- Japan

- /

- Medical Equipment

- /

- TSE:7749

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As we enter 2025, global markets are navigating a landscape marked by fluctuating consumer confidence and mixed economic indicators, with U.S. stocks experiencing moderate gains despite some late-year volatility. In this environment, dividend stocks can offer investors a potential source of steady income and stability, making them an attractive option for those looking to balance growth with income generation amidst uncertain market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.71% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1973 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

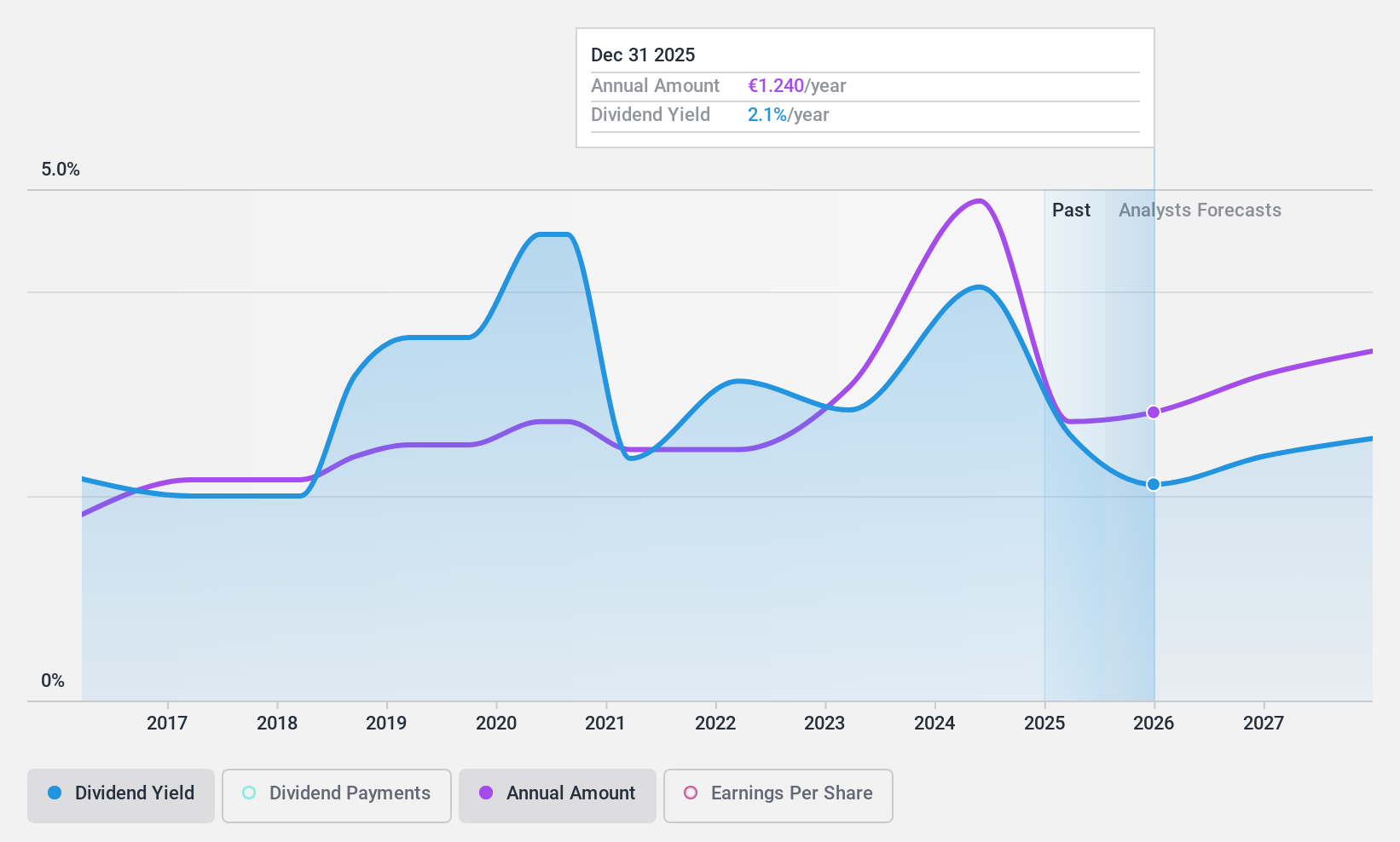

Cargotec (HLSE:CGCBV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cargotec Corporation offers cargo handling solutions and services across various regions including Finland, Europe, the Middle East, Africa, the United States, and Asia-Pacific countries with a market cap of €3.35 billion.

Operations: Cargotec's revenue segments include Hiab at €1.69 billion and MacGregor at €832.10 million.

Dividend Yield: 4.1%

Cargotec offers a stable dividend with a yield of 4.1%, which is well-covered by earnings (41.4% payout ratio) and cash flows (28.1% cash payout ratio). Despite trading at 22.5% below its estimated fair value, its dividend yield is lower than the top Finnish market payers. Recent earnings showed a decline in quarterly net income to €44.6 million, though nine-month figures reflect significant growth due to exceptional items impacting results positively earlier in the year.

- Click here to discover the nuances of Cargotec with our detailed analytical dividend report.

- The analysis detailed in our Cargotec valuation report hints at an deflated share price compared to its estimated value.

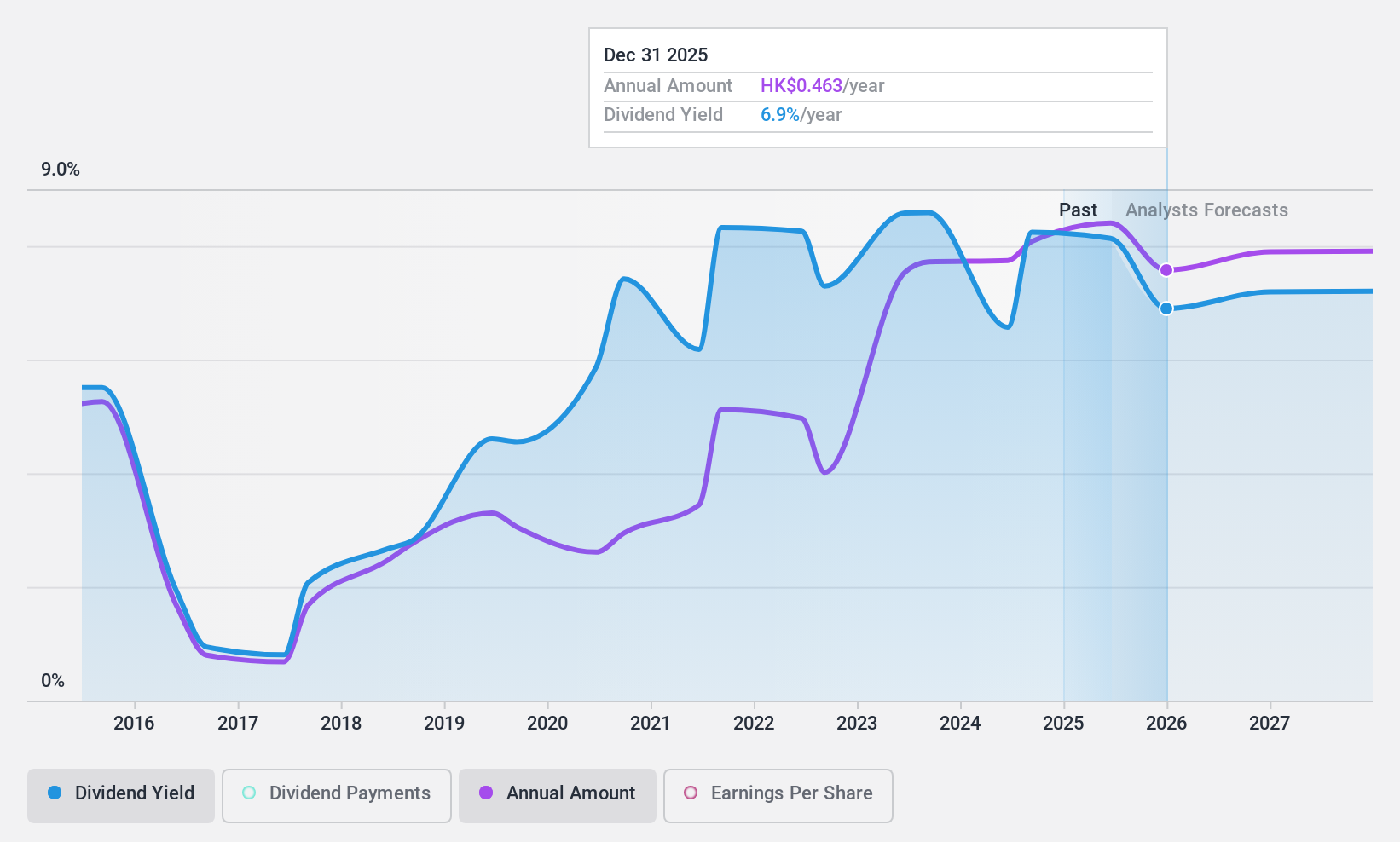

PetroChina (SEHK:857)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PetroChina Company Limited, along with its subsidiaries, is involved in various petroleum-related products, services, and activities both in Mainland China and internationally, with a market cap of approximately HK$1.64 trillion.

Operations: PetroChina's revenue segments include Marketing (CN¥2.47 billion), Natural Gas Sales (CN¥593.33 million), Oil, Gas and New Energy (CN¥923.02 million), and Refining and Chemicals and New Materials (CN¥1.24 billion).

Dividend Yield: 7.7%

PetroChina's dividend yield of 7.75% is lower than the top tier in Hong Kong, yet dividends are well-covered by earnings and cash flows with payout ratios around 51%. Despite a volatile history, dividends have grown over the past decade. The stock trades at a significant discount to its estimated fair value. Recent earnings showed slight declines year-over-year but remain robust overall, supporting its dividend sustainability despite forecasted earnings decline.

- Dive into the specifics of PetroChina here with our thorough dividend report.

- The valuation report we've compiled suggests that PetroChina's current price could be quite moderate.

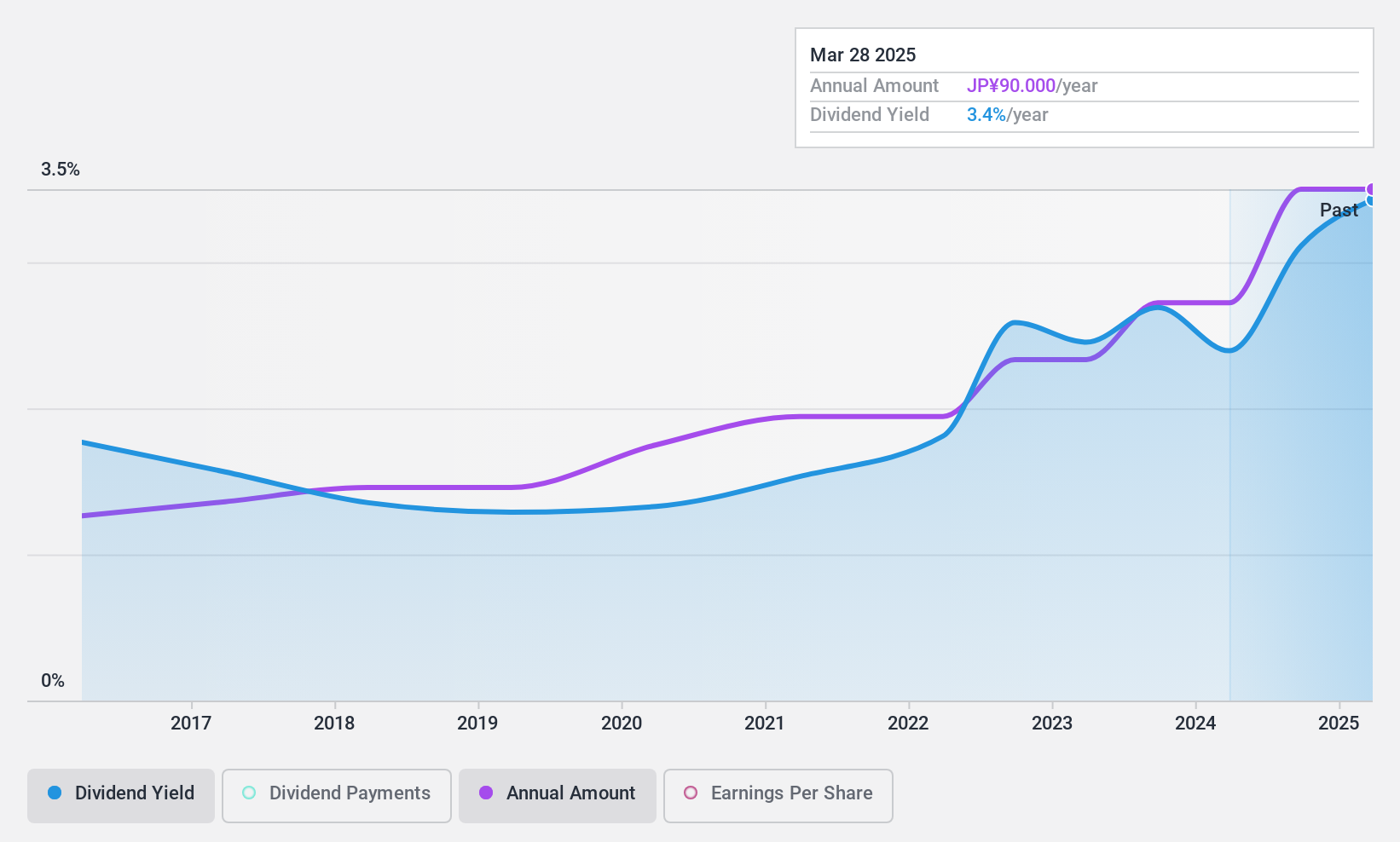

MedikitLtd (TSE:7749)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Medikit Co., Ltd. manufactures and sells vascular access medical devices, with a market cap of ¥40.01 billion.

Operations: Medikit Co., Ltd. generates revenue from the manufacture and sale of vascular access medical devices.

Dividend Yield: 3.3%

Medikit Ltd.'s dividend yield of 3.33% is below Japan's top tier, and while dividends have been stable and growing over the past decade, they are not well covered by free cash flows due to a high cash payout ratio of 133.3%. A share buyback program worth ¥711.75 million aims to enhance capital efficiency and shareholder returns. The stock's price-to-earnings ratio of 13.2x suggests it trades slightly below the market average, offering potential value for investors seeking stability amidst moderate earnings growth.

- Delve into the full analysis dividend report here for a deeper understanding of MedikitLtd.

- In light of our recent valuation report, it seems possible that MedikitLtd is trading beyond its estimated value.

Key Takeaways

- Unlock our comprehensive list of 1973 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7749

MedikitLtd

Engages in the manufacture and sale of vascular access medical devices.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives