- Japan

- /

- Consumer Durables

- /

- TSE:6809

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

In a week marked by volatility, U.S. stocks saw mixed results as AI competition fears and corporate earnings shaped market sentiment, while the Federal Reserve's decision to hold interest rates steady highlighted ongoing economic challenges. Amid these fluctuations, dividend stocks continue to attract investors seeking stability and income in uncertain times. A good dividend stock typically offers a reliable payout history and financial health, making it an appealing option for those looking to navigate current market dynamics with a focus on consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.29% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.09% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.08% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.43% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

Click here to see the full list of 1955 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

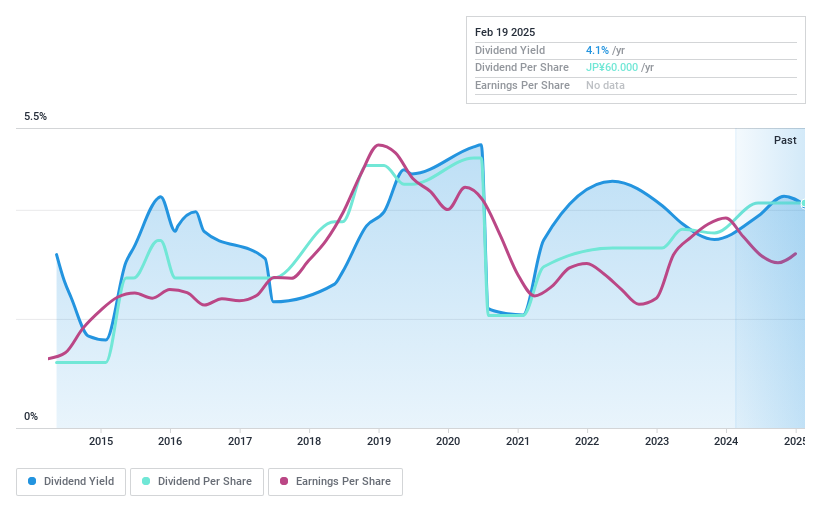

Meiji Electric IndustriesLtd (TSE:3388)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Meiji Electric Industries Co., Ltd. engages in the import, export, and sale of electrical devices, measuring instruments, electrical equipment, and automation and energy-saving components with a market cap of ¥18.75 billion.

Operations: Meiji Electric Industries Co., Ltd.'s revenue is derived from the import, export, and sale of electrical devices, measuring instruments, electrical equipment, and automation and energy-saving function components.

Dividend Yield: 4.1%

Meiji Electric Industries Ltd. offers a compelling dividend yield of 4.08%, ranking in the top 25% of Japanese dividend payers. Despite the attractive yield, its dividend history over the past decade has been volatile, with occasional drops exceeding 20%. However, dividends are well-covered by earnings and cash flows, with payout ratios at 39% and a low cash payout ratio of 10.3%. The stock trades significantly below its estimated fair value.

- Click here to discover the nuances of Meiji Electric IndustriesLtd with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Meiji Electric IndustriesLtd shares in the market.

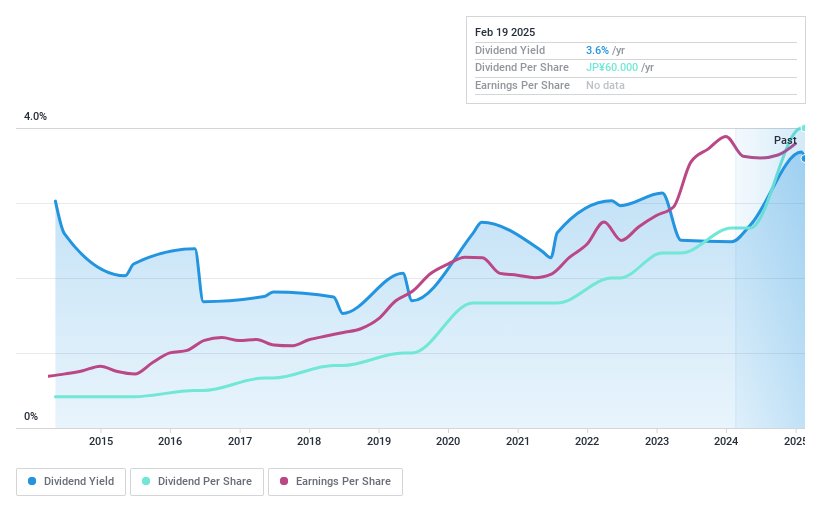

System ResearchLtd (TSE:3771)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: System Research Co., Ltd. provides software development services in Japan and has a market cap of ¥27.60 billion.

Operations: System Research Co., Ltd. generates revenue of ¥25.29 billion from its Software Related Business segment in Japan.

Dividend Yield: 3.6%

System Research Ltd. has a stable dividend history with consistent growth over the past decade, though its share price has been highly volatile recently. Despite a reasonable payout ratio of 32.5%, dividends aren't well-supported by cash flows, indicated by a high cash payout ratio of 104.7%. The dividend yield is slightly below the top quartile in Japan at 3.6%. Currently, the stock trades at a discount to its estimated fair value.

- Delve into the full analysis dividend report here for a deeper understanding of System ResearchLtd.

- The analysis detailed in our System ResearchLtd valuation report hints at an deflated share price compared to its estimated value.

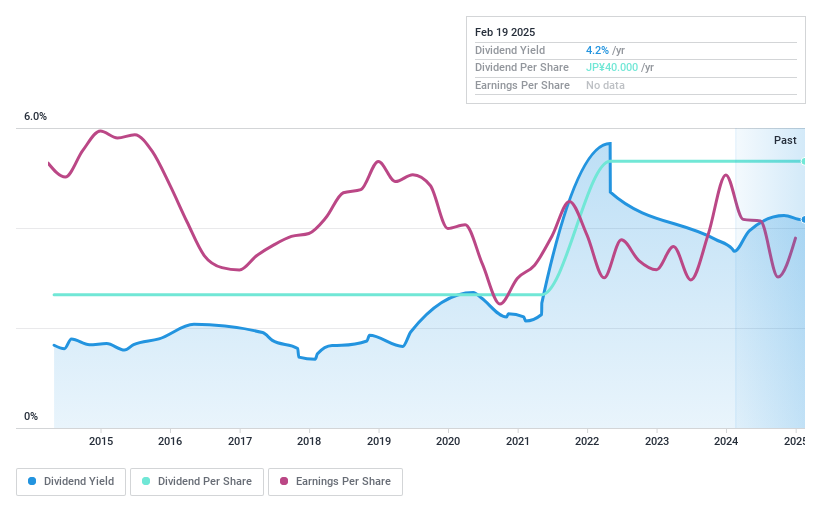

TOA (TSE:6809)

Simply Wall St Dividend Rating: ★★★★★★

Overview: TOA Corporation manufactures and sells broadcasting, communications, and transmission equipment in Japan with a market cap of ¥29.41 billion.

Operations: TOA Corporation's revenue segments include broadcasting equipment at ¥12.34 billion, communications equipment at ¥8.56 billion, and transmission equipment at ¥5.78 billion.

Dividend Yield: 4.1%

TOA Corporation offers an attractive dividend yield of 4.09%, placing it in the top 25% of JP market dividend payers. Its dividends are well-supported by both earnings and cash flows, with payout ratios of 35.1% and 29.7%, respectively, ensuring sustainability. Over the past decade, TOA has maintained stable and growing dividends with minimal volatility. However, recent profit margins have declined from last year’s figures, potentially impacting future performance considerations for investors.

- Click to explore a detailed breakdown of our findings in TOA's dividend report.

- In light of our recent valuation report, it seems possible that TOA is trading behind its estimated value.

Taking Advantage

- Delve into our full catalog of 1955 Top Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6809

TOA

Manufactures and sells broadcasting, communications, and transmission equipment in Japan.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives