- Japan

- /

- Consumer Durables

- /

- TSE:7731

Nikon (TSE:7731) Eyes Advanced Packaging With Maskless Lithography System—Is Its Innovation Edge Growing?

Reviewed by Sasha Jovanovic

- Nikon Corporation recently reaffirmed the commercial availability of its DSP-100 Digital Lithography System for advanced semiconductor packaging, with orders having started in July 2025 and a prominent demonstration at SEMICON West 2025.

- This system’s maskless, high-resolution lithography and large substrate support addresses key industry shifts driven by AI, IoT, and data center growth, potentially reshaping the landscape for advanced packaging solutions.

- Next, we'll explore how Nikon’s move to launch large-format, maskless lithography could influence its investment narrative amid ongoing industry transformation.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Nikon Investment Narrative Recap

For shareholders, the case for Nikon largely comes down to believing in a turnaround in its semiconductor business, with growth in advanced packaging as a major catalyst. Nikon’s DSP-100 Digital Lithography System launch provides tangible progress on this front, but the news by itself may not yet offset the impact of delayed customer investments, which remains the most important near-term risk for revenue generation and earnings stability. Of the recent corporate developments, Nikon’s revised earnings guidance in August, lowering both revenue and profit expectations due to ongoing delays in customer orders, directly reflects the continued challenges facing the semiconductor and lithography division. The DSP-100’s commercial progress will be closely watched to see if it translates into resumed investment and order momentum. Yet, if customer adoption lags for these new lithography solutions, investors should be aware that...

Read the full narrative on Nikon (it's free!)

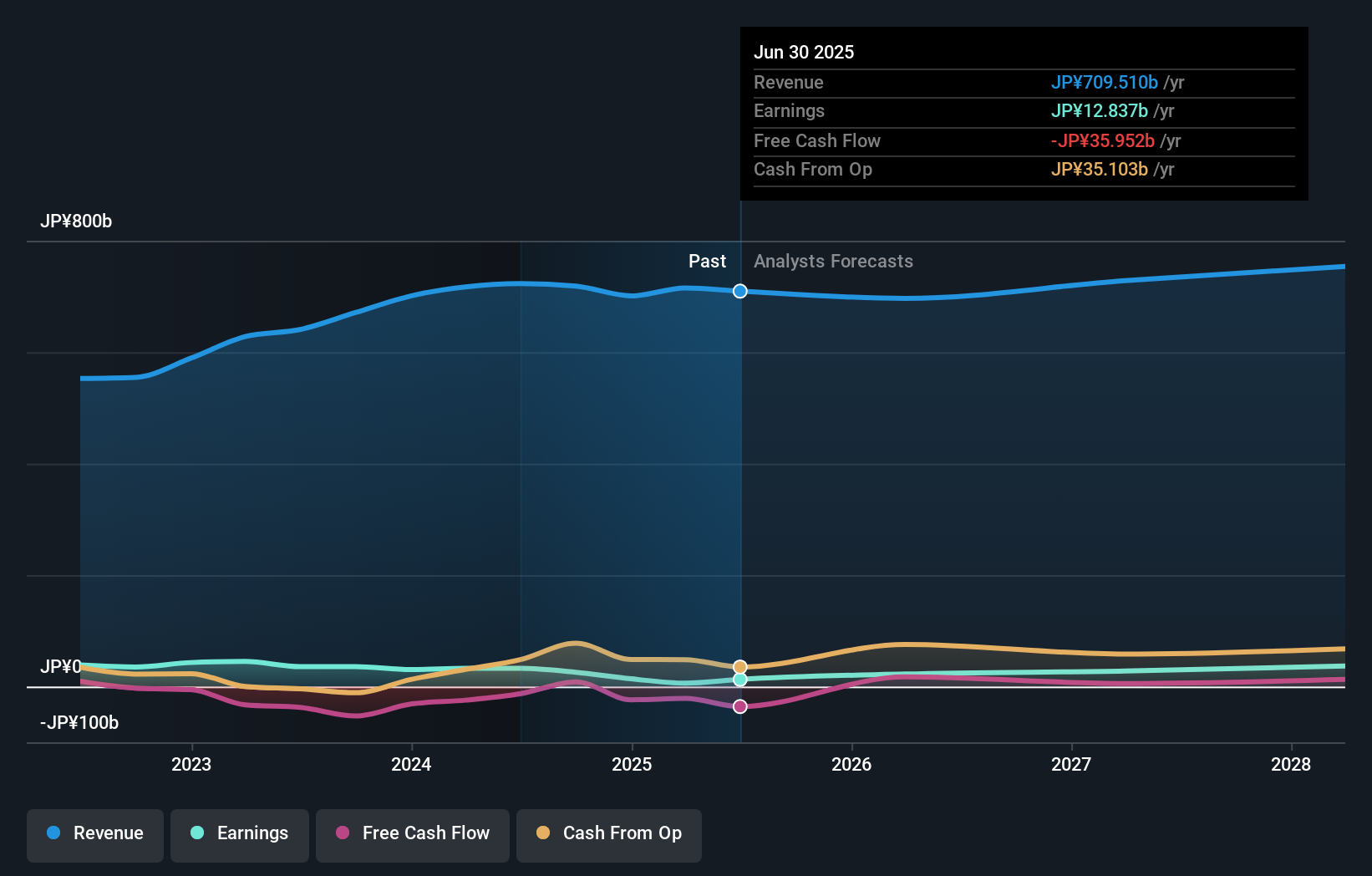

Nikon's narrative projects ¥753.2 billion in revenue and ¥41.0 billion in earnings by 2028. This requires 2.0% yearly revenue growth and a ¥28.2 billion earnings increase from the current earnings of ¥12.8 billion.

Uncover how Nikon's forecasts yield a ¥1473 fair value, a 21% downside to its current price.

Exploring Other Perspectives

You have one fair value estimate from the Simply Wall St Community, set at ¥1,473.18. This single viewpoint stands in contrast to analyst concerns over postponed customer investments currently pressuring Nikon’s earnings outlook, consider exploring a range of opinions before making your own assessment.

Explore another fair value estimate on Nikon - why the stock might be worth as much as ¥1473!

Build Your Own Nikon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nikon research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Nikon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nikon's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nikon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7731

Nikon

Manufactures and sells optical instruments in Japan, North America, Europe, China, Thailand, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives