- Japan

- /

- Consumer Durables

- /

- TSE:6952

Can Purpose-Driven Products Strengthen Casio's Brand Narrative for Investors in TSE:6952?

Reviewed by Sasha Jovanovic

- Earlier this week, Casio America Inc. introduced the Pink Ribbon Model GMAS145PK-4A, a special-edition G-SHOCK timepiece in partnership with the Breast Cancer Research Foundation to raise funds and awareness for breast cancer research.

- This launch combines Casio's product innovation with a cause-driven campaign, aiming to engage customers through both meaningful design and social responsibility.

- We’ll now explore how Casio’s initiative to link brand purpose with social causes could shape its broader investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Casio ComputerLtd Investment Narrative Recap

To be a shareholder in Casio, it's essential to have confidence in the company's ability to revive and sustain demand for its core products, particularly watches, while managing uneven international performance and margin pressures. The launch of the Pink Ribbon Model GMAS145PK-4A showcases Casio's brand purpose and cause-driven marketing, but this campaign alone is unlikely to materially shift the company’s key short-term catalyst, which remains the growth of its Timepieces segment outside China, nor does it resolve the major risk of persistently falling financial metrics tied to soft demand.

Among recent product launches, the introduction of the MTG-B4000, featuring AI-enabled design and enhanced structural engineering, stands out as most relevant to the ongoing catalyst of driving higher-margin, innovative watch products. Both this and the Pink Ribbon edition reinforce the company’s focus on leveraging technology and brand story to reach broader audiences, aiding efforts to grow revenue in international markets.

Yet in contrast to these ambitious new launches, there is a risk investors should be aware of, especially if weak demand continues and net profit trends remain pressured...

Read the full narrative on Casio ComputerLtd (it's free!)

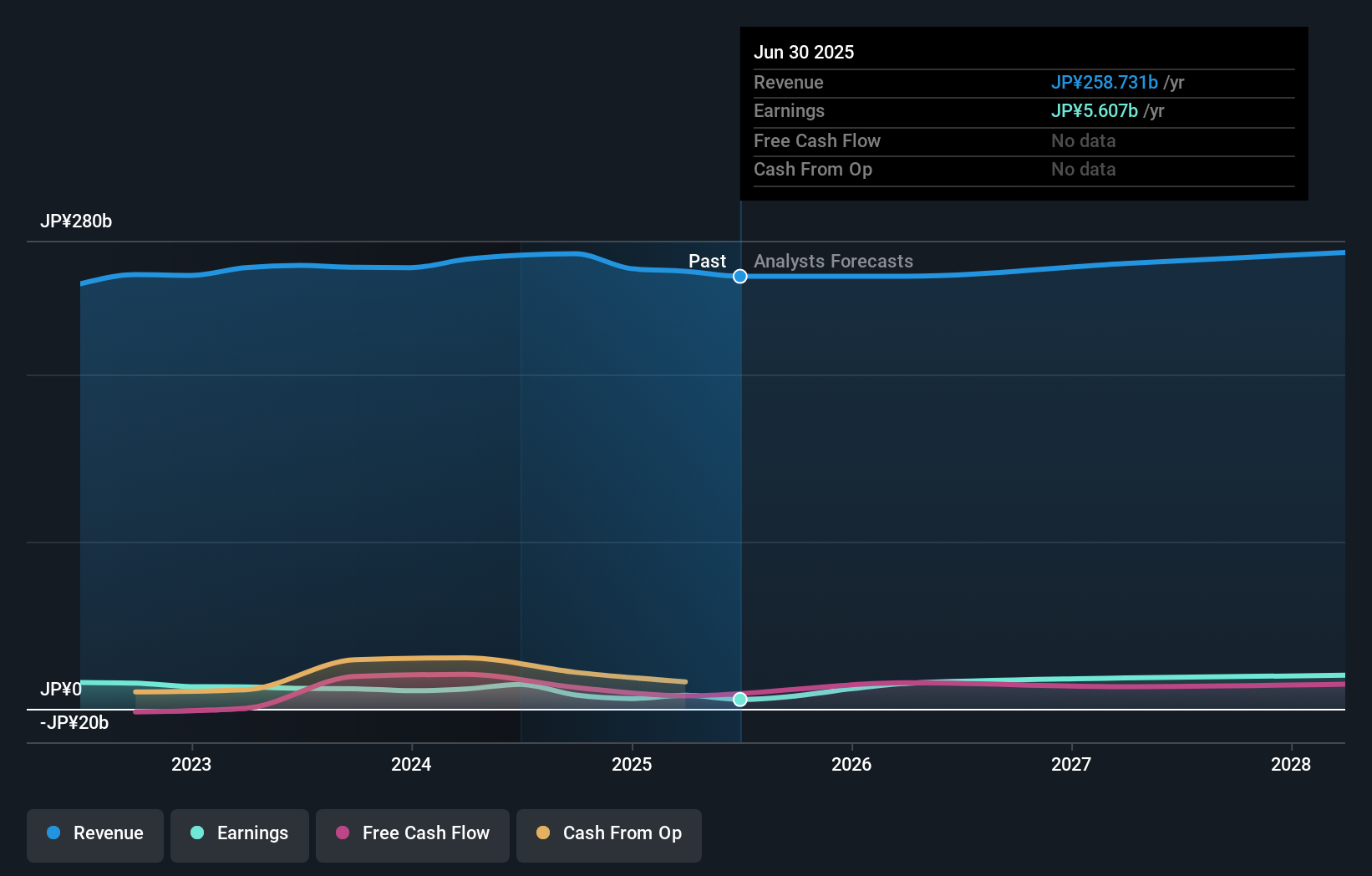

Casio ComputerLtd's outlook forecasts ¥275.8 billion in revenue and ¥20.2 billion in earnings by 2028. This scenario is based on a projected 2.2% annual revenue growth and an increase in earnings of ¥14.6 billion from the current ¥5.6 billion.

Uncover how Casio ComputerLtd's forecasts yield a ¥1291 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for Casio range widely from ¥1,291 to ¥1,531, based on two unique perspectives from the Simply Wall St Community. While many focus on the innovation-led catalyst, concerns about declining core sales remind us to consider all angles before forming an outlook.

Explore 2 other fair value estimates on Casio ComputerLtd - why the stock might be worth just ¥1291!

Build Your Own Casio ComputerLtd Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Casio ComputerLtd research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Casio ComputerLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Casio ComputerLtd's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6952

Casio ComputerLtd

Develops, produces, and sells consumer, system equipment, and other products.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives