- Japan

- /

- Consumer Durables

- /

- TSE:6758

What Sony Group (TSE:6758)'s CEO Transition Means for Shareholders

Reviewed by Sasha Jovanovic

- On October 2, 2025, Sony Group Corporation announced that Kenji Tanaka, currently Senior Vice President, will become President and CEO effective April 1, 2026, and assume the role of Business CEO, reporting to Hiroki Totoki.

- This transition marks a significant leadership change that could influence Sony's future direction and operational priorities as it enters a new phase of executive management.

- We'll examine how the appointment of Kenji Tanaka as President and CEO could influence Sony's investment narrative and future strategy.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Sony Group Investment Narrative Recap

To own Sony Group stock, you need confidence in its ability to deliver steady earnings growth through content monetization, leadership in advanced imaging, and expanding digital and entertainment platforms. The announcement of Kenji Tanaka as incoming President and CEO represents a visible shift for Sony, but with a seasoned leadership team already in place, the near-term focus for shareholders remains tied to key catalysts like gaming ecosystem expansion, while the biggest risk continues to be margin pressures from supply chain constraints and hardware competition. At this stage, the management transition is not expected to materially change either the central catalysts or core risks in the immediate future.

Outside the executive changes, Sony’s recent completion of a large share buyback, repurchasing over 51 million shares as part of a multi-phase program, marks an important shareholder return initiative. While not directly related to the leadership transition, it highlights Sony’s ongoing efforts to reinforce capital efficiency and could impact valuation amid evolving business priorities.

Yet, in contrast, investors should be especially aware of supply chain cost pressures, as these could impact...

Read the full narrative on Sony Group (it's free!)

Sony Group's outlook anticipates ¥12,813.1 billion in revenue and ¥1,265.8 billion in earnings by 2028. This reflects a -0.5% annual revenue decline and a ¥75.3 billion earnings increase from the current earnings of ¥1,190.5 billion.

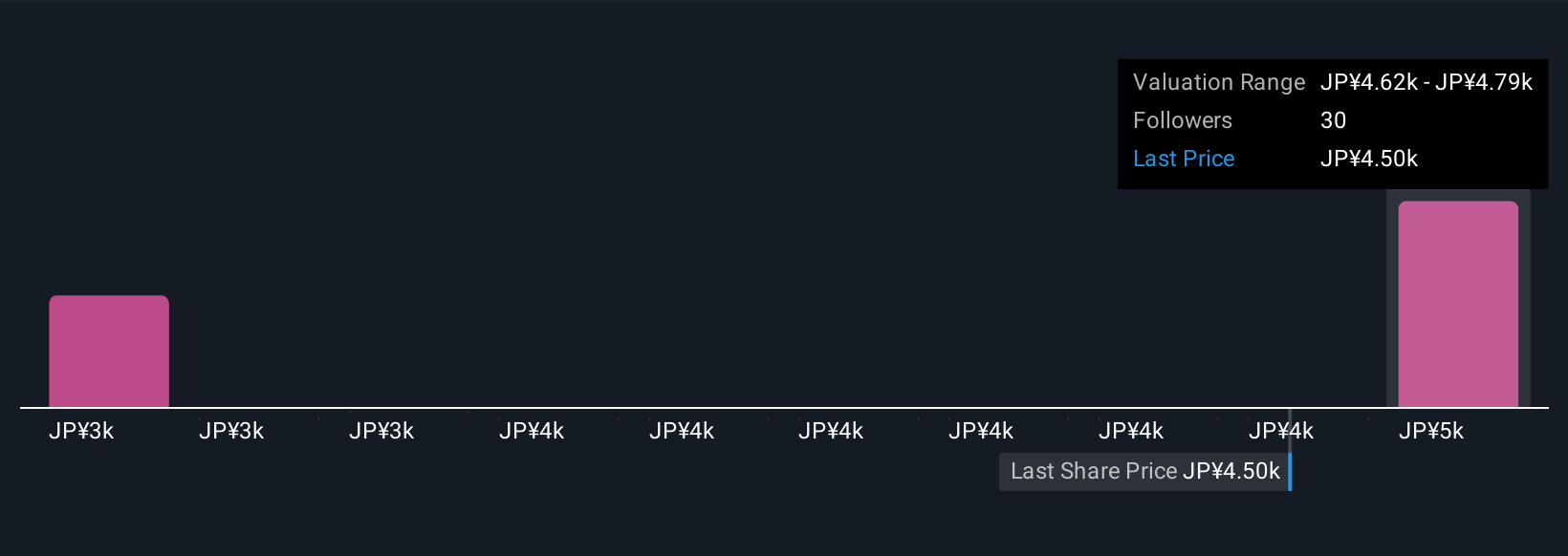

Uncover how Sony Group's forecasts yield a ¥4790 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Four individual fair value estimates from the Simply Wall St Community range from ¥3,054 to ¥4,790. While you see broad opinions on Sony’s worth, challenges like sustained cost and margin pressures often shape these outlooks, so consider several viewpoints as you weigh the company’s future.

Explore 4 other fair value estimates on Sony Group - why the stock might be worth 27% less than the current price!

Build Your Own Sony Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sony Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Sony Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sony Group's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6758

Sony Group

Designs, develops, produces, and sells electronic equipment, instruments, and devices for the consumer, professional, and industrial markets in Japan, the United States, Europe, China, the Asia-Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives