In the wake of significant political shifts and economic policy changes, global markets have seen a rally, with major U.S. indices reaching record highs amid expectations of growth-friendly measures. As investors navigate these dynamic conditions, high-yield dividend stocks can offer attractive income opportunities by providing consistent returns even in fluctuating markets.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.69% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.54% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.89% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Essex Bio-Technology (SEHK:1061)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Essex Bio-Technology Limited is an investment holding company that develops, manufactures, distributes, and sells bio-pharmaceutical products in the People's Republic of China, Hong Kong, and internationally with a market cap of approximately HK$1.49 billion.

Operations: Essex Bio-Technology's revenue is primarily generated from its surgical segment, which accounts for HK$871.44 million, and its ophthalmology segment, contributing HK$747.39 million.

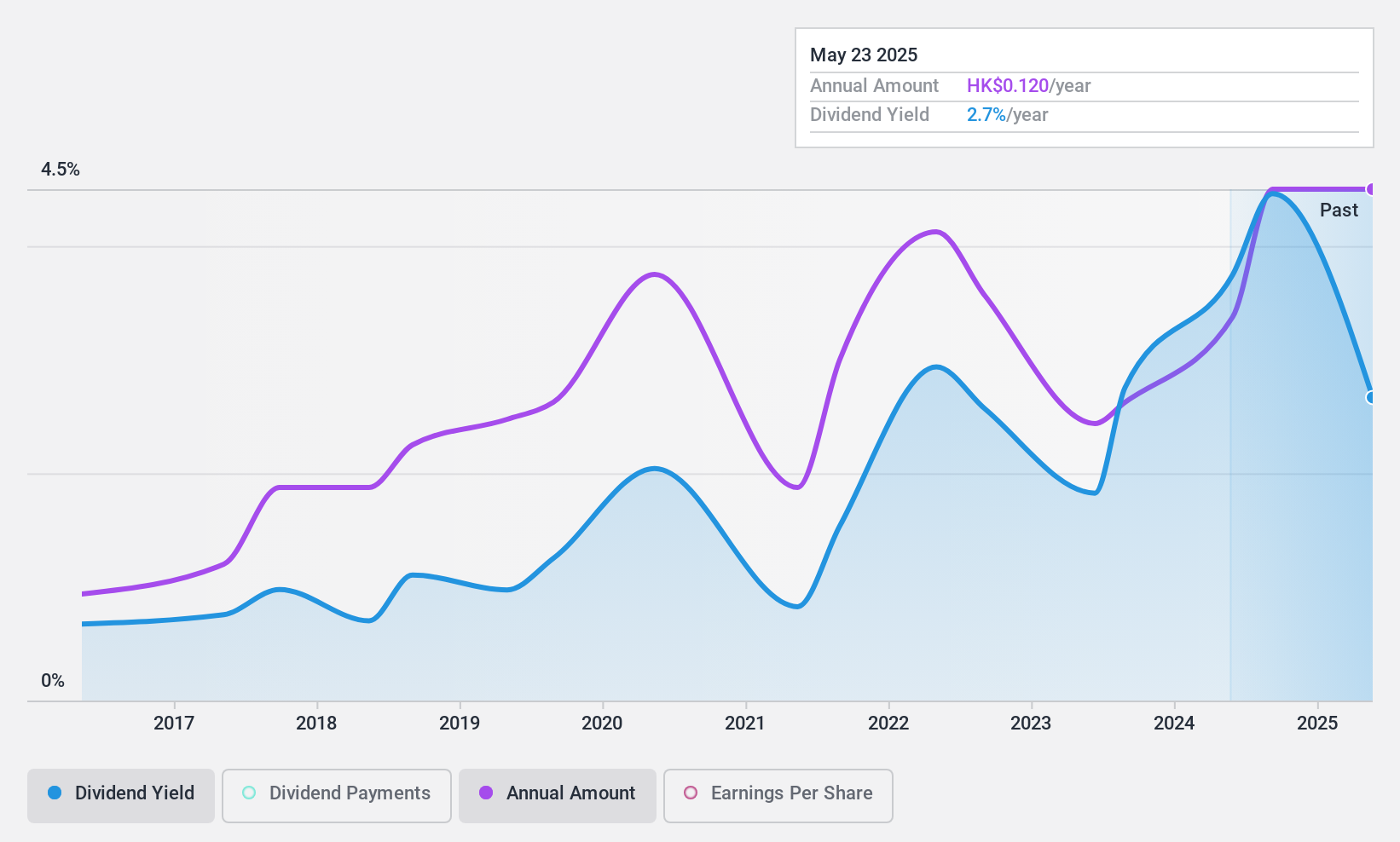

Dividend Yield: 4.6%

Essex Bio-Technology's dividend payments have been inconsistent over the past decade, with volatility and a low yield of 4.56% compared to top Hong Kong payers. However, dividends are well-covered by earnings (22.7% payout ratio) and cash flow (32.3% cash payout ratio). Recent share buybacks may enhance earnings per share, potentially benefiting future dividend stability. Despite recent dividend increases, investors should consider the company's unstable track record when evaluating its long-term dividend potential.

- Click to explore a detailed breakdown of our findings in Essex Bio-Technology's dividend report.

- According our valuation report, there's an indication that Essex Bio-Technology's share price might be on the expensive side.

LH Shopping Centers Leasehold Real Estate Investment Trust (SET:LHSC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LH Shopping Centers Leasehold Real Estate Investment Trust, managed by Land and Houses Fund Management Company Limited, focuses on investing in shopping centers with a market cap of THB5.42 billion.

Operations: The primary revenue segment for LH Shopping Centers Leasehold Real Estate Investment Trust is the rental of immovable properties, generating approximately THB1.36 billion.

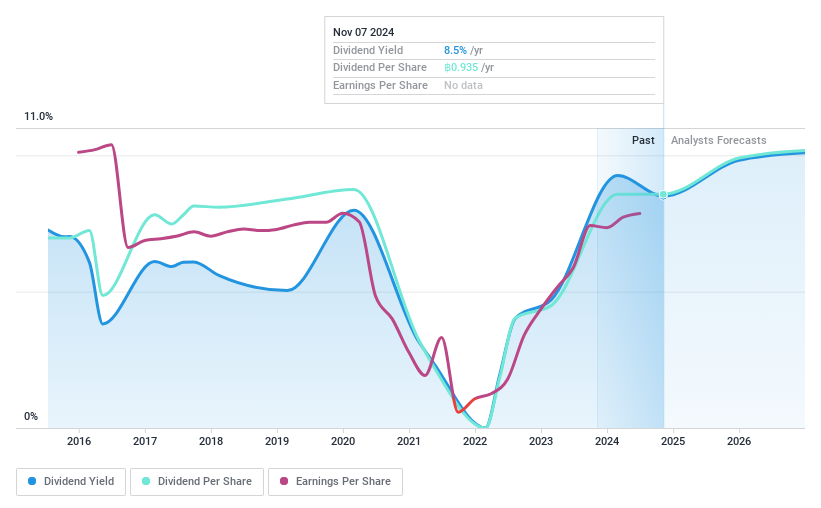

Dividend Yield: 8.3%

LH Shopping Centers Leasehold Real Estate Investment Trust offers a high dividend yield of 8.35%, ranking in the top 25% of Thailand's market. Dividends are well-covered by earnings and cash flows, with payout ratios at 79.5% and 76.1%, respectively, indicating sustainability despite an unstable nine-year track record marked by volatility. Trading at a good value relative to peers, recent dividend increases highlight potential growth, though past payment inconsistency remains a concern for long-term reliability.

- Dive into the specifics of LH Shopping Centers Leasehold Real Estate Investment Trust here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that LH Shopping Centers Leasehold Real Estate Investment Trust is priced lower than what may be justified by its financials.

Kawai Musical Instruments Manufacturing (TSE:7952)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kawai Musical Instruments Manufacturing Co., Ltd. operates in the production and sale of musical instruments, with a market cap of ¥24.24 billion.

Operations: Kawai Musical Instruments Manufacturing Co., Ltd. generates revenue primarily from its Musical Instrument Education segment, which accounts for ¥63.66 billion, and Materials Processing, contributing ¥9.50 billion.

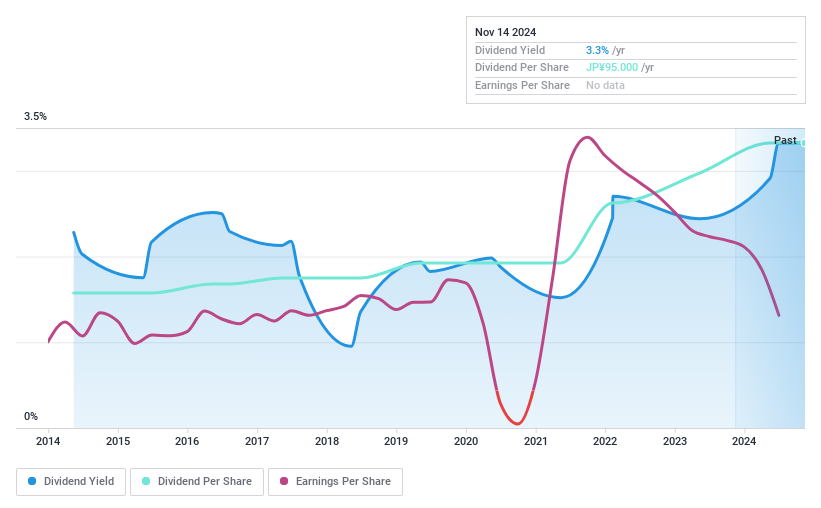

Dividend Yield: 3.3%

Kawai Musical Instruments Manufacturing's dividends have grown and remained stable over the past decade, indicating reliability. However, the current yield of 3.33% is below Japan's top dividend payers' average. Despite a low payout ratio of 47.4%, suggesting coverage by earnings, high cash payout ratios (716.6%) indicate dividends aren't well supported by free cash flows, raising sustainability concerns despite consistent past payments. Recent profit margin declines further highlight potential challenges in maintaining dividend levels.

- Click here and access our complete dividend analysis report to understand the dynamics of Kawai Musical Instruments Manufacturing.

- Our expertly prepared valuation report Kawai Musical Instruments Manufacturing implies its share price may be too high.

Key Takeaways

- Click here to access our complete index of 1951 Top Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kawai Musical Instruments Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7952

Kawai Musical Instruments Manufacturing

Kawai Musical Instruments Manufacturing Co., Ltd.

Excellent balance sheet second-rate dividend payer.