- China

- /

- Electronic Equipment and Components

- /

- SZSE:301566

Zhuzhou Smelter GroupLtd And 2 Other Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a landscape marked by trade uncertainties and mixed performance across major indices, smaller-cap stocks have shown resilience, with the S&P MidCap 400 and Russell 2000 Indexes posting gains despite broader challenges. In this context, identifying promising opportunities in Asia's dynamic market can be particularly rewarding for investors seeking to diversify their portfolios. A good stock in this environment is one that demonstrates strong fundamentals and potential for growth amidst economic fluctuations, making it an attractive addition to a well-rounded investment strategy.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Changsha Tongcheng HoldingsLtd | 7.91% | -11.02% | -6.79% | ★★★★★★ |

| Saison Technology | NA | 0.96% | -11.65% | ★★★★★★ |

| Chongqing Machinery & Electric | 25.60% | 7.97% | 18.73% | ★★★★★☆ |

| Qingdao CHOHO IndustrialLtd | 41.25% | 15.72% | 7.45% | ★★★★★☆ |

| Chongqing Changjiang River Moulding Material (Group) | 7.05% | 4.22% | 14.03% | ★★★★★☆ |

| Ligitek ElectronicsLtd | 37.53% | -3.34% | -5.55% | ★★★★★☆ |

| ShenZhen QiangRui Precision Technology | 3.31% | 22.02% | 4.22% | ★★★★★☆ |

| Wuhan Guide Technology | 10.56% | 10.03% | 19.12% | ★★★★★☆ |

| Uniplus Electronics | 27.23% | 44.40% | 74.50% | ★★★★★☆ |

| Weiye Construction Group | 98.53% | 29.07% | -44.59% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Zhuzhou Smelter GroupLtd (SHSE:600961)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhuzhou Smelter Group Co., Ltd. operates in China, producing and selling lead, zinc, and alloy products under the Torch brand, with a market capitalization of approximately CN¥11.06 billion.

Operations: Zhuzhou Smelter Group generates revenue primarily from the production and sale of lead, zinc, and alloy products. The company's financial performance is influenced by its ability to manage costs associated with raw materials and production processes. Notably, its net profit margin reflects the efficiency of these operations in relation to overall revenue generation.

Zhuzhou Smelter Group, a smaller player in the metals and mining sector, has demonstrated impressive financial health. Its earnings growth of 43.6% over the past year outpaced the industry average of -3.8%. The company's debt-to-equity ratio improved significantly from 517.4% to 40.5% over five years, showcasing effective debt management. Trading at 26.8% below its estimated fair value suggests potential undervaluation in the market's eyes. Recent quarterly earnings revealed sales climbing to CNY 4,802 million from CNY 4,426 million year-on-year and net income increasing to CNY 276 million from CNY 159 million, highlighting robust performance momentum.

- Navigate through the intricacies of Zhuzhou Smelter GroupLtd with our comprehensive health report here.

Learn about Zhuzhou Smelter GroupLtd's historical performance.

Dalian Dalicap TechnologyLtd (SZSE:301566)

Simply Wall St Value Rating: ★★★★★★

Overview: Dalian Dalicap Technology Co., Ltd. is involved in the research, development, manufacture, and sale of RF microwave ceramic capacitors both in China and internationally, with a market cap of CN¥6.55 billion.

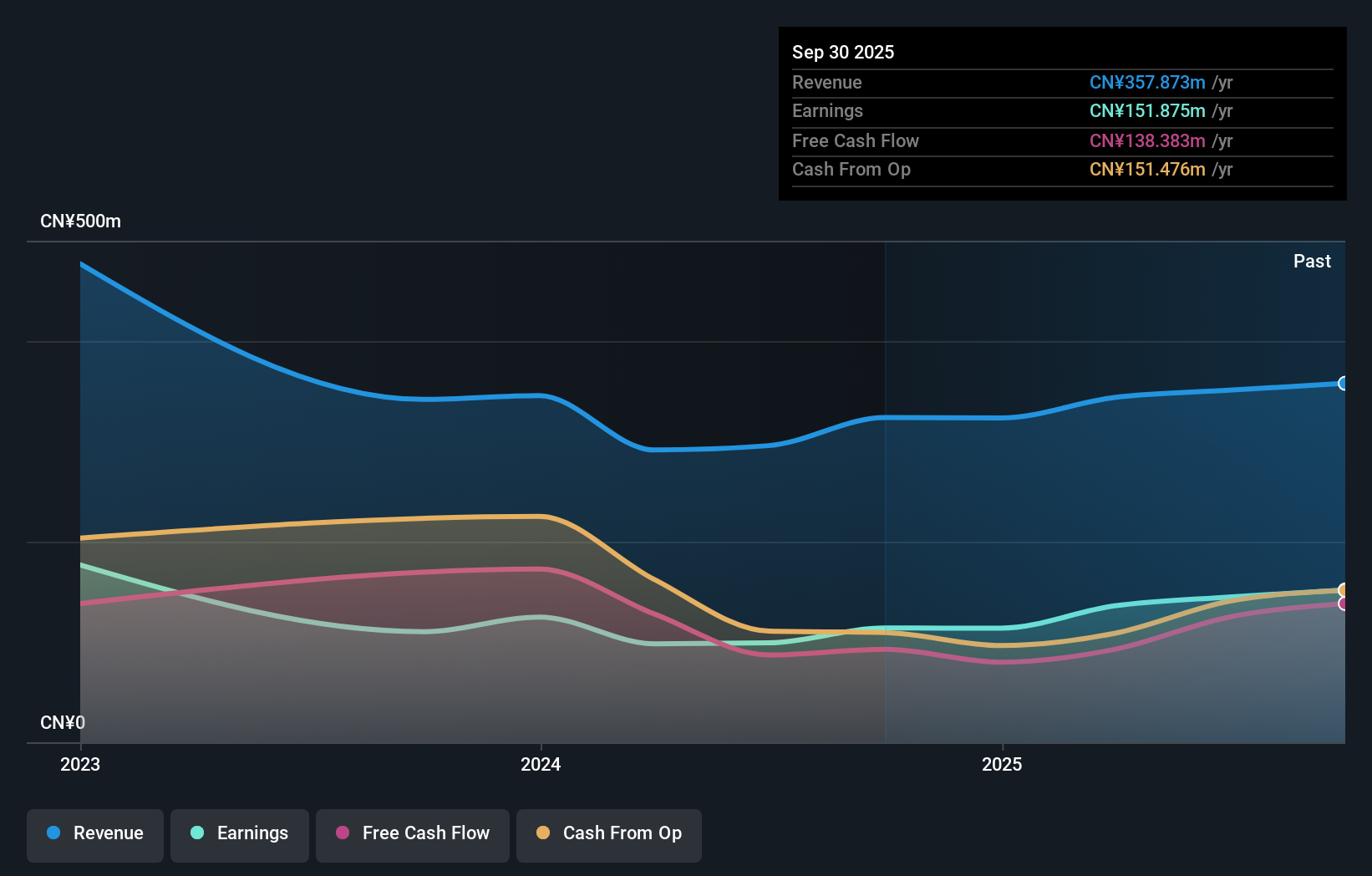

Operations: Dalian Dalicap Technology generates revenue primarily through the sale of RF microwave ceramic capacitors. The company's net profit margin is noteworthy at 20.5%, reflecting its ability to manage costs effectively within its operational framework.

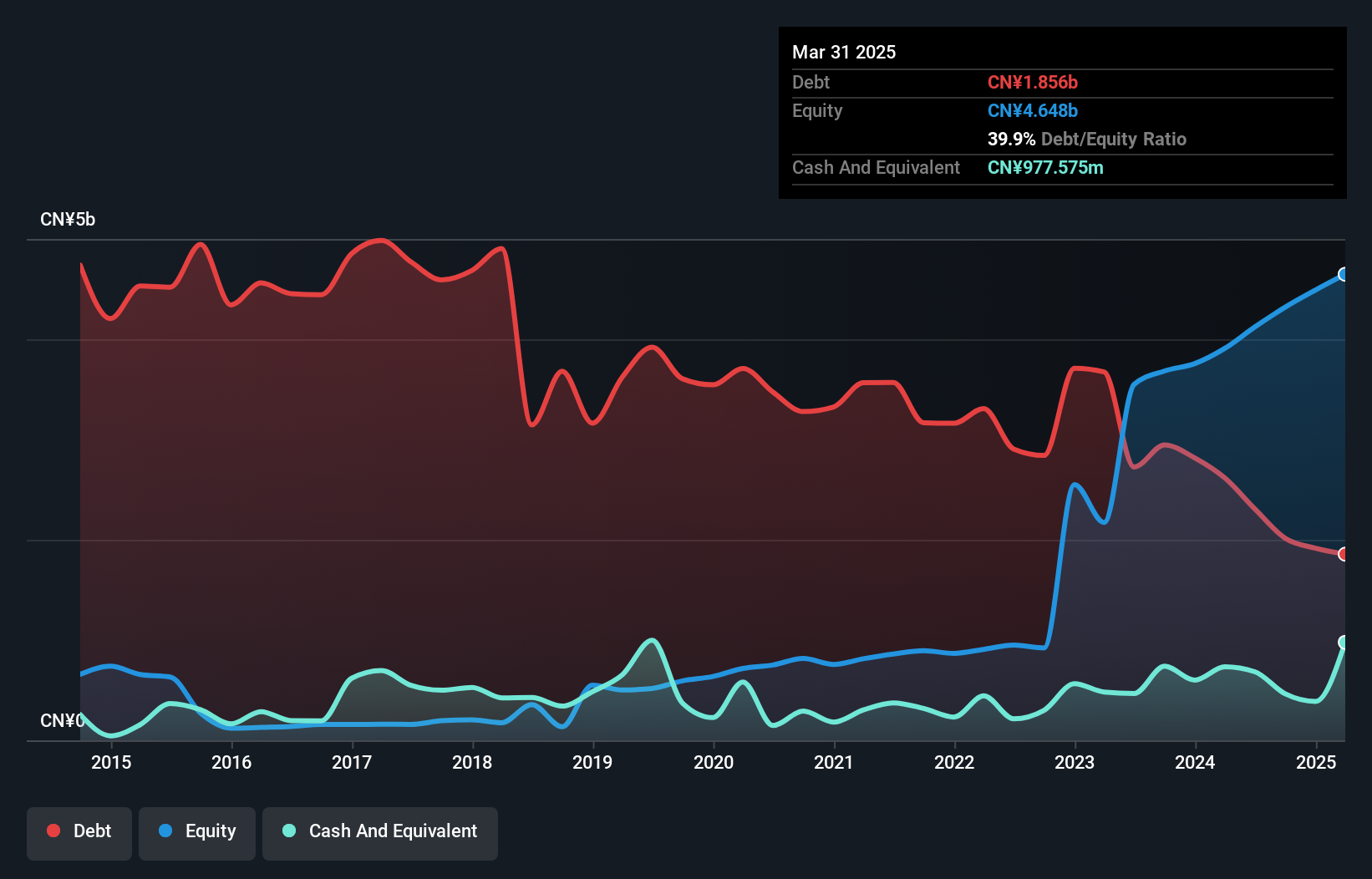

Dalian Dalicap Technology, a small player in the tech sector, boasts impressive financial health with more cash than total debt and a reduced debt-to-equity ratio from 1.9% to 0.06% over five years. The company reported Q1 2025 sales of CNY 100.84 million and net income of CNY 51.5 million, reflecting significant growth from last year's figures of CNY 80.47 million and CNY 29.3 million respectively. Earnings per share doubled to CNY 0.13 from the previous year, showcasing robust performance despite recent share price volatility, likely driven by its high-quality earnings and strong cash flow position.

ITOCHU-SHOKUHIN (TSE:2692)

Simply Wall St Value Rating: ★★★★★★

Overview: ITOCHU-SHOKUHIN Co., Ltd. operates as a wholesaler of food products and alcoholic beverages in Japan, with a market capitalization of approximately ¥115.70 billion.

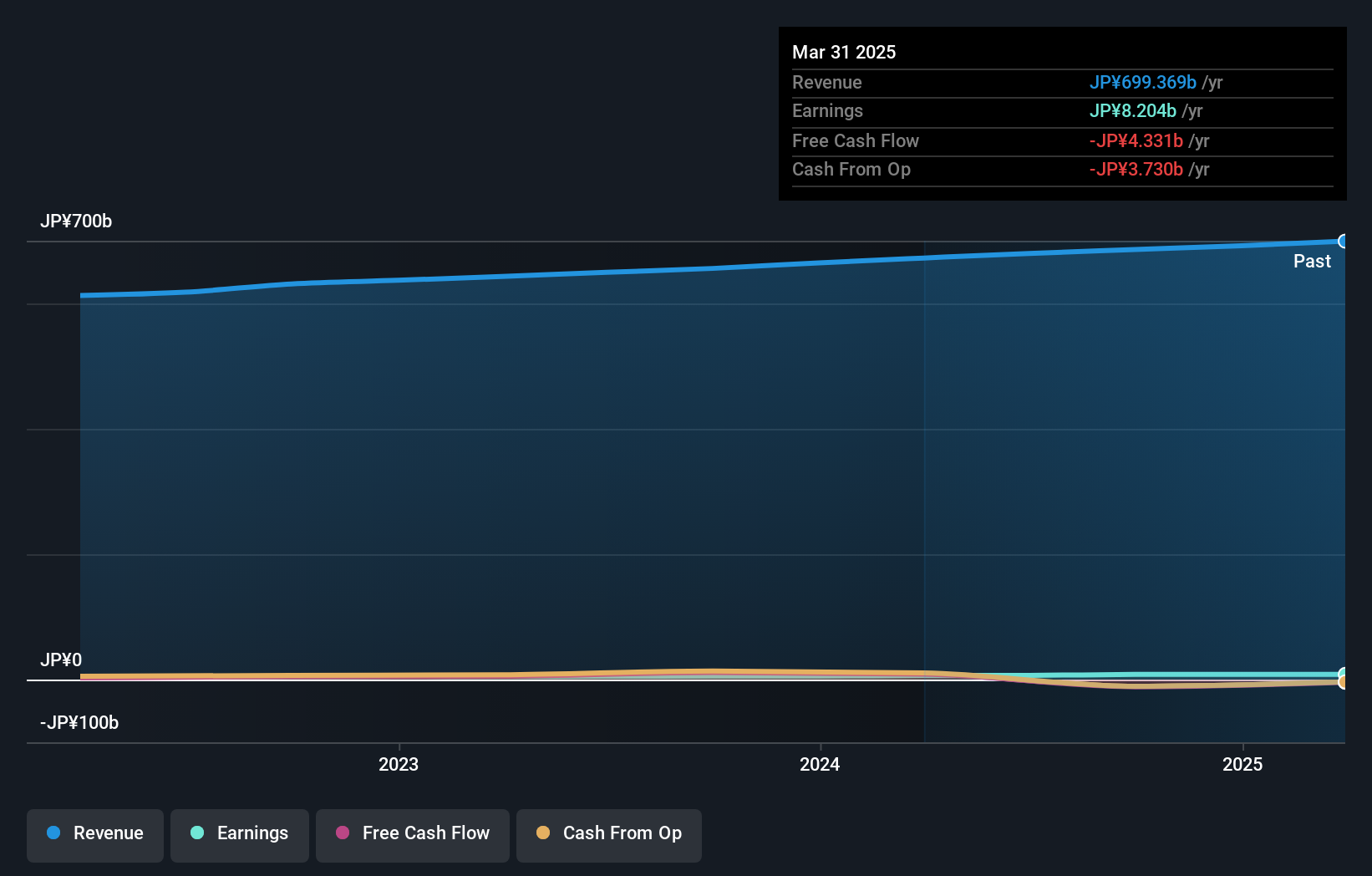

Operations: The company generates revenue primarily from its Food Wholesale Business, which accounts for ¥692.12 billion.

With earnings growth of 49.8% over the past year, ITOCHU-SHOKUHIN stands out as a dynamic player in the Consumer Retailing sector, significantly outpacing the industry's 8.3% growth rate. The company boasts high-quality earnings and operates without debt, a notable improvement from five years ago when its debt-to-equity ratio was 1.7%. Despite not being free cash flow positive recently, profitability ensures that cash runway isn't a pressing issue for now. This financial stability positions it well within its industry context and suggests potential resilience amidst market fluctuations in Asia's competitive landscape.

- Get an in-depth perspective on ITOCHU-SHOKUHIN's performance by reading our health report here.

Evaluate ITOCHU-SHOKUHIN's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Delve into our full catalog of 2654 Asian Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301566

Dalian Dalicap TechnologyLtd

Engages in the research and development, manufacture, and sale of radio frequency (RF) microwave ceramic capacitors in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives