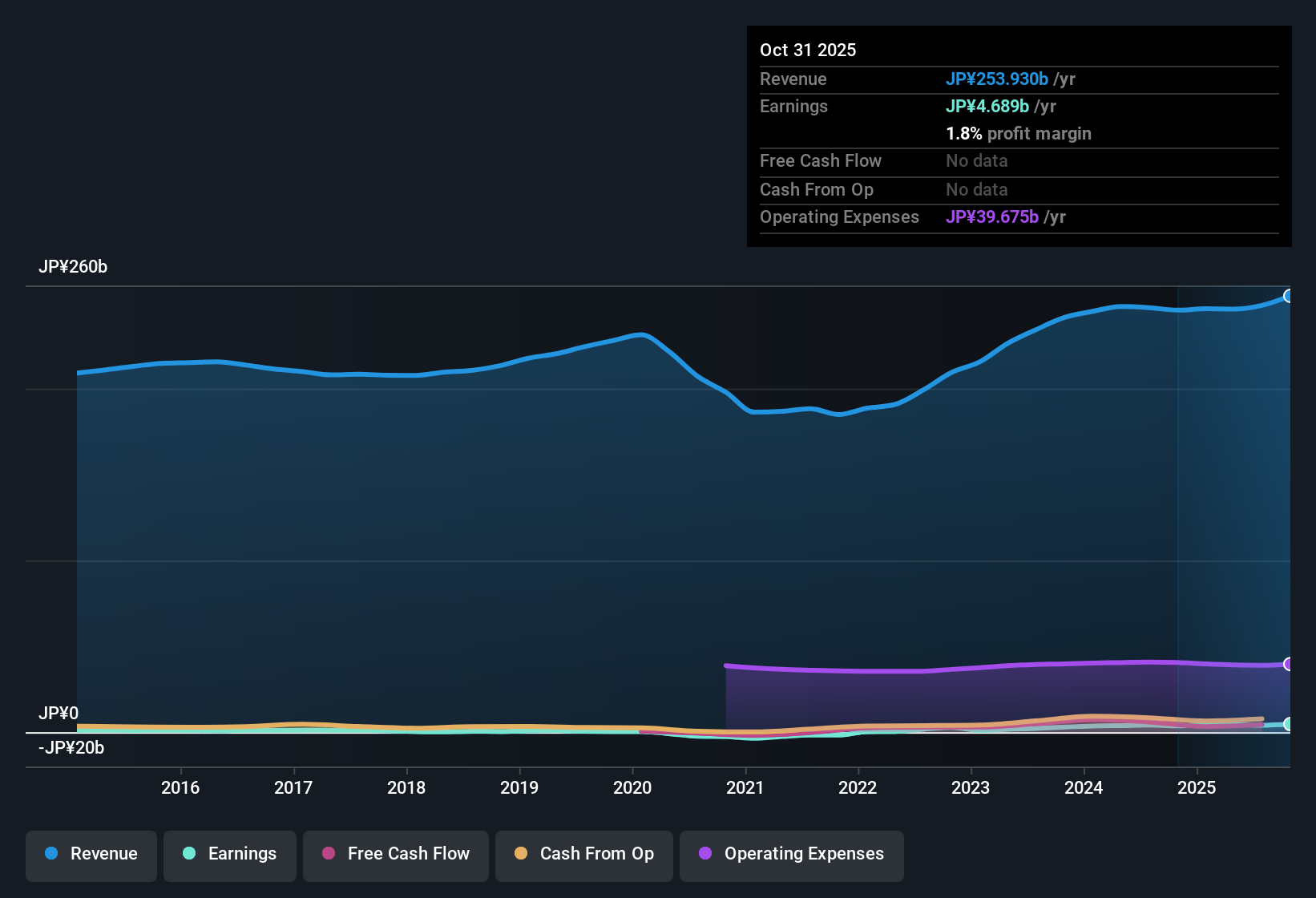

Toho (TSE:8142) has just posted a punchy Q3 2026 update, with revenue of ¥66.2 billion and basic EPS of ¥161.7, setting the tone for a year where reported earnings have grown 28.5% over the last 12 months as net profit margins edged up to 1.8%. The company has seen quarterly revenue move from ¥60.7 billion in Q3 2025 to ¥66.2 billion in Q3 2026, while quarterly EPS has climbed from ¥95.5 to ¥161.7 over the same period, giving investors a clear sense that profitability is tracking higher across the income statement. Overall, the latest figures point to a business that is converting more of its top line into profit, giving margins a welcome lift.

See our full analysis for Toho.With the latest numbers on the table, the next step is to see how this margin story lines up with the dominant narratives around Toho and where the data might be quietly shifting the conversation.

Curious how numbers become stories that shape markets? Explore Community Narratives

28.5% earnings growth but slower than five year pace

- Net income over the last 12 months reached ¥4,689 million, up 28.5% from a year earlier, compared with a much faster five year average earnings growth rate of 58.6% per year.

- What stands out for bullish investors is that solid trailing growth sits alongside improving profitability, yet the latest 28.5% annual earnings increase lags the much stronger 58.6% five year trend, which suggests:

- The combination of ¥253.9 billion in trailing revenue and ¥4,689 million in net income still underpins a growing business, even if the most recent year was not as explosive as the longer term record.

- The high quality label on past earnings is consistent with steady growth and a positive margin trend, but the gap between 28.5% one year growth and 58.6% per year over five years reminds investors that sustaining that historic pace is not guaranteed every year.

Net margin edges up to 1.8%

- Trailing net profit margin has moved from 1.5% to 1.8% over the last 12 months on ¥253.9 billion of revenue and ¥4,689 million of net income, indicating the business is keeping a slightly larger share of sales as profit.

- From a more cautious, bearish angle, critics point out that even with this improvement the margin still sits under 2%, which means:

- A thin 1.8% margin can be sensitive to cost pressures or weaker demand, so any reversal could quickly eat into net income despite the recent uptick from 1.5%.

- The fact that margin gains are modest relative to total sales reinforces that Toho still operates in a structurally low margin area of consumer retailing, where efficiency and scale need to be maintained to protect profitability.

Valuation sits well below DCF fair value

- At a share price of ¥3,795, Toho trades on a trailing P E of 8.6 times, below both peers at 12 times and the JP Consumer Retailing industry at 13.2 times, and roughly 64.8% under the stated DCF fair value of ¥10,779.60.

- Viewed through a bullish lens, this gap between price and valuation metrics heavily supports a value case, yet it is tempered by the company’s income profile, because:

- The combination of below peer and industry P E ratios and a DCF fair value of ¥10,779.60 versus ¥3,795 suggests the market is not fully pricing in the 28.5% earnings growth and 1.8% margin achieved over the last year.

- An unstable dividend track record, flagged in the analysis, may help explain why some investors are hesitant to close that valuation gap even though trailing profitability and growth look better than what the current multiple implies.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Toho's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Toho is growing, its sub 2% net margin and slowdown from its five year earnings pace highlight how fragile and uneven its profit engine remains.

If that kind of thin, inconsistent profitability worries you, use our stable growth stocks screener (2103 results) to focus on companies already proving they can compound earnings more predictably through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Toho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8142

Toho

Through its subsidiaries, engages in the food wholesale, cash and carry, and supermarket businesses primarily in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)