- Japan

- /

- Consumer Durables

- /

- TSE:6794

Market Participants Recognise Foster Electric Company, Limited's (TSE:6794) Earnings Pushing Shares 26% Higher

Foster Electric Company, Limited (TSE:6794) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 63% in the last year.

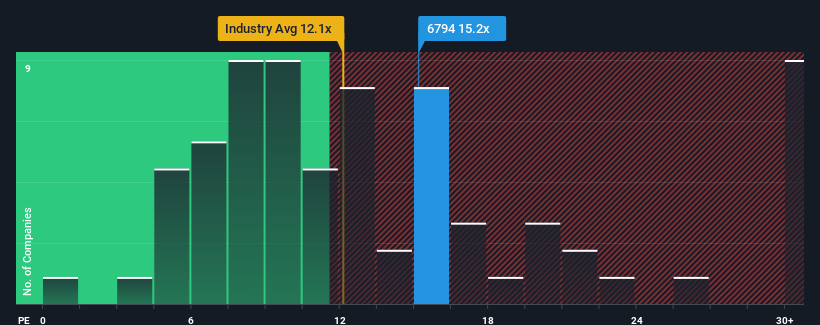

Although its price has surged higher, it's still not a stretch to say that Foster Electric Company's price-to-earnings (or "P/E") ratio of 15.2x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been advantageous for Foster Electric Company as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Foster Electric Company

How Is Foster Electric Company's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Foster Electric Company's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 171% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 9.5% over the next year. That's shaping up to be similar to the 9.7% growth forecast for the broader market.

In light of this, it's understandable that Foster Electric Company's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Foster Electric Company's P/E?

Its shares have lifted substantially and now Foster Electric Company's P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Foster Electric Company's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

Plus, you should also learn about these 2 warning signs we've spotted with Foster Electric Company.

Of course, you might also be able to find a better stock than Foster Electric Company. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6794

Foster Electric Company

Engages in the production and sale of loudspeakers, audio equipment, and electronical equipment in Japan and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives