- Japan

- /

- Food and Staples Retail

- /

- TSE:2586

With A 27% Price Drop For Fruta Fruta Inc. (TSE:2586) You'll Still Get What You Pay For

The Fruta Fruta Inc. (TSE:2586) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 267% in the last twelve months.

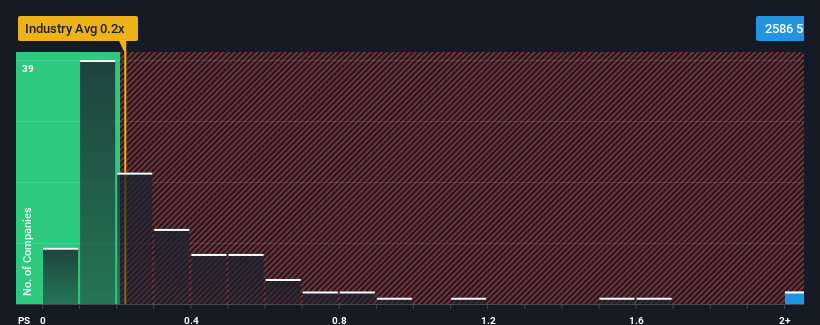

Although its price has dipped substantially, given around half the companies in Japan's Consumer Retailing industry have price-to-sales ratios (or "P/S") below 0.2x, you may still consider Fruta Fruta as a stock to avoid entirely with its 5.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Fruta Fruta

What Does Fruta Fruta's Recent Performance Look Like?

Fruta Fruta certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Fruta Fruta will help you shine a light on its historical performance.How Is Fruta Fruta's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Fruta Fruta's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 69% last year. The strong recent performance means it was also able to grow revenue by 117% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 2.1%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's understandable that Fruta Fruta's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On Fruta Fruta's P/S

Fruta Fruta's shares may have suffered, but its P/S remains high. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Fruta Fruta revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Fruta Fruta (of which 2 are concerning!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2586

Fruta Fruta

Engages in the marketing and selling of fruits and foods in Japan.

Flawless balance sheet slight.

Market Insights

Community Narratives