- Japan

- /

- Professional Services

- /

- TSE:6532

BayCurrent (TSE:6532) Edges Net Margin Higher, Reinforcing Bullish Growth Narrative

Reviewed by Simply Wall St

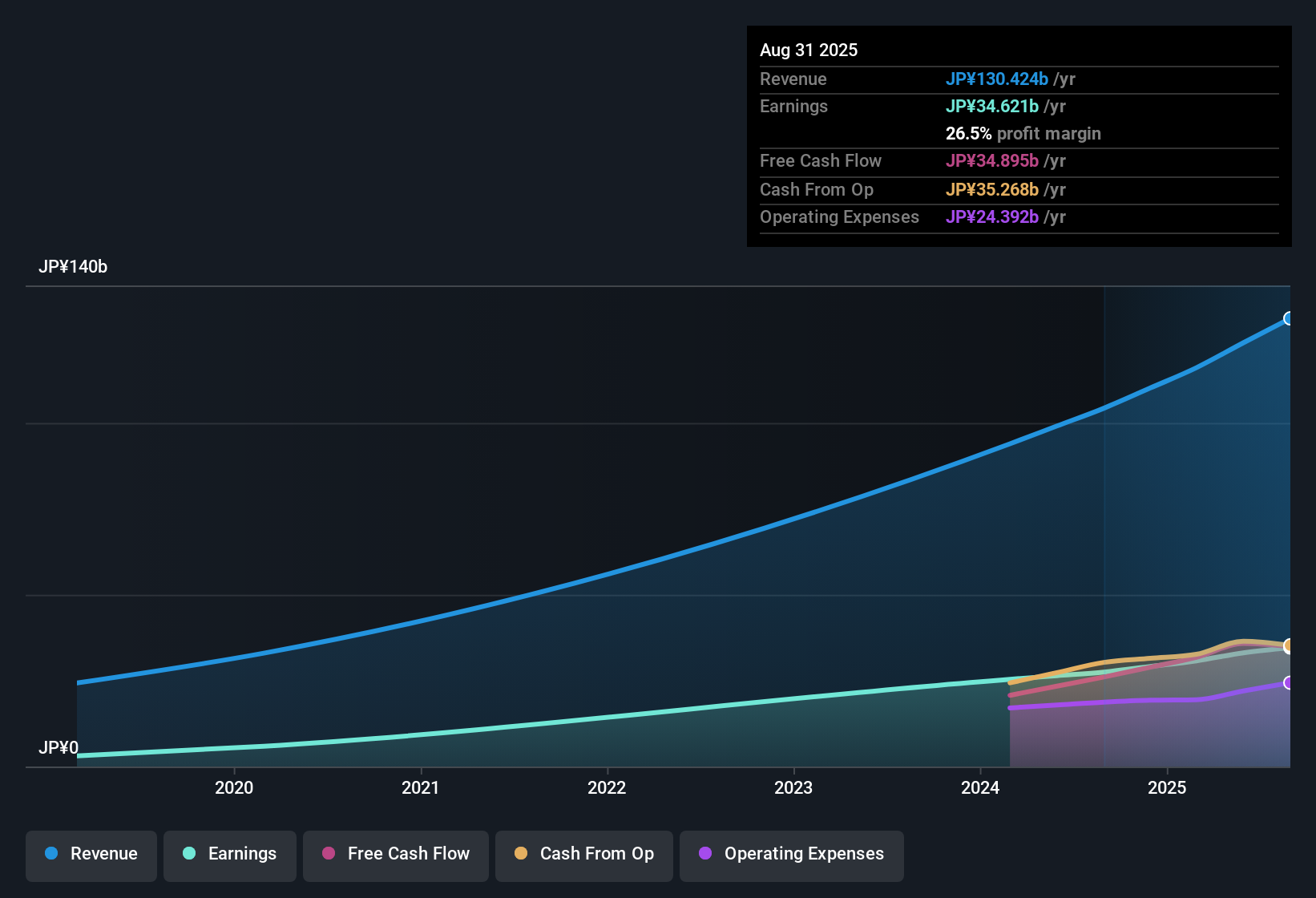

Baycurrent (TSE:6532) posted a net profit margin of 26.5%, just edging out last year's margin of 26.3%. Earnings are forecast to grow at an impressive 20.65% per year, with revenue expected to rise at a 20.3% clip, both setting a faster pace than the broader Japanese market’s projected growth. Analysts are calling for annual earnings growth of 20.7%, far outstripping the JP market's 8.1% forecast, which underlines Baycurrent’s robust growth profile and superior margin performance.

See our full analysis for Baycurrent.To put these figures in context, we’ll measure Baycurrent’s latest results against the most-followed narratives on Simply Wall St, highlighting where the company’s momentum matches expectations and where perceptions might shift.

Curious how numbers become stories that shape markets? Explore Community Narratives

Valuation Premium Balanced by High Quality Profits

- Baycurrent is trading at a Price-To-Earnings (P/E) ratio of 33.5x, sharply above both the Japanese professional services industry average of 15.5x and its peer group at 19.8x. However, current profitability, with a net margin of 26.5%, reflects the kind of superior earnings quality that few rivals match.

- Baycurrent’s valuation draws sharply mixed views. On one hand, the combination of ultra-high profit margins and earnings growth that is outpacing sector benchmarks strongly supports a case for the premium, especially for bulls who see digital transformation delivering durable pricing power.

- Unlike lower-margin peers, Baycurrent delivers both top-tier margins and high analyst-forecast earnings growth of 20.7% per year. As a result, its above-average P/E is more than just optimism; it is rooted in superior results.

- However, such a rich multiple means investors have little margin for error if growth slows, which adds risk during periods of market volatility.

DCF Fair Value Points to Undervaluation

- With shares recently trading at ¥7648, Baycurrent sits well below its DCF fair value estimate of ¥10,192.39. This suggests the market is not fully pricing in the company's robust growth trajectory or its earnings quality.

- Bulls argue that the gap between market price and DCF fair value is a sign that strong revenue expansion and historically high margins still leave room for further upside, provided no material risks have emerged.

- Market expectations are elevated, but there are no new risk flags according to the latest report. This supports the case that valuation may catch up to fundamentals.

- Analysts' consensus metrics underscore that Baycurrent is forecast to decisively outgrow its market, which could see the share price close at least some of the DCF gap if performance is sustained.

Sector-Beating Margin Holds Steady

- Baycurrent’s net profit margin of 26.5% is not only steady compared to last year’s 26.3%, but also continues to significantly exceed industry and market averages. This underlines its operational edge.

- Skeptics highlight that sustaining such elevated profitability in a competitive consulting environment can be challenging, but the track record so far offers little to refute the bullish momentum in margins.

- No signs of margin contraction emerged in the latest results, which gives less weight to bearish concerns over rapid expansion coming at the expense of efficiency.

- Instead, the maintained margin, together with above-market growth, signals Baycurrent is keeping its edge even while scaling up revenue.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Baycurrent's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Baycurrent’s steep valuation premium means investors face higher risk if earnings growth falters or market volatility increases.

If you want stronger downside protection and more reasonable pricing, use our these 874 undervalued stocks based on cash flows to find stocks where growth potential comes with better value and margin for safety.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Baycurrent might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6532

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion