- Japan

- /

- Consumer Durables

- /

- TSE:6952

Assessing Casio (TSE:6952) Valuation Following Recent Share Movements and Growth Signals

Reviewed by Simply Wall St

The latest movement in Casio ComputerLtd (TSE:6952) shares may have some investors pressing pause and wondering what’s next. With no single headline driving the action, there is always a chance that the market is digesting broader signals around the company’s prospects or sector. Often, such shifts, no matter how minor, raise important questions for those deciding whether to hold, buy, or look elsewhere for opportunity.

Over the past year, Casio’s stock has put in a return of 12%, boosted by a 15% gain in the past three months. That momentum stands in contrast to its slight slide over the year-to-date as the stock has traded lower, offset by several recent spurts of growth. The bigger picture is one of moderate gains against a backdrop of steady revenue growth and a meaningful uptick in net income over the latest annual figures.

So, is Casio’s current valuation leaving upside on the table, or have markets already baked in those signs of improving performance?

Most Popular Narrative: 3.4% Undervalued

According to the most followed narrative, Casio ComputerLtd is currently viewed as modestly undervalued, with analysts seeing some upside versus its present trading level.

The continued expansion of Casio's Timepieces and Casio Watch segments into global markets, especially the strong sales outside of China (up 7% YoY ex-China) and emphasis on premium, higher-margin SKUs, positions the company to benefit from the rising global middle class and international demand, supporting sustained revenue growth and eventual margin expansion.

Curious what dominoes need to fall for this narrative to hold up? The answer lies in ambitious forecasts on growth, margin expansion, and shifting business drivers. Want to know which metrics matter most in the race to justify today's price? Keep reading to discover how analysts believe Casio can close the value gap, and what makes this estimate stand apart from the crowd.

Result: Fair Value of ¥1,291.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent declines in key metrics or fresh trade disruptions could easily undermine these upbeat forecasts and keep investors on alert for sudden changes.

Find out about the key risks to this Casio ComputerLtd narrative.Another View: Using Valuation Multiples

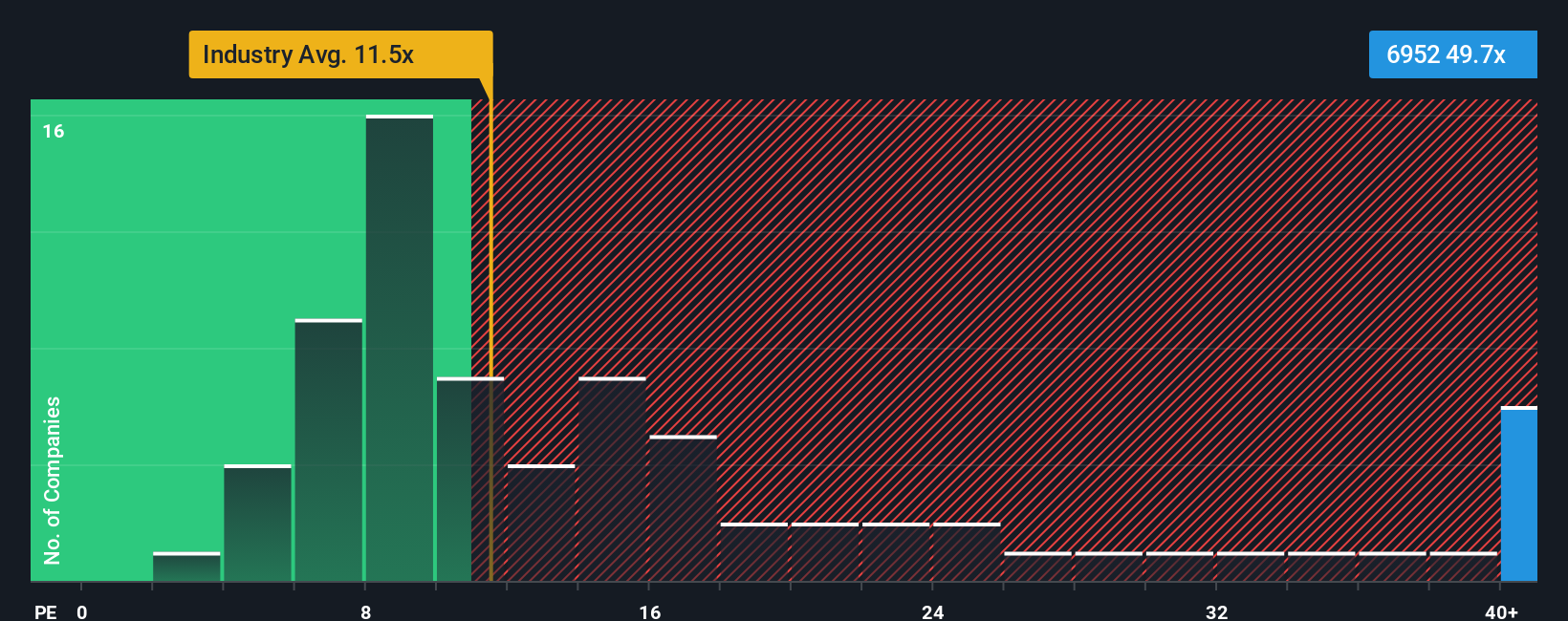

Not everyone sees the same value story. When we look at Casio’s price-to-earnings ratio compared to the industry, it actually appears quite expensive on this measure. Could the market be overestimating future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Casio ComputerLtd to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Casio ComputerLtd Narrative

If you think there’s more to the story or want to dig into the numbers yourself, you can shape your own Casio ComputerLtd narrative in just a few minutes, Do it your way.

A great starting point for your Casio ComputerLtd research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Don't miss your chance to get ahead and uncover stocks that align with your investment goals. The right screener could lead you straight to your next portfolio win.

- Boost your income strategy by tapping into dividend stocks with yields > 3%, which offers solid yields above 3% and steady payout histories.

- Stay at the forefront of technology breakthroughs by targeting AI penny stocks, which are shaping tomorrow’s innovations in artificial intelligence.

- Seize potential bargains by searching for undervalued stocks based on cash flows, identified as trading below their true worth based on forward-looking cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6952

Casio ComputerLtd

Develops, produces, and sells consumer, system equipment, and other products.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives