- Japan

- /

- Electrical

- /

- TSE:6653

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets continue to reach record highs, with the S&P 500 and Dow Jones Industrial Average leading the charge, investors are navigating a landscape influenced by geopolitical developments and domestic policy shifts. In this dynamic environment, dividend stocks can offer stability and income potential, making them a compelling option for those seeking to balance growth with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.99% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.28% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.33% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.47% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.92% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

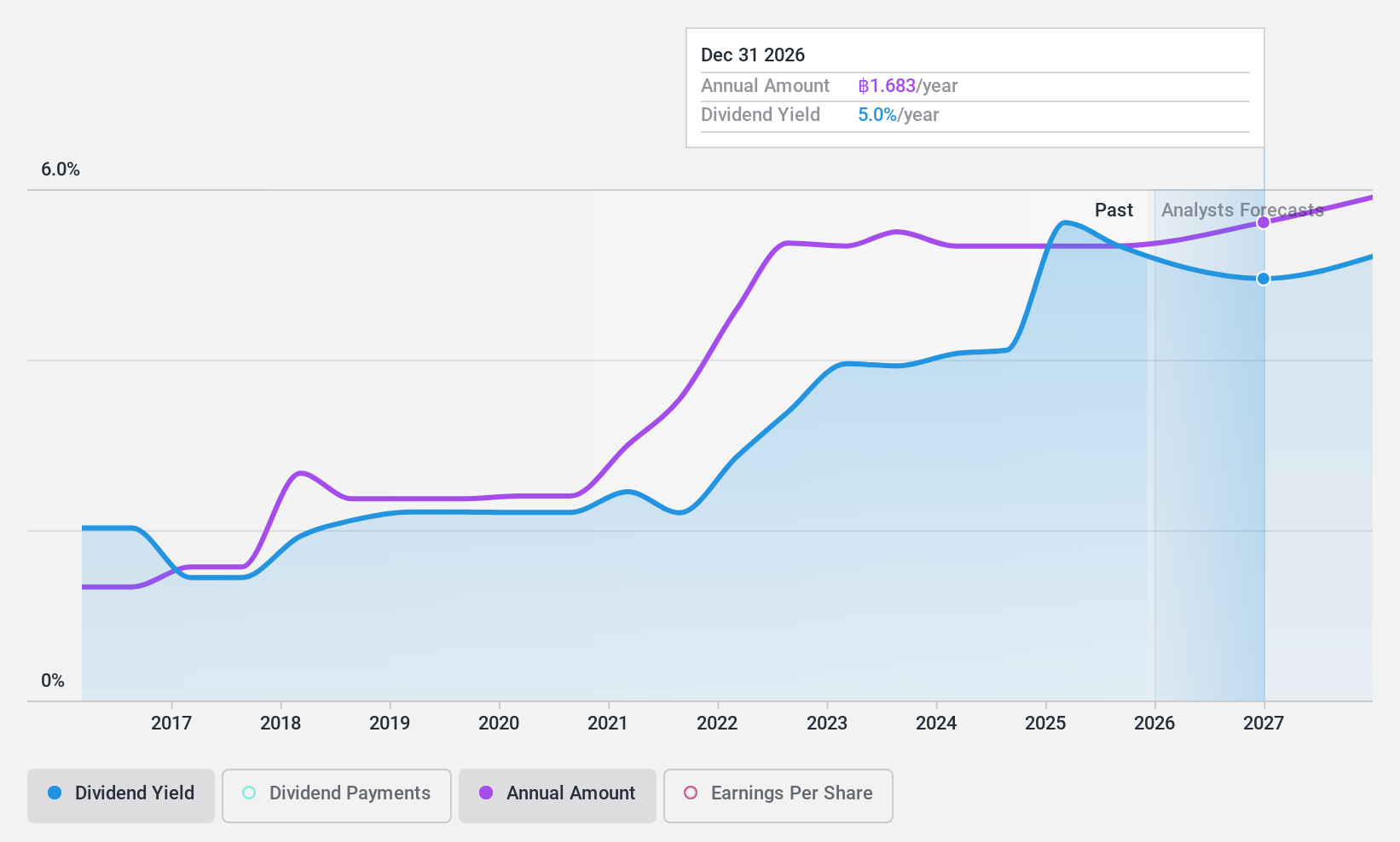

Mega Lifesciences (SET:MEGA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mega Lifesciences Public Company Limited, along with its subsidiaries, produces and distributes health food supplements, pharmaceuticals, over-the-counter products, herbal products, vitamins, and fast-moving consumer goods across Southeast Asia and Sub-Saharan Africa; the company has a market cap of THB30.73 billion.

Operations: Mega Lifesciences generates revenue from three primary segments: Brands (THB8.24 billion), Distribution (THB7.34 billion), and Original Equipment Manufacture (OEM) (THB289.67 million).

Dividend Yield: 4.5%

Mega Lifesciences has shown consistent revenue growth, with recent quarterly earnings of THB 4.03 billion, yet net income declined to THB 382.59 million. Its dividend yield of 4.54% is below the top tier in Thailand's market and has been volatile over the past decade, raising concerns about reliability despite being covered by earnings (75.6%) and cash flows (82.4%). The stock trades at a significant discount to its estimated fair value, suggesting potential for appreciation.

- Click to explore a detailed breakdown of our findings in Mega Lifesciences' dividend report.

- Our valuation report here indicates Mega Lifesciences may be undervalued.

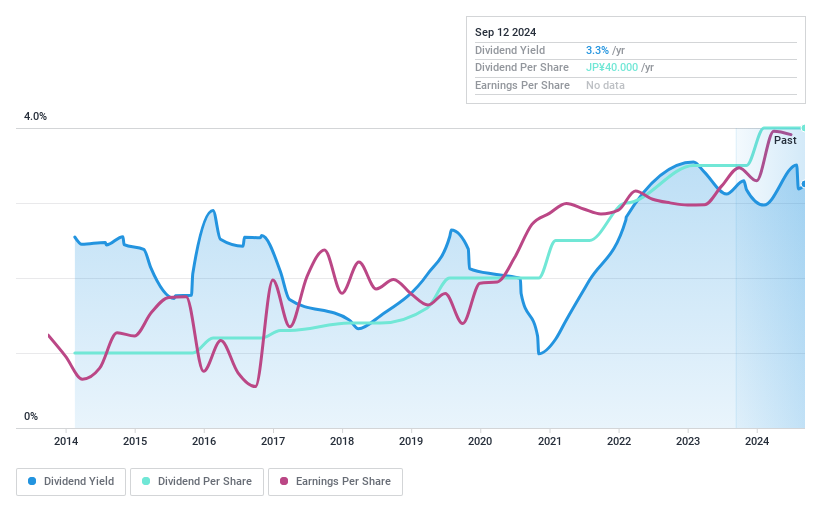

Seiko Electric (TSE:6653)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Seiko Electric Co., Ltd. operates in Japan, focusing on power systems and environmental energy and control systems, with a market cap of ¥16.19 billion.

Operations: Seiko Electric Co., Ltd.'s revenue is primarily derived from its operations in power systems and environmental energy and control systems within Japan.

Dividend Yield: 3.3%

Seiko Electric's dividend reliability is underscored by a decade of stable and growing payments, with recent guidance indicating an increase to ¥20 per share. The dividend yield of 3.29% falls short of Japan's top tier but remains well-covered by earnings (30.4%) and cash flows (27%). Despite recent shareholder dilution, the stock trades significantly below its estimated fair value, offering potential upside alongside its consistent dividend strategy.

- Navigate through the intricacies of Seiko Electric with our comprehensive dividend report here.

- The analysis detailed in our Seiko Electric valuation report hints at an deflated share price compared to its estimated value.

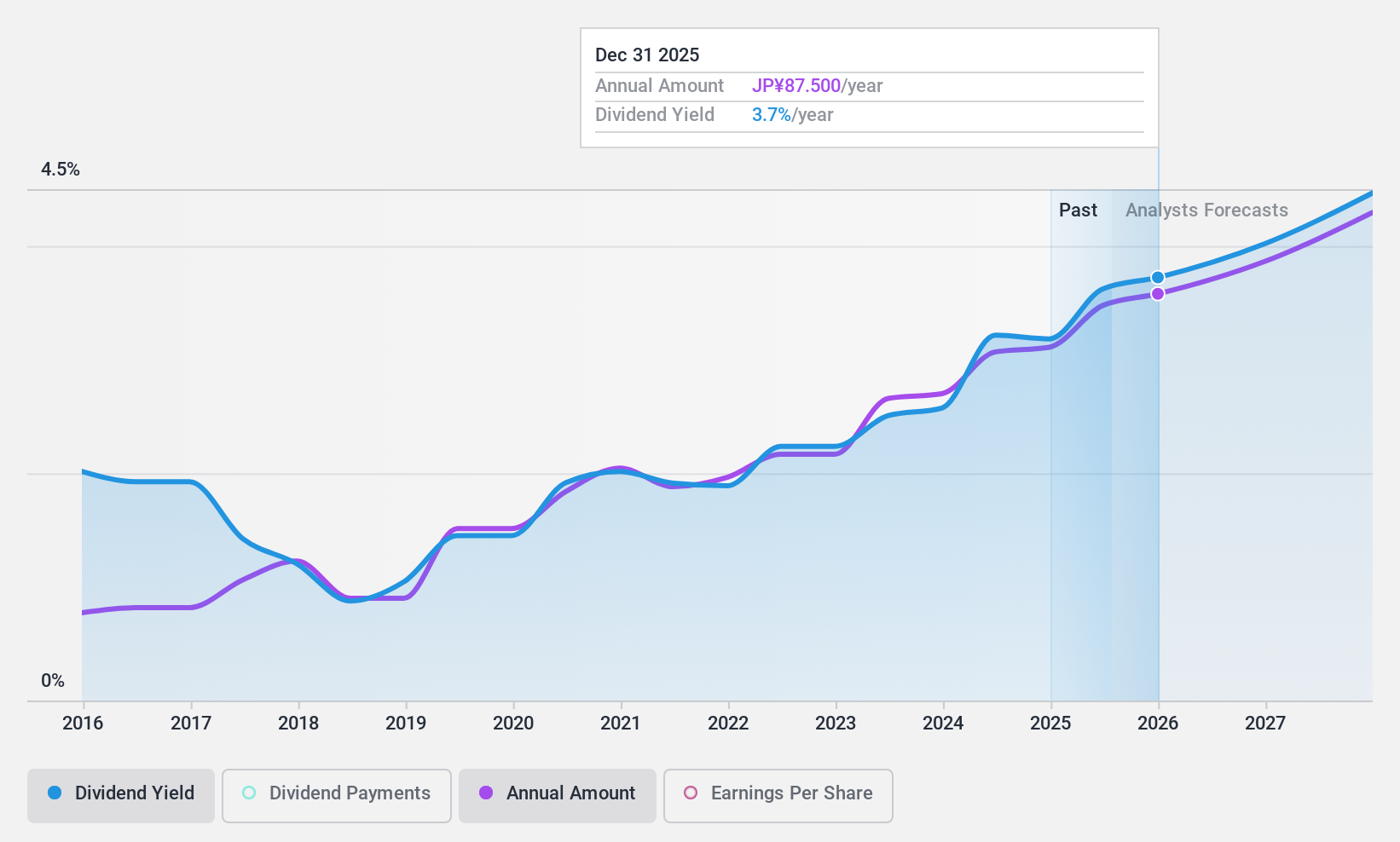

Funai Soken Holdings (TSE:9757)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Funai Soken Holdings Incorporated offers consulting services to manufacturing and retail businesses in Japan, with a market cap of ¥110.85 billion.

Operations: Funai Soken Holdings Incorporated generates revenue through its segments in Consulting (¥22.51 billion), Digital Solutions (¥4.77 billion), and Logistics (¥4.63 billion).

Dividend Yield: 3.2%

Funai Soken Holdings' dividend payments, with a payout ratio of 57.1%, are well-covered by earnings and cash flows (68.6%). However, the dividends have been volatile over the past decade, despite overall growth. The current yield of 3.18% is below Japan's top tier but remains sustainable due to solid earnings coverage. Recent share buybacks totaling ¥2.85 billion highlight management's commitment to shareholder value amidst trading at a discount to estimated fair value.

- Unlock comprehensive insights into our analysis of Funai Soken Holdings stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Funai Soken Holdings shares in the market.

Next Steps

- Delve into our full catalog of 1963 Top Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6653

Seiko Electric

Primarily operates in the fields of power system, and environmental energy and control system in Japan.

Solid track record with excellent balance sheet and pays a dividend.