- Japan

- /

- Food and Staples Retail

- /

- TSE:8142

Global Dividend Stocks To Consider In August 2025

Reviewed by Simply Wall St

Amidst a backdrop of slowing job growth, trade policy uncertainties, and fluctuating inflation rates, global markets have experienced notable declines, with U.S. stock indexes posting significant losses due to renewed tariffs and weak economic data. As investors navigate these turbulent waters, dividend stocks can offer a measure of stability by providing regular income streams that may help cushion against market volatility.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.24% | ★★★★★★ |

| NCD (TSE:4783) | 4.03% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.10% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.05% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

| Daicel (TSE:4202) | 4.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.67% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.61% | ★★★★★★ |

Click here to see the full list of 1460 stocks from our Top Global Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

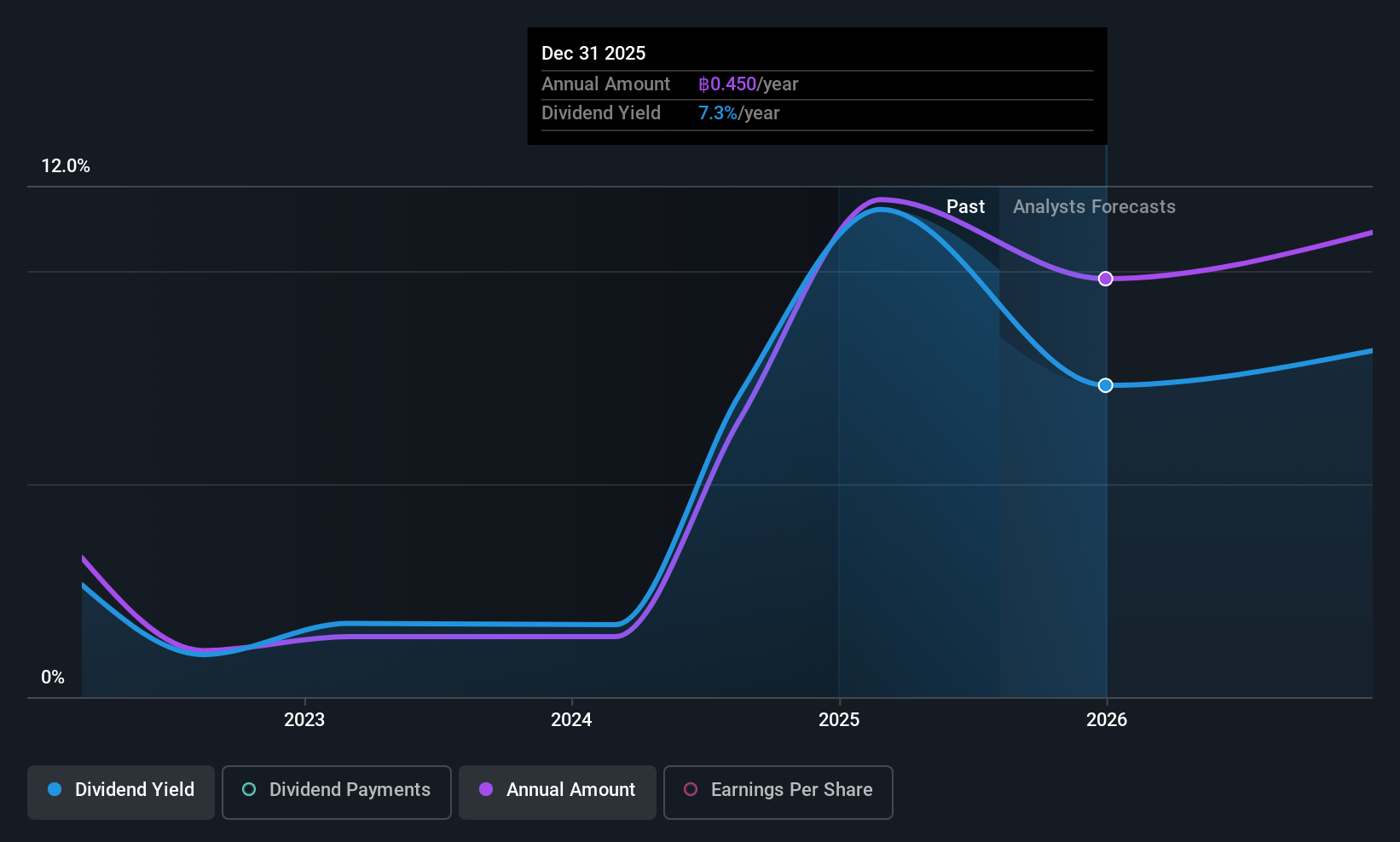

Thai Union Feedmill (SET:TFM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thai Union Feedmill Public Company Limited, with a market cap of THB5.40 billion, manufactures and distributes animal feeds across Thailand, Sri Lanka, Pakistan, Indonesia, and other international markets.

Operations: Thai Union Feedmill Public Company Limited generates revenue through the manufacture and distribution of animal feeds in Thailand, Sri Lanka, Pakistan, Indonesia, and various international markets.

Dividend Yield: 9.9%

Thai Union Feedmill offers a compelling dividend yield of 9.91%, ranking in the top 25% of Thai market payers. Despite trading at a significant discount of 47.6% below estimated fair value, its dividend history is less stable, with payments only made for three years and showing volatility. Recent earnings growth is robust, with net income rising to THB 193.72 million in Q2 2025 from THB 129.39 million a year prior, supporting current payout ratios covered by both earnings (84%) and cash flows (81.1%).

- Delve into the full analysis dividend report here for a deeper understanding of Thai Union Feedmill.

- According our valuation report, there's an indication that Thai Union Feedmill's share price might be on the cheaper side.

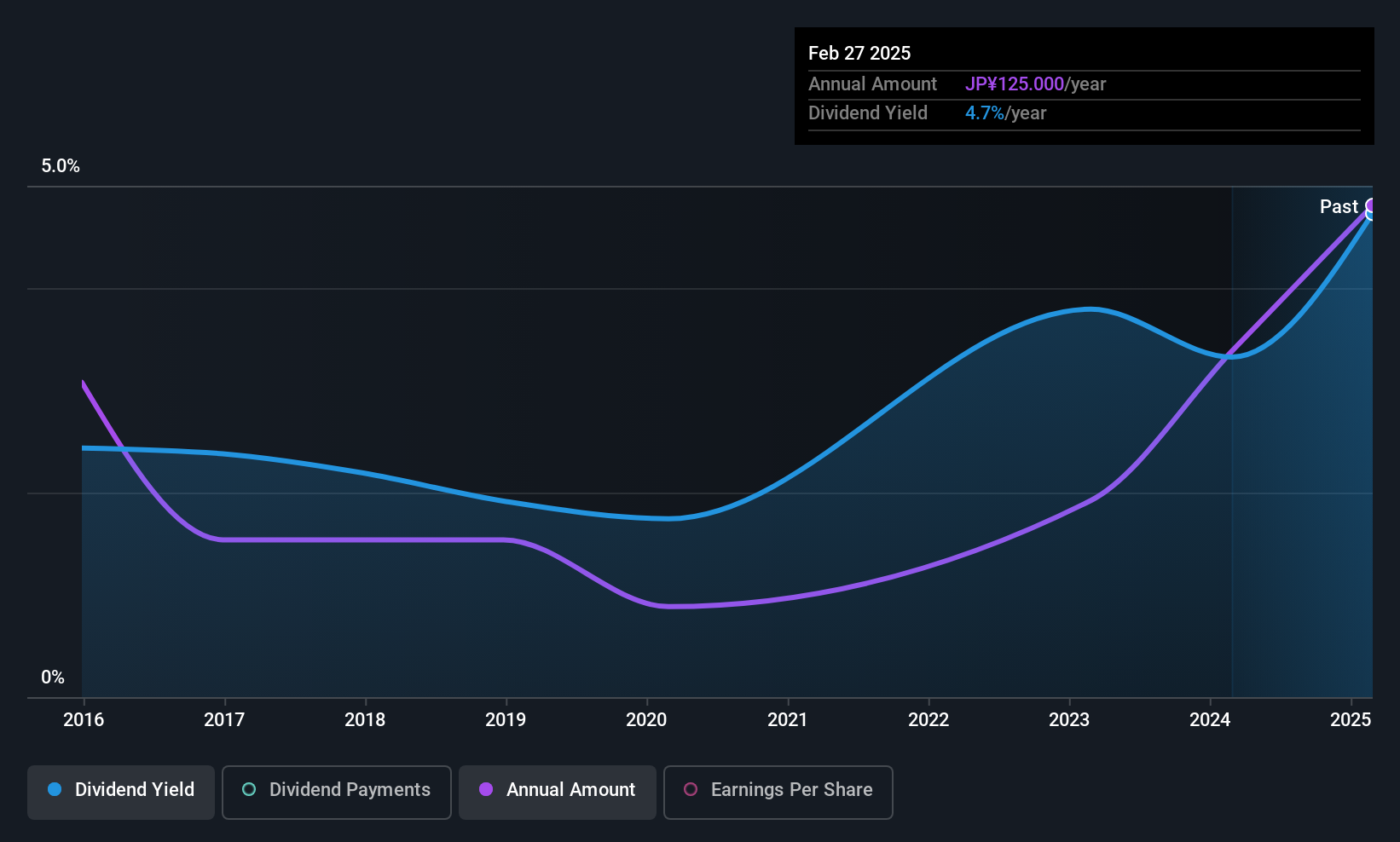

Sanyo Shokai (TSE:8011)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sanyo Shokai Ltd. is a Japanese company involved in the manufacture and sale of men's and women's clothing and accessories, with a market cap of ¥32.54 billion.

Operations: Sanyo Shokai Ltd. generates its revenue primarily from the fashion-related segment, amounting to ¥59.66 billion.

Dividend Yield: 4.5%

Sanyo Shokai's dividend yield of 4.49% places it among the top 25% in Japan, supported by a payout ratio of 41.7%, indicating coverage by earnings and cash flows. However, its dividend history is marked by volatility and unreliability over the past decade. Recent activist pressure from Sapphireterra Capital suggests enhancing shareholder value through capital efficiency improvements and potential share buybacks totaling ¥16 billion over three years, alongside strategic positioning considerations with Mitsui & Co., Ltd.

- Unlock comprehensive insights into our analysis of Sanyo Shokai stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Sanyo Shokai shares in the market.

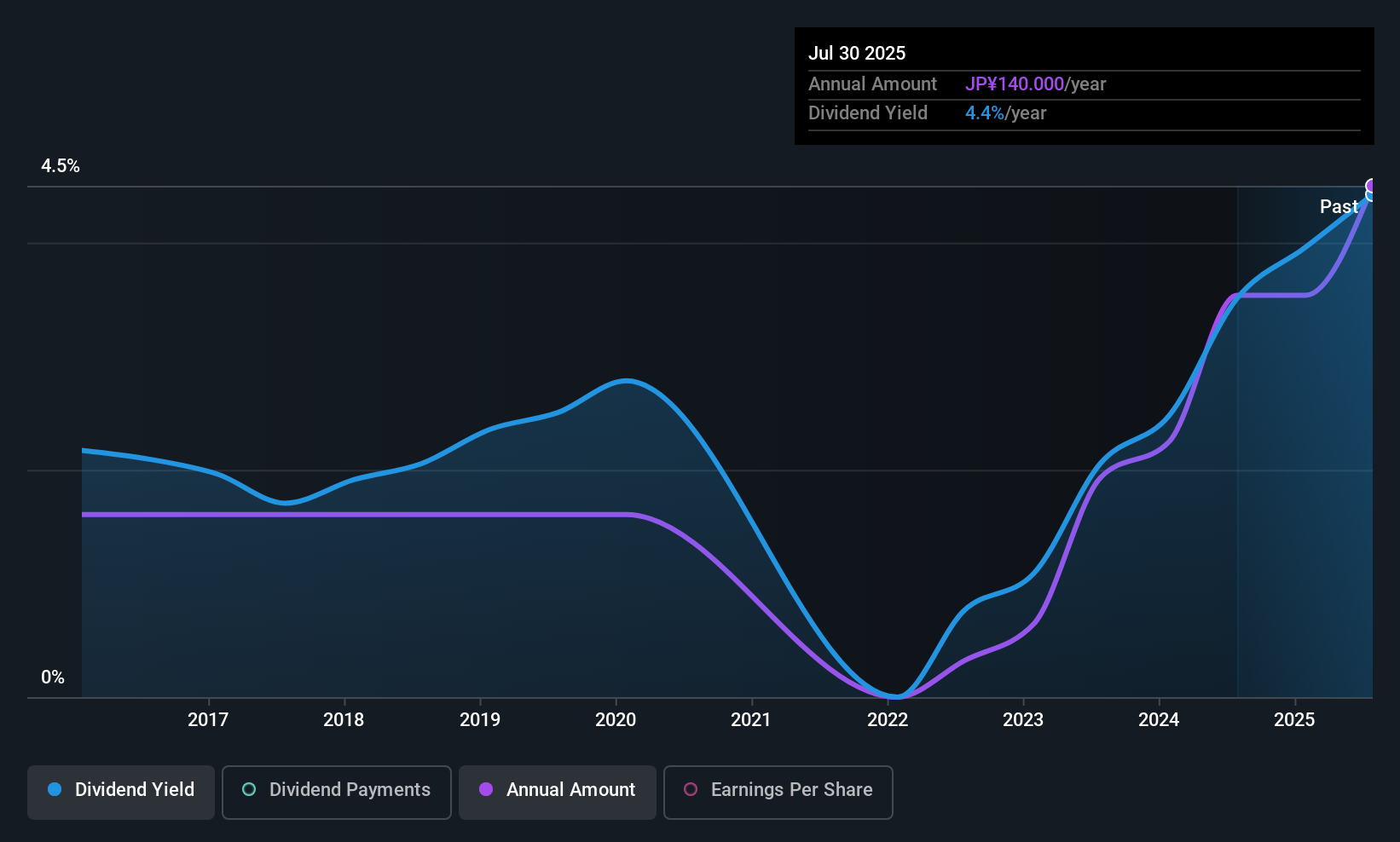

Toho (TSE:8142)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toho Co., Ltd. operates in Japan through its subsidiaries, focusing on food wholesale, cash and carry, and supermarket businesses, with a market cap of ¥36.02 billion.

Operations: Toho Co., Ltd. generates revenue from its Distributor Business with ¥21.98 billion, Food Solution Business with ¥17.07 billion, and Cash and Carry Business with ¥45.41 billion in Japan.

Dividend Yield: 4%

Toho's dividend yield of 4.04% ranks in the top 25% of Japanese dividend payers, with a payout ratio of 29.8% and cash payout ratio of 46%, ensuring coverage by earnings and cash flows. Despite past volatility, dividends have grown over the last decade. Recent actions include a ¥387.4 million share buyback to improve capital efficiency, alongside strategic initiatives like developing "Kaiju No. 8 THE GAME," enhancing its media presence globally.

- Dive into the specifics of Toho here with our thorough dividend report.

- Upon reviewing our latest valuation report, Toho's share price might be too pessimistic.

Key Takeaways

- Delve into our full catalog of 1460 Top Global Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Toho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8142

Toho

Through its subsidiaries, engages in the food wholesale, cash and carry, and supermarket businesses primarily in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)