As global markets navigate a cautious economic landscape marked by the Federal Reserve's rate cuts and political uncertainties, smaller-cap indexes have faced notable challenges, reflecting broader investor sentiment. Despite these headwinds, the search for undiscovered gems in the stock market remains compelling, as investors look for companies with strong fundamentals that can thrive amid shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Jensen-Group (ENXTBR:JEN)

Simply Wall St Value Rating: ★★★★★★

Overview: Jensen-Group NV, along with its subsidiaries, specializes in designing, producing, and supplying single machines, systems, and turnkey solutions for the heavy-duty laundry industry with a market capitalization of €413.06 million.

Operations: Jensen-Group generates revenue primarily from its heavy-duty laundry segment, amounting to €420.74 million.

Jensen-Group, a smaller player in the machinery sector, has shown impressive financial health with earnings growth of 48.8% over the past year, far outpacing the industry's 2.5%. The company’s debt to equity ratio has significantly improved from 35.1% to 17% over five years, indicating prudent financial management. Additionally, Jensen-Group trades at a substantial discount of 69.2% below its estimated fair value and maintains high-quality earnings with a satisfactory net debt to equity ratio of just 1.2%. These factors suggest that Jensen-Group may offer compelling value potential within its industry context.

Zhejiang Jiecang Linear Motion TechnologyLtd (SHSE:603583)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Jiecang Linear Motion Technology Co., Ltd. specializes in the development and manufacturing of linear motion systems, with a market capitalization of approximately CN¥9.92 billion.

Operations: Jiecang generates revenue primarily from the linear drive industry, amounting to CN¥3.50 billion. The company's gross profit margin is a key financial metric to consider when evaluating its profitability.

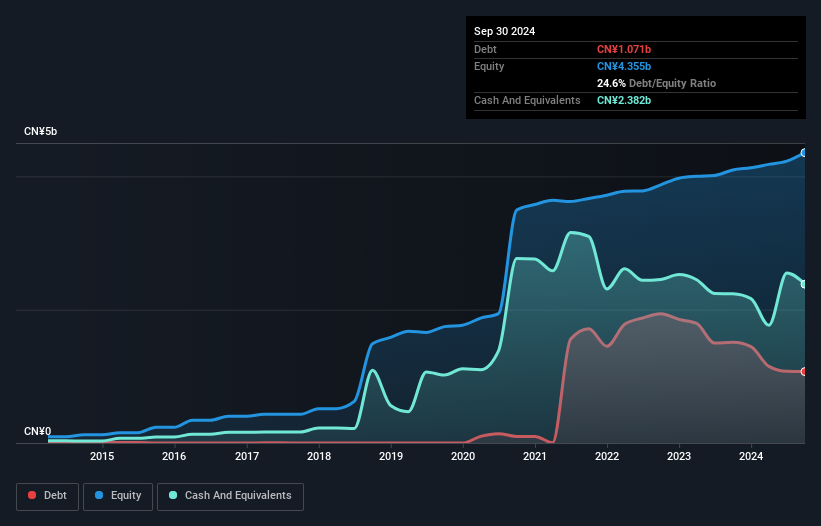

Zhejiang Jiecang Linear Motion Technology, a smaller player in the electronics sector, showcases promising financial health with earnings growth at 35% over the past year, outpacing the industry average of 1.9%. The company reported sales of CNY 2.57 billion for nine months ending September 2024, up from CNY 2.10 billion the previous year. Net income rose to CNY 293 million compared to last year's CNY 188 million. With more cash than debt and positive free cash flow, it appears well-positioned financially despite a rising debt-to-equity ratio now at 24%. Future earnings are expected to grow annually by about 25%, suggesting continued momentum.

Onward Holdings (TSE:8016)

Simply Wall St Value Rating: ★★★★★★

Overview: Onward Holdings Co., Ltd. operates in the design, manufacture, and sale of men's, women's, and children's apparel across Japan, China, the United Kingdom, and the United States with a market capitalization of ¥78.05 billion.

Operations: Onward Holdings generates revenue primarily from the sale of apparel across various international markets, with a market capitalization of ¥78.05 billion. The company's financial performance is influenced by its operations in Japan, China, the United Kingdom, and the United States.

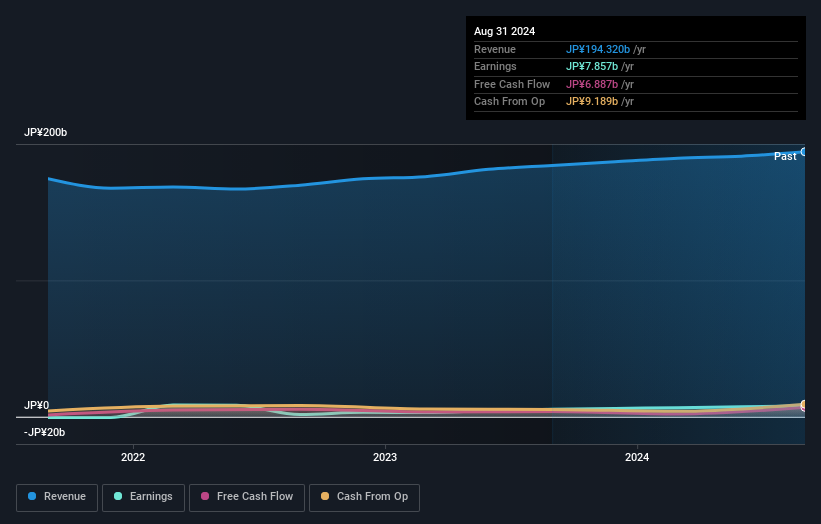

Onward Holdings, a small cap player in the industry, has shown impressive earnings growth of 44.2% over the past year, outpacing its luxury sector peers at 13.1%. The company's net debt to equity ratio stands at a satisfactory 31.6%, and interest payments are well covered with an EBIT coverage of 23.2 times. Recent sales figures indicate strong performance, with November's net sales at all stores reaching 128.6% compared to last year, boosted by the new consolidation of WEGO since October 2024. However, financial results were impacted by a significant one-off loss amounting to ¥3.9 billion in the past year ending August 2024.

- Click here to discover the nuances of Onward Holdings with our detailed analytical health report.

Explore historical data to track Onward Holdings' performance over time in our Past section.

Taking Advantage

- Unlock our comprehensive list of 4632 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:JEN

Jensen-Group

Designs, produces, and supplies single machines, systems, turnkey solutions, and laundry process automation for the heavy-duty laundry industry.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives