- Japan

- /

- Commercial Services

- /

- TSE:9768

IDEA Consultants,Inc. (TSE:9768) Stock Rockets 30% But Many Are Still Ignoring The Company

The IDEA Consultants,Inc. (TSE:9768) share price has done very well over the last month, posting an excellent gain of 30%. The last 30 days bring the annual gain to a very sharp 49%.

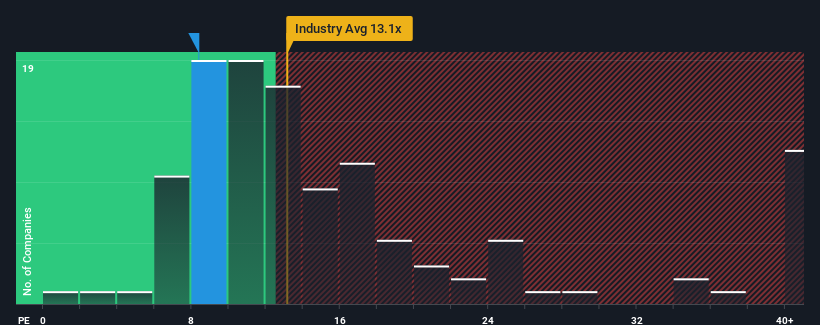

In spite of the firm bounce in price, IDEA ConsultantsInc's price-to-earnings (or "P/E") ratio of 8.4x might still make it look like a buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 15x and even P/E's above 24x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

As an illustration, earnings have deteriorated at IDEA ConsultantsInc over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for IDEA ConsultantsInc

Is There Any Growth For IDEA ConsultantsInc?

The only time you'd be truly comfortable seeing a P/E as low as IDEA ConsultantsInc's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 7.4%. Even so, admirably EPS has lifted 48% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

This is in contrast to the rest of the market, which is expected to grow by 11% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that IDEA ConsultantsInc's P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Despite IDEA ConsultantsInc's shares building up a head of steam, its P/E still lags most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of IDEA ConsultantsInc revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Having said that, be aware IDEA ConsultantsInc is showing 1 warning sign in our investment analysis, you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9768

IDEA ConsultantsInc

Provides integrated consultancy services on social infrastructure development and environmental conservation projects in Japan and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives