- Japan

- /

- Food and Staples Retail

- /

- TSE:2586

Investors Appear Satisfied With Fruta Fruta Inc.'s (TSE:2586) Prospects As Shares Rocket 49%

Fruta Fruta Inc. (TSE:2586) shareholders would be excited to see that the share price has had a great month, posting a 49% gain and recovering from prior weakness. This latest share price bounce rounds out a remarkable 336% gain over the last twelve months.

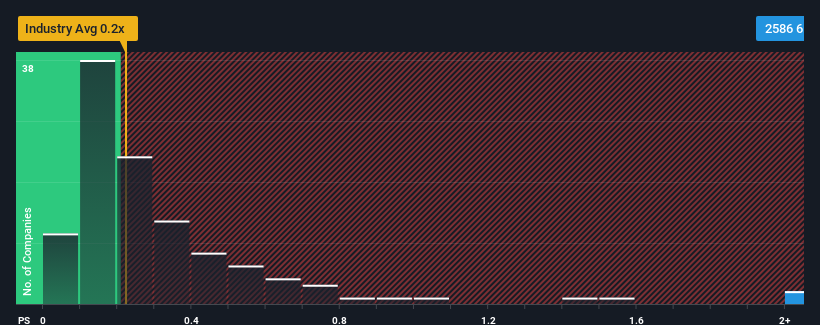

After such a large jump in price, you could be forgiven for thinking Fruta Fruta is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6.7x, considering almost half the companies in Japan's Consumer Retailing industry have P/S ratios below 0.2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Fruta Fruta

How Has Fruta Fruta Performed Recently?

With revenue growth that's exceedingly strong of late, Fruta Fruta has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Fruta Fruta will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Fruta Fruta?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Fruta Fruta's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 69% gain to the company's top line. Pleasingly, revenue has also lifted 117% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 8.9%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why Fruta Fruta is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On Fruta Fruta's P/S

The strong share price surge has lead to Fruta Fruta's P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Fruta Fruta revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Fruta Fruta (including 2 which are concerning).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2586

Fruta Fruta

Engages in the marketing and selling of fruits and foods in Japan.

Flawless balance sheet slight.

Market Insights

Community Narratives