- Japan

- /

- Construction

- /

- TSE:1879

December 2024's Top Dividend Stocks For Reliable Income

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, with the Nasdaq Composite reaching new highs amidst broader index declines and central banks adjusting rates, investors are keenly observing how these dynamics influence their portfolios. In this climate of fluctuating market conditions and economic uncertainty, dividend stocks stand out as a potential source of reliable income, offering stability through regular payouts while potentially benefiting from capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.43% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.95% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.77% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.25% | ★★★★★★ |

Click here to see the full list of 1967 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

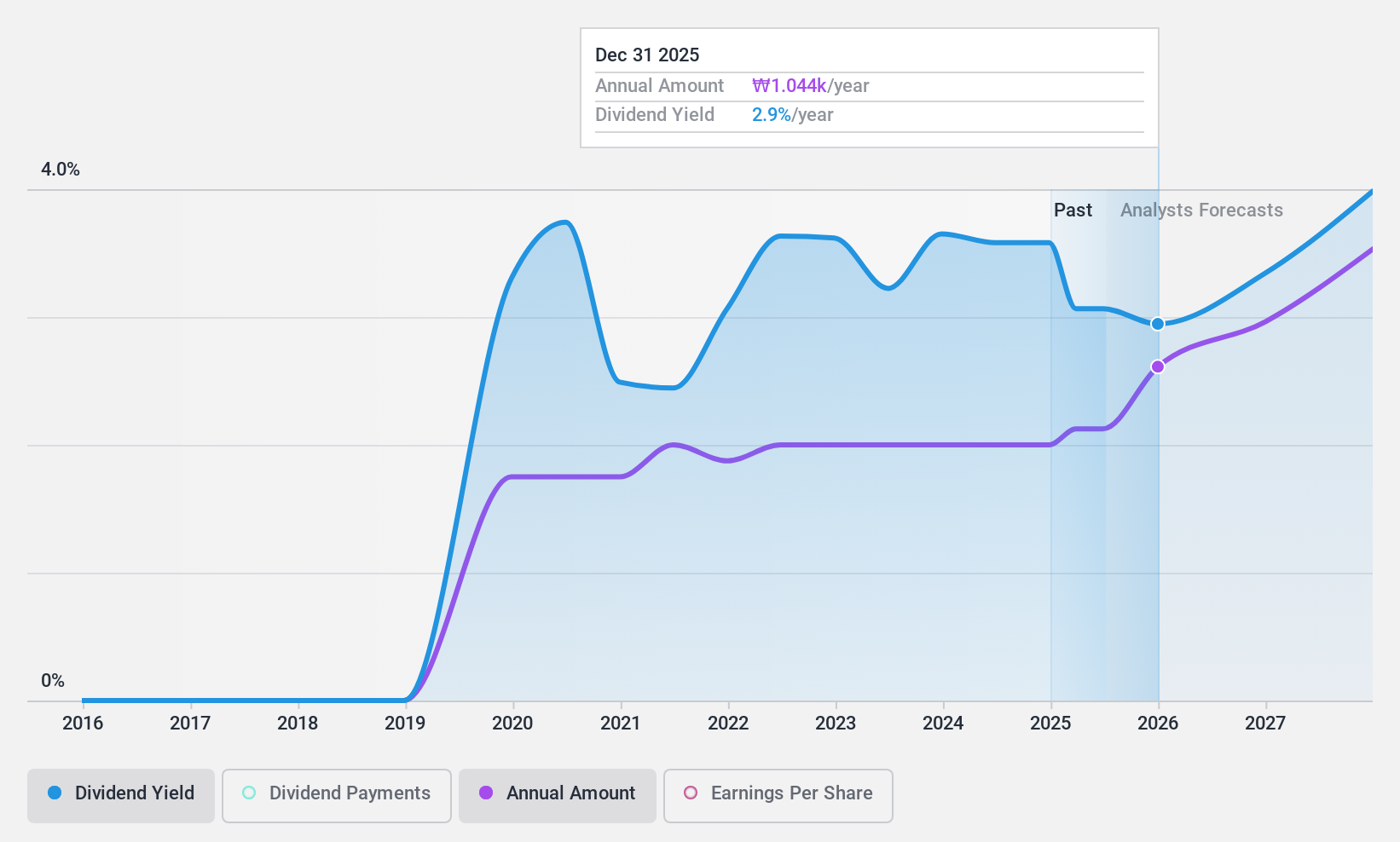

SNT Motiv (KOSE:A064960)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SNT Motiv Co., Ltd. engages in the production, development, and sale of products for the defense and automotive industries both in South Korea and internationally, with a market cap of ₩482.64 billion.

Operations: SNT Motiv Co., Ltd.'s revenue is primarily derived from its Vehicle Parts segment, which generates ₩718.41 million.

Dividend Yield: 4%

SNT Motiv's dividend payments have been volatile over the past five years, though they are well covered by earnings and cash flows with payout ratios of 28.9% and 24.1%, respectively. Despite an unstable track record, the dividend yield is competitive at 3.95%, placing it in the top quartile of Korean market payers. Recent share buybacks totaling KRW 7.50 billion may positively influence future dividends by reducing outstanding shares and potentially increasing earnings per share.

- Click here and access our complete dividend analysis report to understand the dynamics of SNT Motiv.

- Our valuation report unveils the possibility SNT Motiv's shares may be trading at a discount.

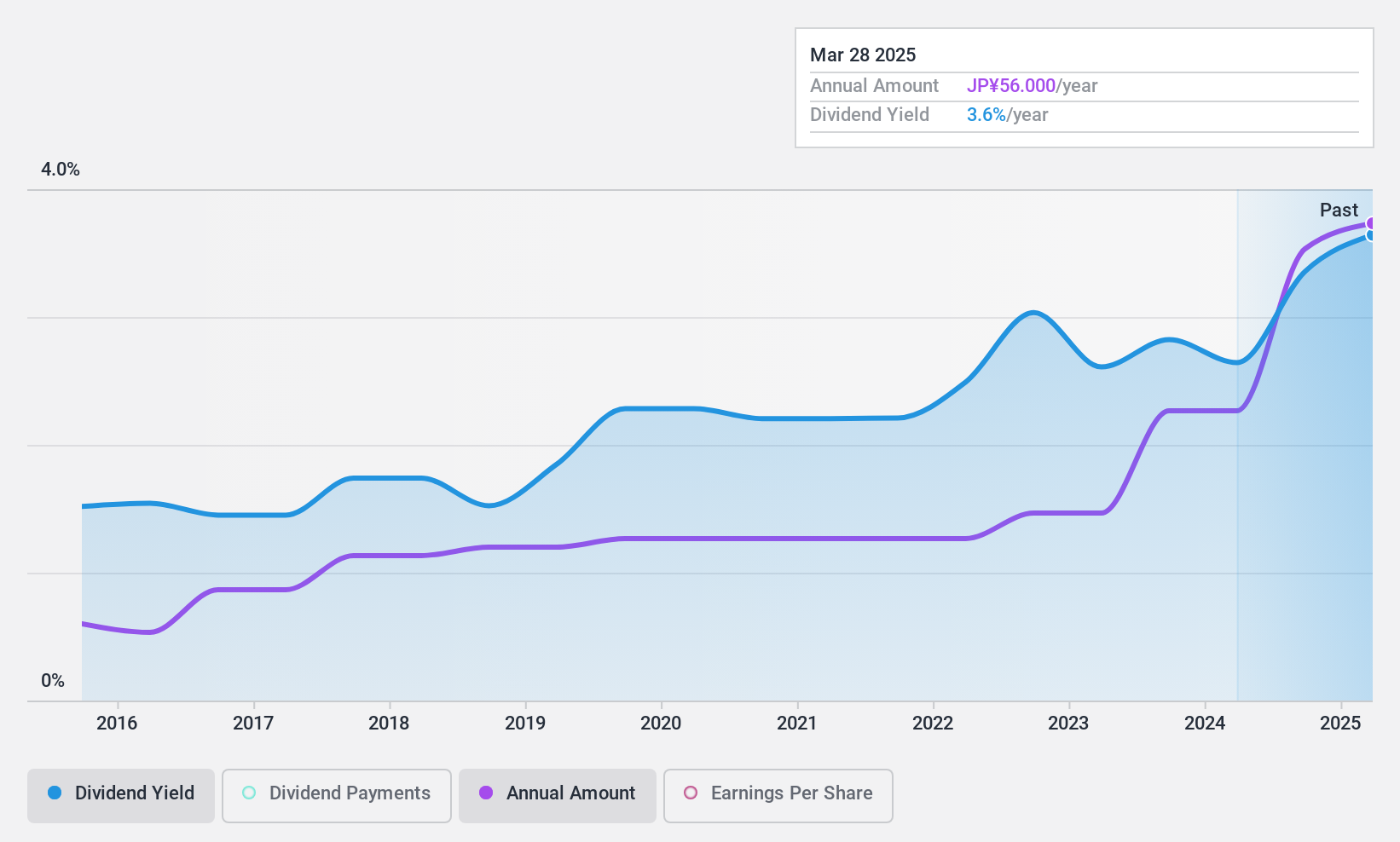

Shinnihon (TSE:1879)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shinnihon Corporation is a construction company operating in Japan with a market cap of ¥86.74 billion.

Operations: Shinnihon Corporation generates its revenue primarily through its construction operations in Japan.

Dividend Yield: 4.3%

Shinnihon's recent dividend increase to JPY 26.00 per share from JPY 15.00 highlights its growing payouts, though historically volatile over the past decade. Despite this instability, dividends are well covered by earnings and cash flows with low payout ratios of 18.4% and 19.4%, respectively, ensuring sustainability. Trading significantly below estimated fair value, Shinnihon offers a competitive yield of 4.32%, ranking in the top quartile among Japanese dividend stocks as of recent market data.

- Click here to discover the nuances of Shinnihon with our detailed analytical dividend report.

- According our valuation report, there's an indication that Shinnihon's share price might be on the cheaper side.

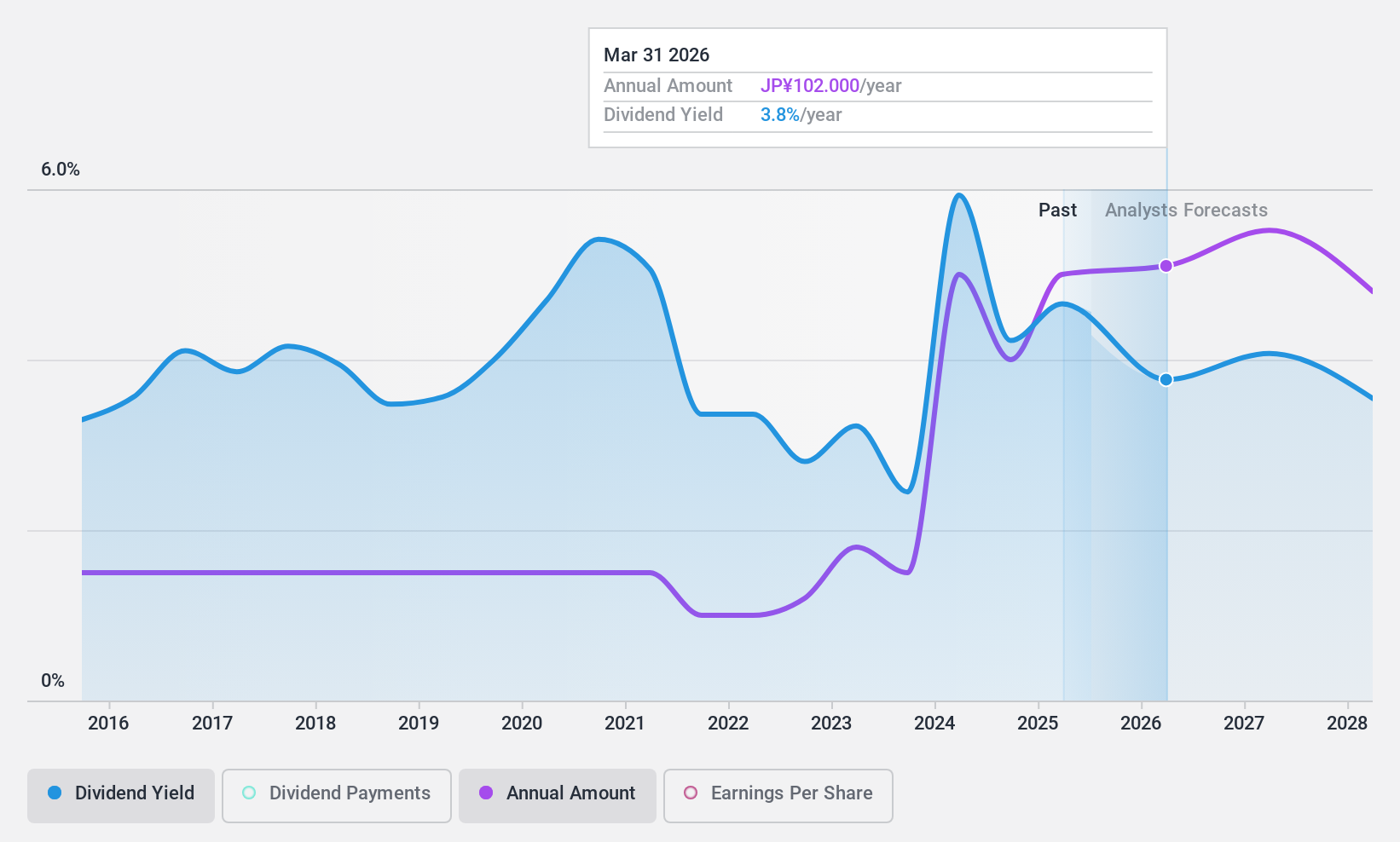

Sankyo (TSE:6417)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sankyo Co., Ltd. is a Japanese company that manufactures and sells game machines and ball bearing supply systems, with a market cap of ¥451.19 billion.

Operations: Sankyo Co., Ltd.'s revenue segments include the Pachinko-Related Segment at ¥102.92 billion, the Pachislo-Related Segment at ¥49.66 billion, and the Supplementary Equipment-Related Business at ¥20.57 billion.

Dividend Yield: 3.9%

Sankyo's recent dividend announcement of JPY 40.00 per share for the second quarter aligns with its guidance for fiscal year 2025. Despite a historically volatile and unreliable dividend track record, the company's payouts have grown over the past decade. With a payout ratio of 43.6% and cash payout ratio of 34%, dividends are well covered by earnings and cash flows, supporting sustainability. Trading at a substantial discount to estimated fair value, Sankyo offers competitive yield within Japan's top quartile.

- Get an in-depth perspective on Sankyo's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Sankyo is trading behind its estimated value.

Summing It All Up

- Click through to start exploring the rest of the 1964 Top Dividend Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1879

Flawless balance sheet established dividend payer.