IKK Holdings And 2 Other Top Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a complex landscape of rate cuts and economic indicators, investors are keenly observing the performance of major indices like the Nasdaq Composite, which recently hit a record high despite broader market declines. With inflationary pressures and labor market dynamics influencing monetary policy decisions, dividend stocks offer a compelling option for those seeking stability and income in uncertain times. In this context, selecting robust dividend stocks such as IKK Holdings can provide both resilience and potential returns amidst fluctuating economic conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.43% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.95% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.77% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.25% | ★★★★★★ |

Click here to see the full list of 1967 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

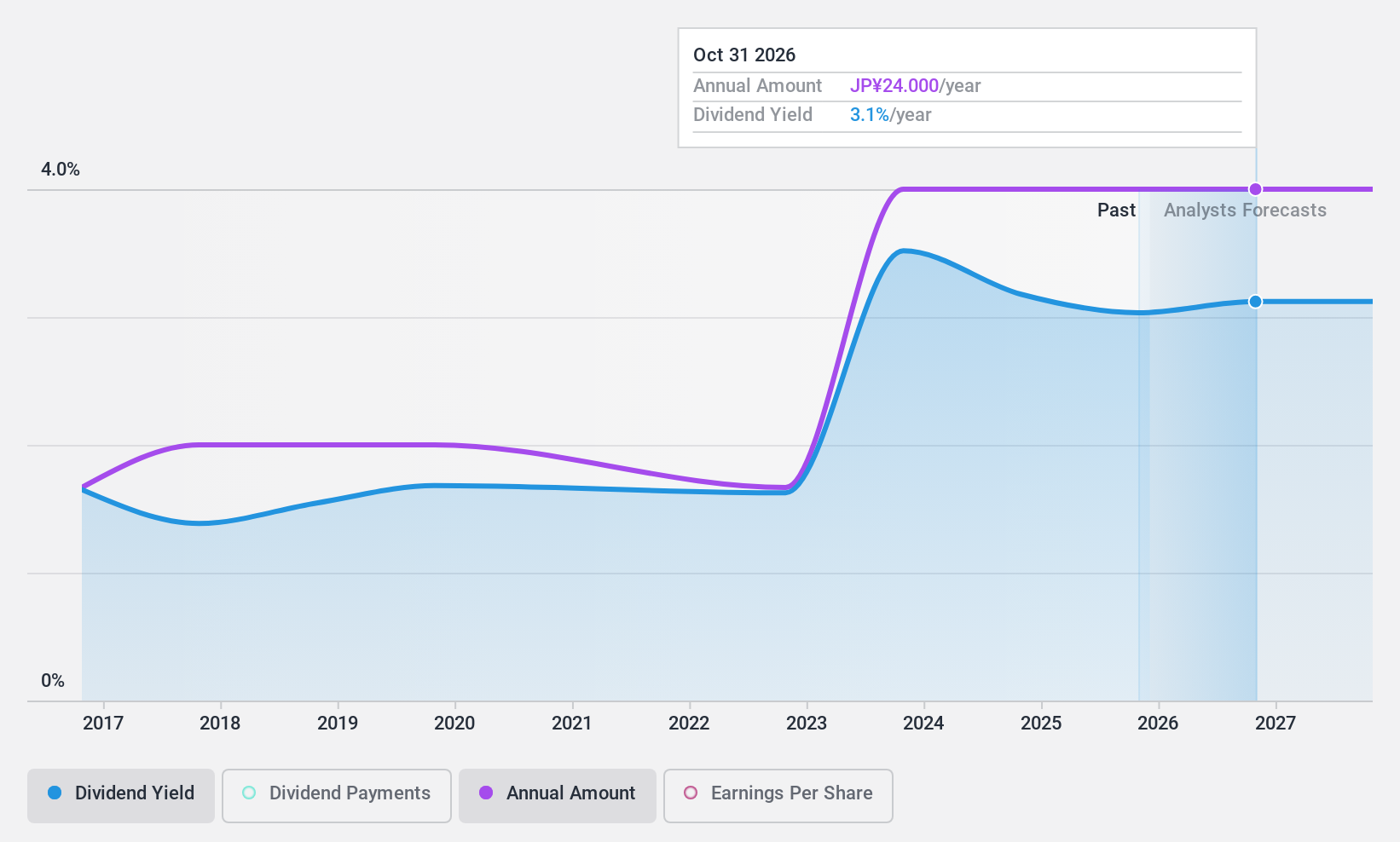

IKK Holdings (TSE:2198)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IKK Holdings Inc. operates in Japan across various sectors including wedding services, nursing care, food, financial services, photography, and matrimonial matchmaking with a market capitalization of ¥20.98 billion.

Operations: IKK Holdings Inc. generates revenue from its diverse operations in Japan, including wedding services, nursing care, food services, financial services, photography, and matrimonial matchmaking.

Dividend Yield: 3.3%

IKK Holdings offers a mixed dividend profile. Its dividends are well-covered by earnings and cash flows, with payout ratios of 40.6% and 20.3% respectively, suggesting sustainability. However, the dividend history is volatile and unreliable, with fluctuations over 20%. Despite trading at a good value relative to peers and industry, its current yield of 3.27% lags behind top-tier payers in Japan (3.84%). Earnings grew significantly last year but are forecasted to decline in the future.

- Dive into the specifics of IKK Holdings here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that IKK Holdings is priced lower than what may be justified by its financials.

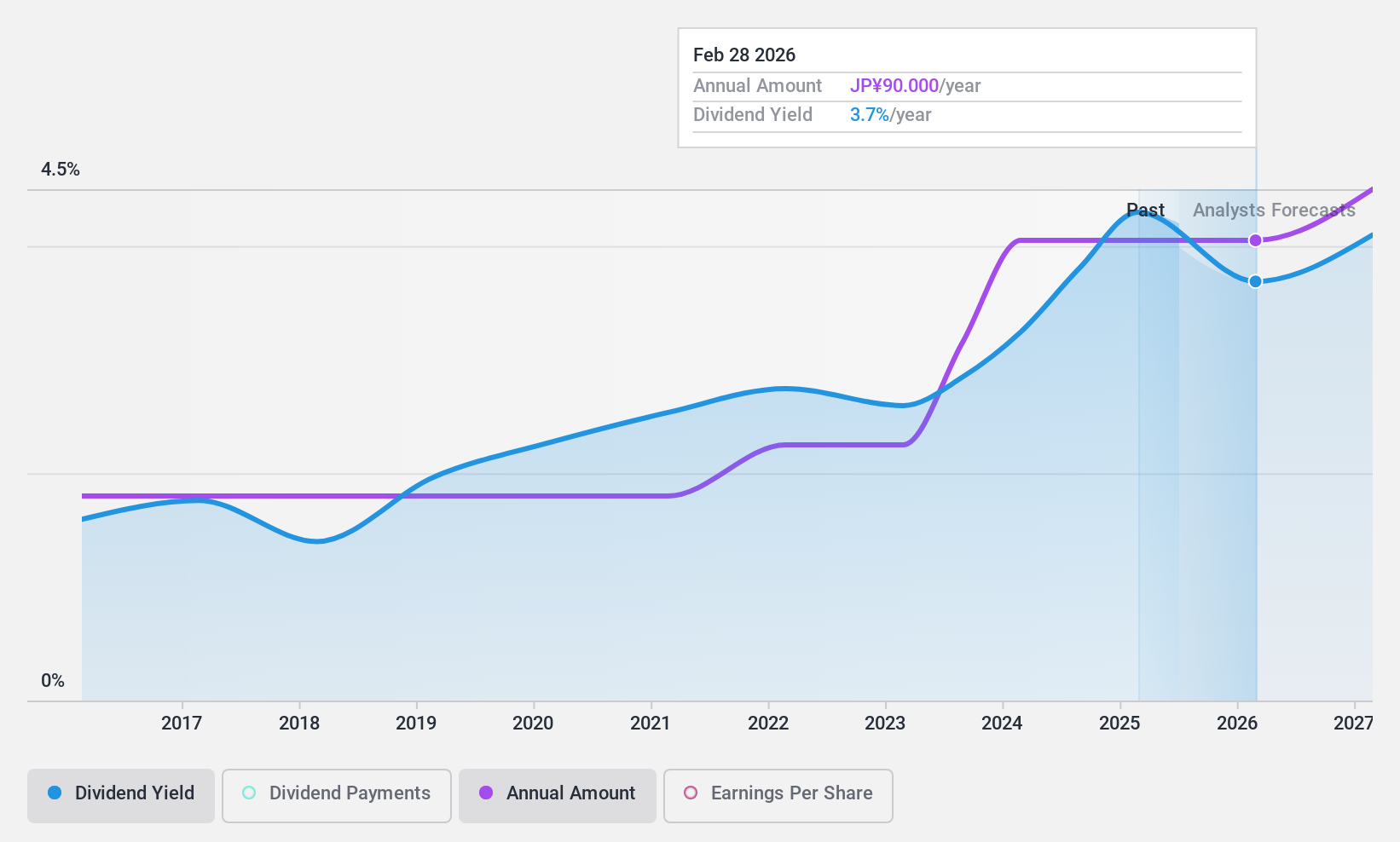

Warabeya Nichiyo Holdings (TSE:2918)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Warabeya Nichiyo Holdings Co., Ltd., along with its subsidiaries, manufactures and sells food products for convenience stores in Japan and internationally, with a market cap of ¥34.62 billion.

Operations: Warabeya Nichiyo Holdings Co., Ltd. generates revenue through the manufacture and sale of food products tailored for convenience stores across both domestic and international markets.

Dividend Yield: 4.5%

Warabeya Nichiyo Holdings maintains stable dividends, recently affirming a JPY 45.00 per share payout. While the dividend yield of 4.54% ranks in the top 25% of Japanese payers, it is not covered by free cash flows despite a reasonable payout ratio of 54.5%. The company's recent downsizing and lowered earnings guidance suggest challenges ahead, though past earnings have shown growth. Shares are trading at a discount compared to estimated fair value and peers.

- Navigate through the intricacies of Warabeya Nichiyo Holdings with our comprehensive dividend report here.

- According our valuation report, there's an indication that Warabeya Nichiyo Holdings' share price might be on the cheaper side.

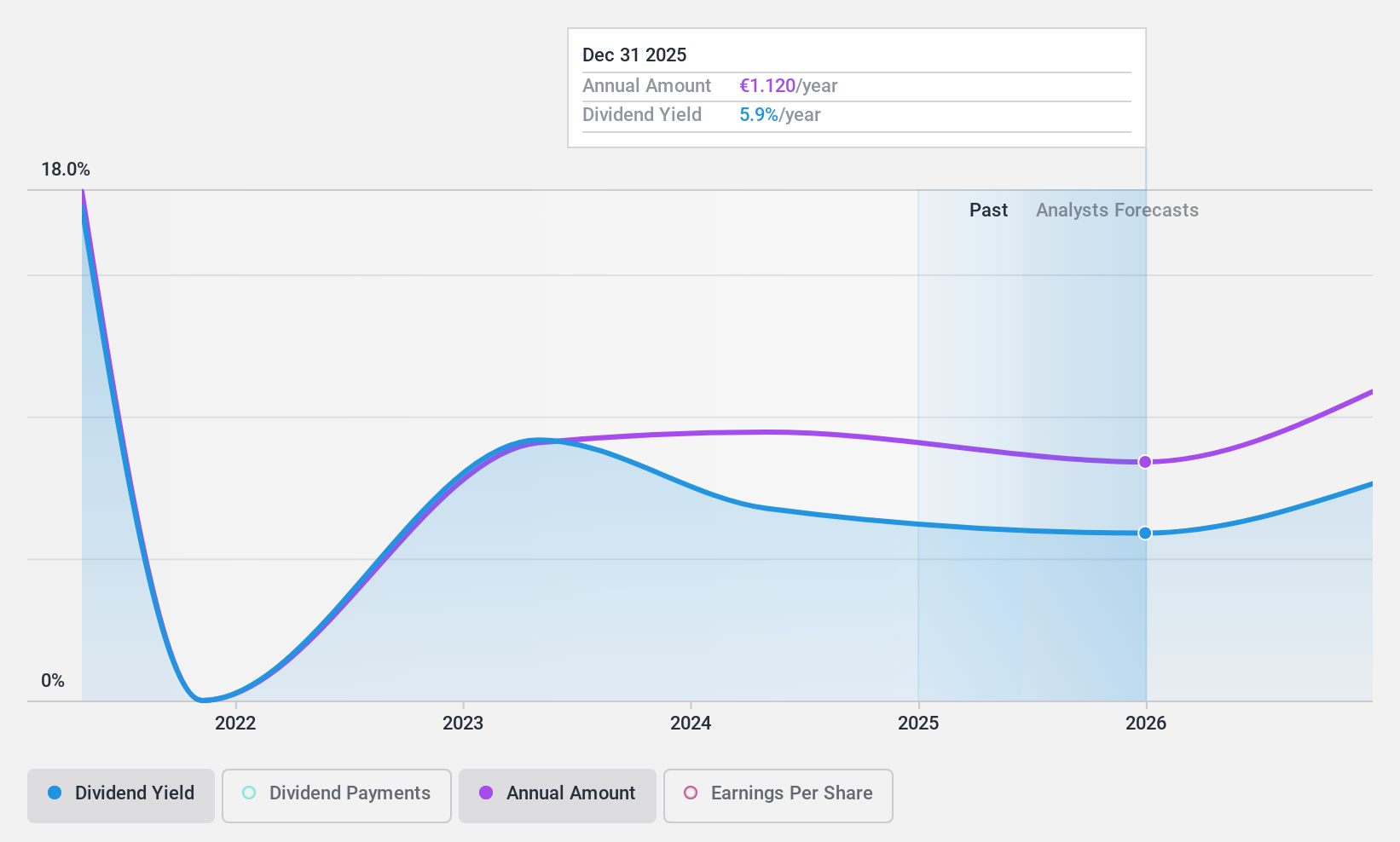

Addiko Bank (WBAG:ADKO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Addiko Bank AG offers a range of banking products and services across Croatia, Slovenia, Serbia, Bosnia and Herzegovina, Montenegro, Austria, and Germany with a market cap of €360.67 million.

Operations: Addiko Bank AG's revenue segments include Consumer (€162.50 million), Mortgage (€25.60 million), SME Business (€93.80 million), Public Finance (€6.20 million), and Large Corporates (€9.70 million).

Dividend Yield: 6.7%

Addiko Bank's dividend yield of 6.68% ranks in the top 25% among Austrian payers, supported by a payout ratio of 51.7%, ensuring current and future coverage by earnings. However, its four-year dividend history is marked by volatility and declines, reflecting an unstable track record. Despite recent earnings growth and a low price-to-earnings ratio of 7.5x compared to the market average, high bad loans at 4% pose risks to sustainability.

- Click to explore a detailed breakdown of our findings in Addiko Bank's dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Addiko Bank shares in the market.

Where To Now?

- Take a closer look at our Top Dividend Stocks list of 1967 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Warabeya Nichiyo Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Warabeya Nichiyo Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2918

Warabeya Nichiyo Holdings

Engages in the manufacture and sale of food products for convenience stores in Japan and internationally.

Undervalued with excellent balance sheet and pays a dividend.