- Japan

- /

- Professional Services

- /

- TSE:7352

Investors Will Want TWOSTONE&Sons' (TSE:7352) Growth In ROCE To Persist

What are the early trends we should look for to identify a stock that could multiply in value over the long term? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Speaking of which, we noticed some great changes in TWOSTONE&Sons' (TSE:7352) returns on capital, so let's have a look.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on TWOSTONE&Sons is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.15 = JP¥704m ÷ (JP¥7.5b - JP¥2.7b) (Based on the trailing twelve months to November 2024).

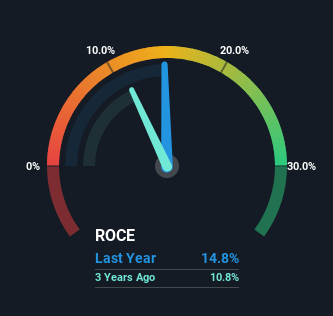

Therefore, TWOSTONE&Sons has an ROCE of 15%. In absolute terms, that's a pretty normal return, and it's somewhat close to the Professional Services industry average of 16%.

Check out our latest analysis for TWOSTONE&Sons

In the above chart we have measured TWOSTONE&Sons' prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free analyst report for TWOSTONE&Sons .

What The Trend Of ROCE Can Tell Us

The trends we've noticed at TWOSTONE&Sons are quite reassuring. The numbers show that in the last three years, the returns generated on capital employed have grown considerably to 15%. Basically the business is earning more per dollar of capital invested and in addition to that, 354% more capital is being employed now too. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, a combination that's common among multi-baggers.

Our Take On TWOSTONE&Sons' ROCE

To sum it up, TWOSTONE&Sons has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. And with the stock having performed exceptionally well over the last three years, these patterns are being accounted for by investors. So given the stock has proven it has promising trends, it's worth researching the company further to see if these trends are likely to persist.

Like most companies, TWOSTONE&Sons does come with some risks, and we've found 1 warning sign that you should be aware of.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you're looking to trade TWOSTONE&Sons, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TWOSTONE&Sons might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7352

Exceptional growth potential with outstanding track record.

Market Insights

Community Narratives