- China

- /

- Consumer Durables

- /

- SZSE:000521

3 Top Dividend Stocks Yielding Up To 3.9%

Reviewed by Simply Wall St

As global markets navigate a period of heightened activity and mixed economic signals, major indices like the Nasdaq Composite and S&P 500 have experienced fluctuations amid busy earnings reports and labor market uncertainties. In this dynamic environment, dividend stocks can offer investors a measure of stability through regular income streams, making them an attractive option for those looking to balance potential market volatility with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.85% | ★★★★★★ |

| Globeride (TSE:7990) | 4.09% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.21% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.42% | ★★★★★★ |

| Innotech (TSE:9880) | 4.73% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.52% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.13% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.33% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

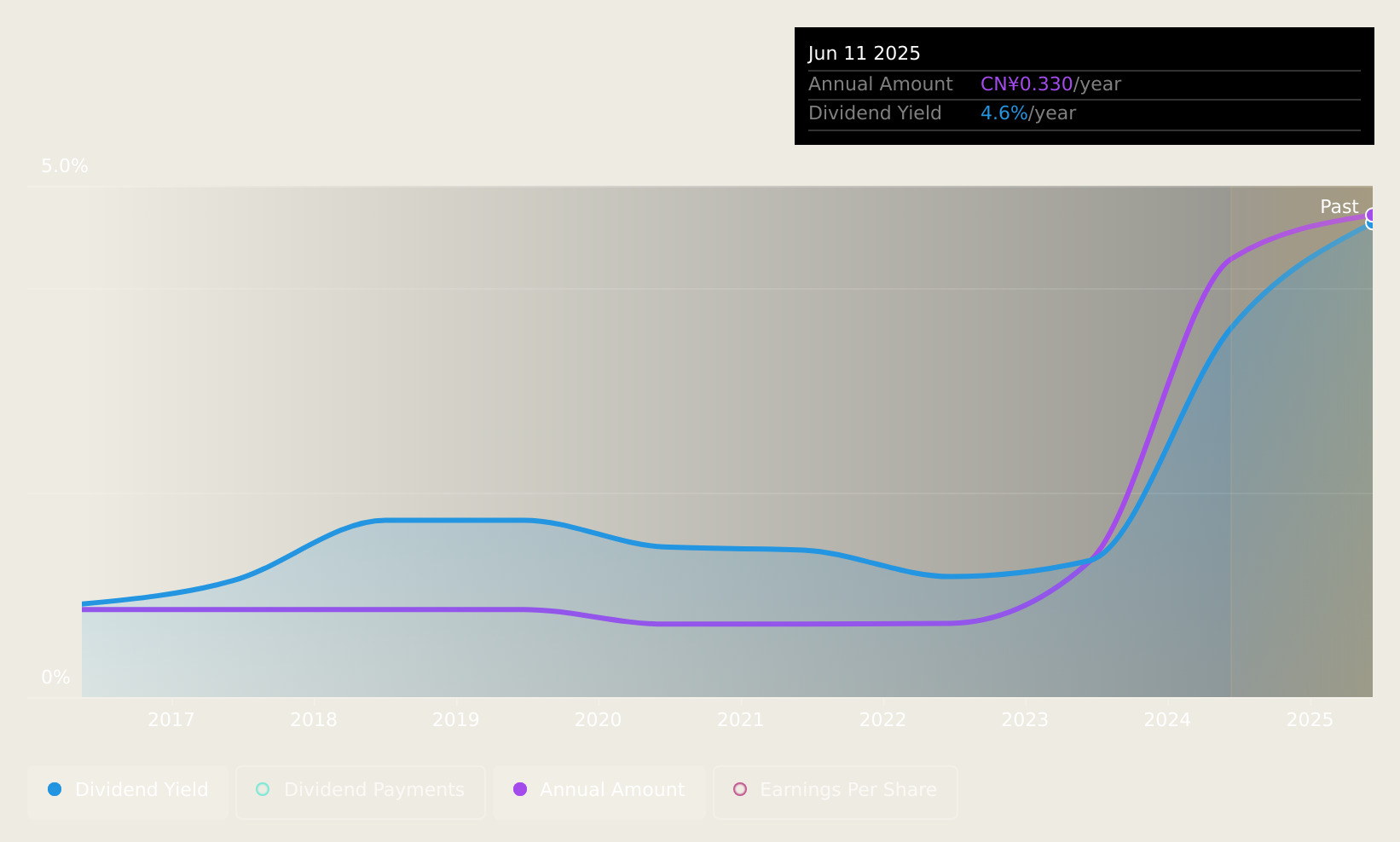

Changhong Meiling (SZSE:000521)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Changhong Meiling Co., Ltd. operates in the electrical machinery and equipment manufacturing industry both in China and internationally, with a market cap of CN¥8.51 billion.

Operations: Changhong Meiling Co., Ltd. generates revenue through its operations in the electrical machinery and equipment manufacturing sector, serving both domestic and international markets.

Dividend Yield: 3.2%

Changhong Meiling offers a compelling dividend profile, with a yield of 3.18% that ranks in the top 25% of CN market payers. Its dividends are well-covered by earnings (40% payout ratio) and cash flows (14.7% cash payout ratio), indicating sustainability. The company has maintained stable and growing dividends over the past decade, supported by recent earnings growth of 33%. Trading significantly below estimated fair value, it presents good relative value for investors seeking income stability.

- Delve into the full analysis dividend report here for a deeper understanding of Changhong Meiling.

- Upon reviewing our latest valuation report, Changhong Meiling's share price might be too pessimistic.

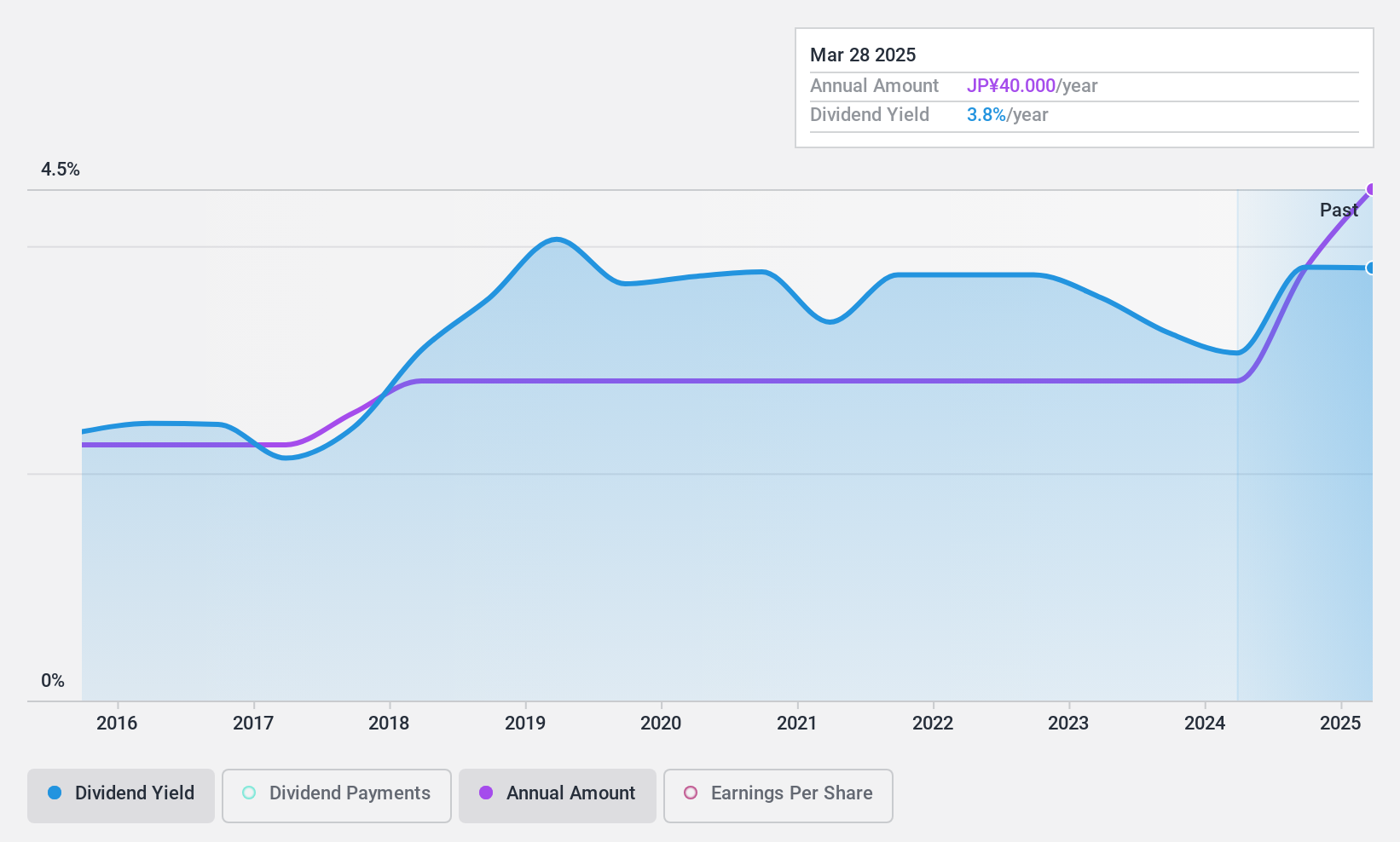

Kyodo Printing (TSE:7914)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kyodo Printing Co., Ltd., along with its subsidiaries, operates in the printing industry in Japan and has a market capitalization of ¥26.00 billion.

Operations: Kyodo Printing Co., Ltd. generates revenue through its various printing operations in Japan.

Dividend Yield: 3.6%

Kyodo Printing's dividend payments have been stable and growing over the past decade, supported by a reasonable payout ratio of 53.1% and cash payout ratio of 72.7%, indicating sustainability. Although its yield of 3.56% is slightly below the top quartile in Japan, it remains reliable with minimal volatility. The recent addition to the S&P Global BMI Index may enhance visibility among investors seeking consistent income streams without significant yield premiums.

- Dive into the specifics of Kyodo Printing here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Kyodo Printing is trading beyond its estimated value.

ZERO (TSE:9028)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ZERO Co., Ltd., along with its subsidiaries, offers vehicle transportation and maintenance services in Japan and has a market capitalization of approximately ¥39.60 billion.

Operations: ZERO Co., Ltd.'s revenue segments include Domestic Car Related Business at ¥63.92 billion, Overseas Related Business at ¥48.94 billion, Human Resource Business at ¥23.42 billion, and General Cargo Transportation at ¥6.51 billion.

Dividend Yield: 3.9%

ZERO Co., Ltd. offers a mixed dividend profile with recent increases in dividend guidance, indicating potential growth. The payout ratio of 25% and cash payout ratio of 21.2% suggest dividends are well covered by earnings and cash flows, enhancing sustainability prospects despite past volatility. While the yield of 3.95% ranks in the top tier for Japan, historical unreliability and share price volatility may concern some investors seeking stability alongside income growth opportunities.

- Click to explore a detailed breakdown of our findings in ZERO's dividend report.

- Our valuation report here indicates ZERO may be undervalued.

Seize The Opportunity

- Take a closer look at our Top Dividend Stocks list of 1937 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Changhong Meiling, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000521

Changhong Meiling

Operates in electrical machinery and equipment manufacturing industry in China and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives