- Japan

- /

- Real Estate

- /

- TSE:9639

Undiscovered Gems with Potential In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate cuts from the ECB and SNB, and anticipation of a Federal Reserve decision, small-cap stocks have faced challenges with the Russell 2000 Index underperforming larger peers. Amidst this backdrop of fluctuating economic indicators and mixed market sentiment, identifying promising small-cap stocks requires careful consideration of their growth potential, financial health, and ability to adapt to changing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ShareHope Medicine | 38.07% | 3.80% | -7.16% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 9.32% | 12.22% | 22.08% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Hamakyorex (TSE:9037)

Simply Wall St Value Rating: ★★★★★★

Overview: Hamakyorex Co., Ltd. operates in the 3PL logistics and truck transportation sectors both domestically in Japan and internationally, with a market cap of ¥96.69 billion.

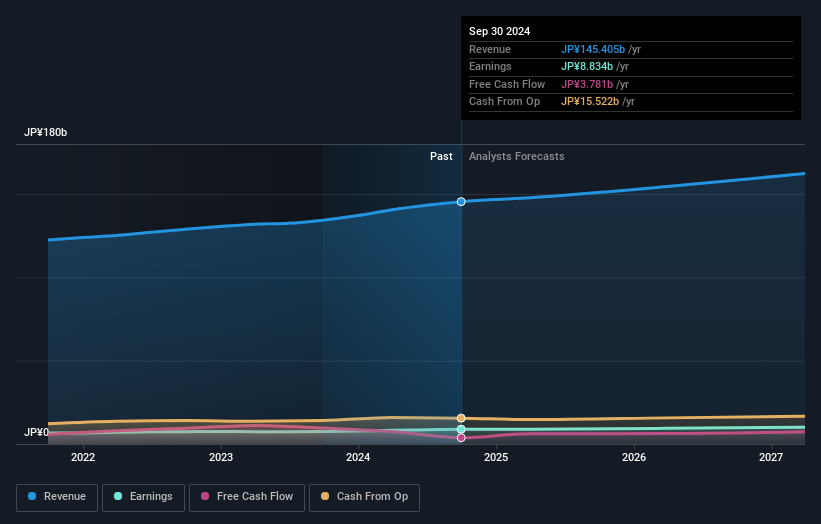

Operations: Hamakyorex generates revenue primarily from its Logistics Center Business, contributing ¥94.19 billion, and the Autonomous Cargo Transportation Business, adding ¥53.54 billion.

Hamakyorex, a notable player in the logistics sector, has been making waves with earnings growth of 17.9% over the past year, outpacing the industry's 8.4%. The company is trading at nearly 30% below its estimated fair value, suggesting potential upside for investors. Over five years, its debt to equity ratio improved from 32.5% to 24.9%, indicating prudent financial management. Recent share repurchases amounting to ¥991.82 million reflect an active capital strategy aimed at adapting to market conditions and enhancing shareholder value. With interest payments covered by EBIT nearly 399 times over, Hamakyorex shows robust financial health and stability.

Sankyo FrontierLtd (TSE:9639)

Simply Wall St Value Rating: ★★★★★★

Overview: Sankyo Frontier Co., Ltd. is involved in the production, sale, and rental of modular buildings, self-storage units, and multistory parking devices both in Japan and internationally with a market capitalization of ¥46.94 billion.

Operations: The primary revenue stream for Sankyo Frontier Co., Ltd. is its House Business segment, generating ¥55.76 billion. The company's market capitalization stands at ¥46.94 billion.

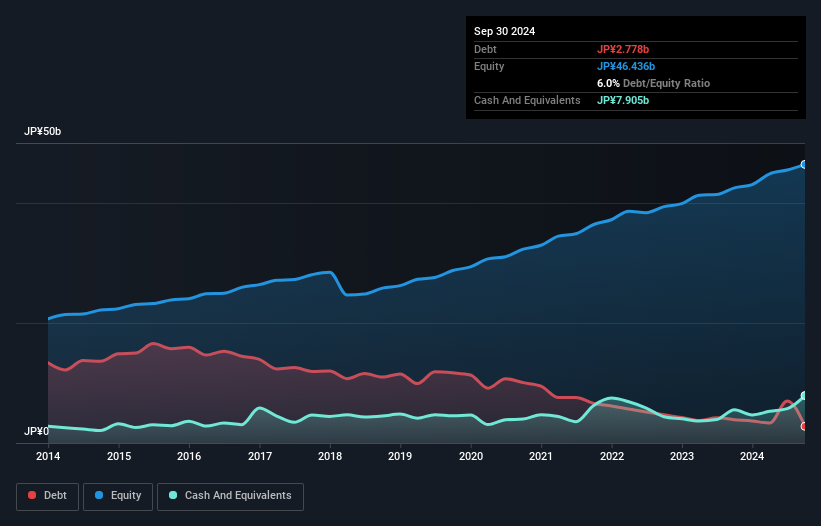

Sankyo FrontierLtd, a small cap player, seems to be an intriguing prospect with its high-quality earnings and a debt-to-equity ratio that has impressively shrunk from 40.7% to 6% over the past five years. The company trades at a significant discount of 74.6% below its estimated fair value, suggesting potential undervaluation in the market. Over the last year, earnings have grown by 15.9%, although this pace lags behind the broader Real Estate industry growth of 20.3%. With more cash than total debt and well-covered interest payments by EBIT (703x), Sankyo appears financially robust for future endeavors.

- Delve into the full analysis health report here for a deeper understanding of Sankyo FrontierLtd.

Examine Sankyo FrontierLtd's past performance report to understand how it has performed in the past.

Altek (TWSE:3059)

Simply Wall St Value Rating: ★★★★★☆

Overview: Altek Corporation, with a market cap of NT$9.02 billion, develops, manufactures, and sells automobile cameras and medical and digital image technology application products through its subsidiaries.

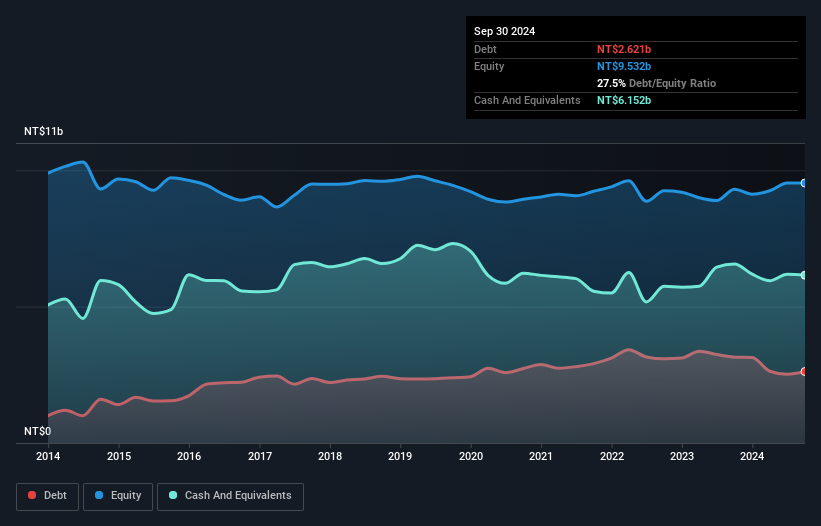

Operations: Altek's primary revenue stream is from its Photographic Equipment & Supplies segment, generating NT$7.53 billion. The company has a market cap of NT$9.02 billion.

Altek has been navigating a challenging landscape, with its recent earnings showing a dip in sales to TWD 1.88 billion from TWD 2.30 billion year-on-year for Q3 2024, while net income fell to TWD 78.69 million from TWD 106.86 million. Despite these figures, the company remains profitable and has high-quality past earnings, indicating resilience in its operations. The debt-to-equity ratio slightly increased over five years but is balanced by having more cash than total debt, suggesting financial stability. A follow-on equity offering indicates potential capital raising for future growth or operational needs.

- Get an in-depth perspective on Altek's performance by reading our health report here.

Assess Altek's past performance with our detailed historical performance reports.

Key Takeaways

- Embark on your investment journey to our 4622 Undiscovered Gems With Strong Fundamentals selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9639

Sankyo FrontierLtd

Produces, sells, and rents modular buildings, self-storage, and multistory parking devices in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives