- Japan

- /

- Commercial Services

- /

- TSE:7375

REFINVERSE Group, Inc.'s (TSE:7375) 28% Share Price Surge Not Quite Adding Up

REFINVERSE Group, Inc. (TSE:7375) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Looking further back, the 23% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

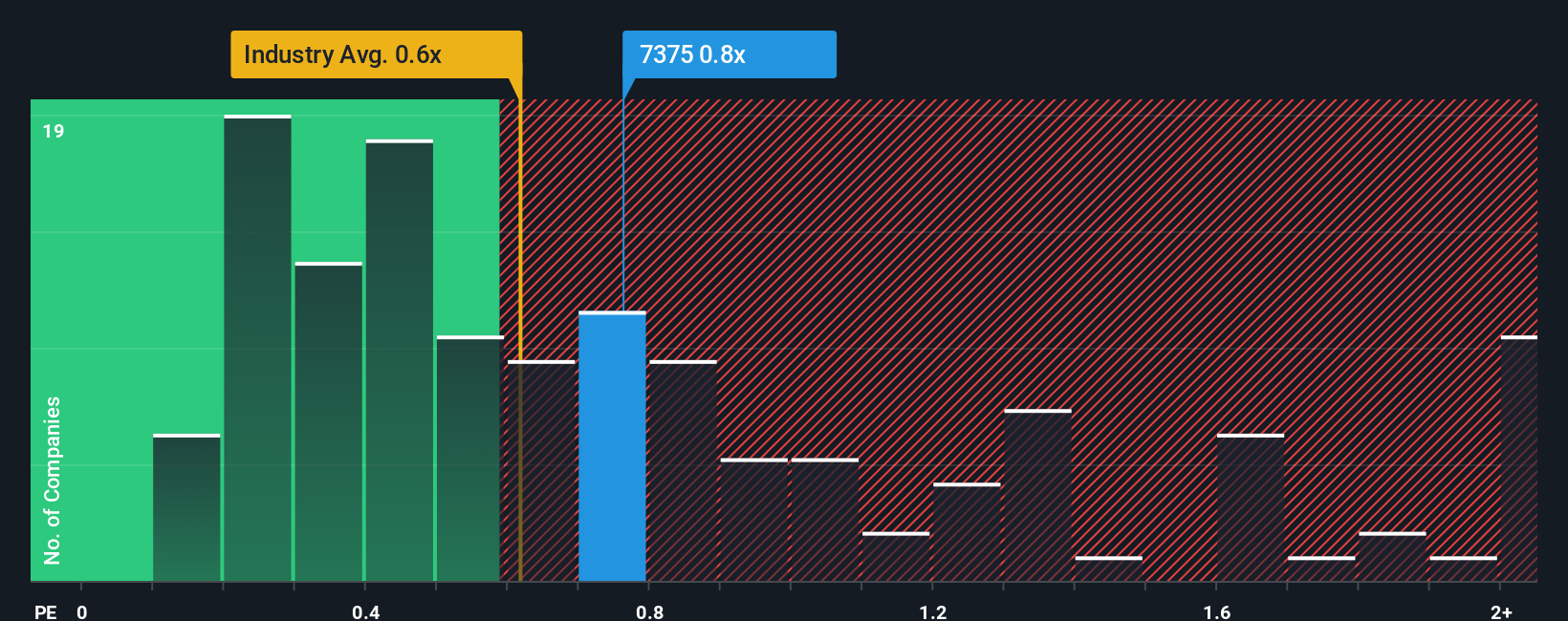

Even after such a large jump in price, there still wouldn't be many who think REFINVERSE Group's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in Japan's Commercial Services industry is similar at about 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for REFINVERSE Group

What Does REFINVERSE Group's Recent Performance Look Like?

The recent revenue growth at REFINVERSE Group would have to be considered satisfactory if not spectacular. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for REFINVERSE Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is REFINVERSE Group's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like REFINVERSE Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 5.7%. Revenue has also lifted 9.1% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 5.6% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's curious that REFINVERSE Group's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

REFINVERSE Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that REFINVERSE Group's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

And what about other risks? Every company has them, and we've spotted 2 warning signs for REFINVERSE Group (of which 1 doesn't sit too well with us!) you should know about.

If you're unsure about the strength of REFINVERSE Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7375

Solid track record and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026