- Japan

- /

- Professional Services

- /

- TSE:6532

Top Growth Companies With Strong Insider Ownership In November 2024

Reviewed by Simply Wall St

In November 2024, global markets are navigating a landscape marked by policy uncertainties from the incoming Trump administration and fluctuating interest rate expectations, which have influenced sector performances and investor sentiment. Amidst these dynamics, growth companies with high insider ownership can offer unique insights into potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.5% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

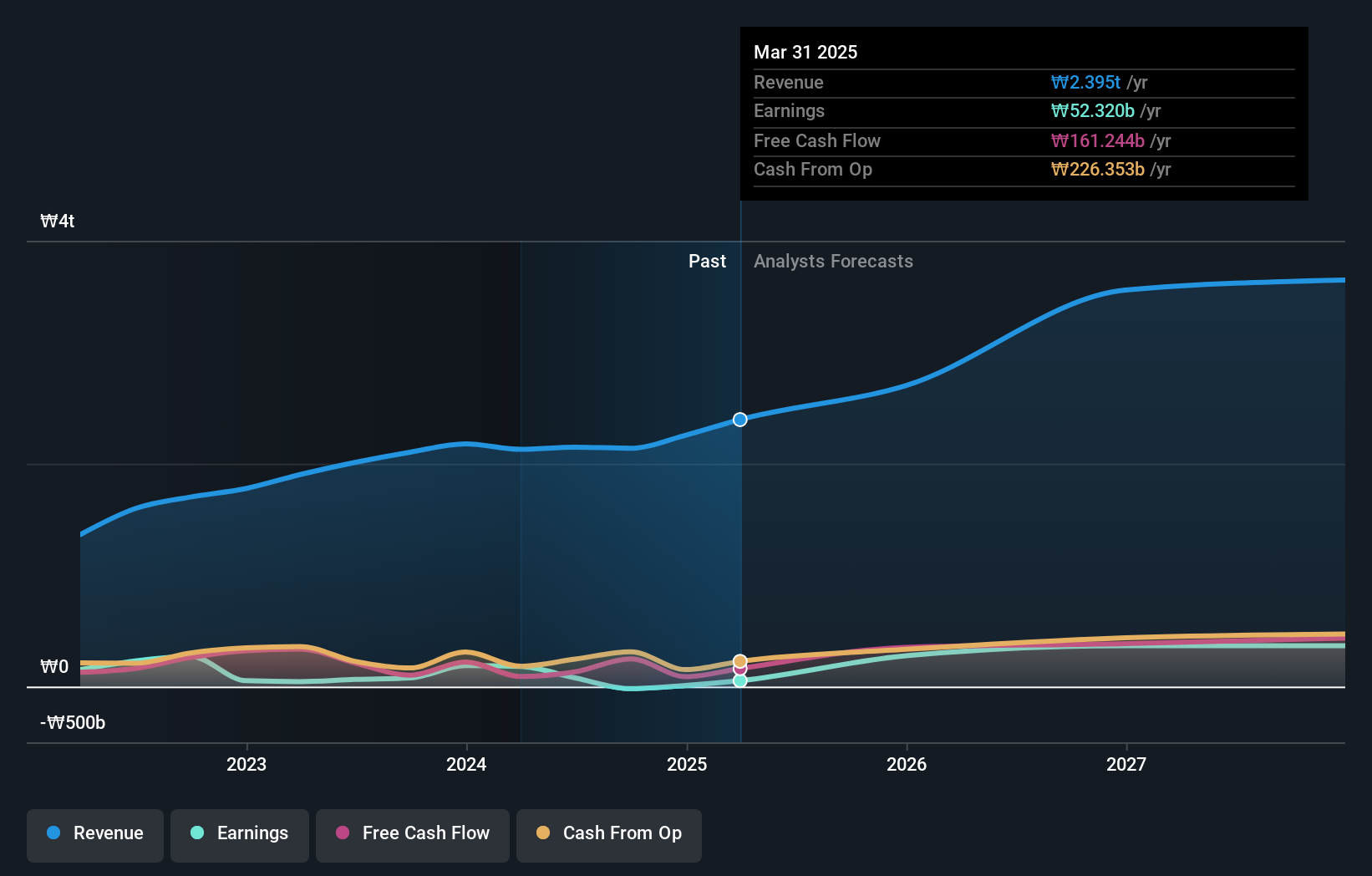

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management with a market cap of ₩8.81 trillion.

Operations: The company's revenue is primarily derived from three segments: Label (₩1.28 trillion), Platform (₩361.12 billion), and Solution (₩1.24 trillion).

Insider Ownership: 32.5%

Revenue Growth Forecast: 14.5% p.a.

HYBE's earnings are forecast to grow significantly at 38.1% annually, outpacing the Korean market. Despite one-off items impacting recent results, its revenue is expected to rise by 14.5% per year, surpassing the market average. Recent strategic moves include a KRW 400 billion private placement of convertible bonds and a completed share buyback program aimed at stabilizing stock prices. Analysts agree on a potential price increase of 21.4%, reflecting positive sentiment towards future growth prospects.

- Navigate through the intricacies of HYBE with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report HYBE implies its share price may be too high.

Surgical Science Sweden (OM:SUS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Surgical Science Sweden AB (publ) develops and markets virtual reality simulators for evidence-based medical training globally, with a market cap of approximately SEK7.27 billion.

Operations: Surgical Science Sweden AB generates revenue from developing and marketing virtual reality simulators for medical training across Europe, the Americas, Asia, and other international markets.

Insider Ownership: 26.6%

Revenue Growth Forecast: 17.8% p.a.

Surgical Science Sweden's earnings are projected to grow significantly at 36.1% annually, exceeding the Swedish market's growth rate. Despite recent declines in net income and sales for the third quarter, analysts anticipate a 34.9% stock price increase, suggesting confidence in its growth trajectory. The company is trading below estimated fair value, indicating potential undervaluation. Recent presentations at global conferences highlight its active engagement with industry peers and stakeholders.

- Click here and access our complete growth analysis report to understand the dynamics of Surgical Science Sweden.

- Insights from our recent valuation report point to the potential undervaluation of Surgical Science Sweden shares in the market.

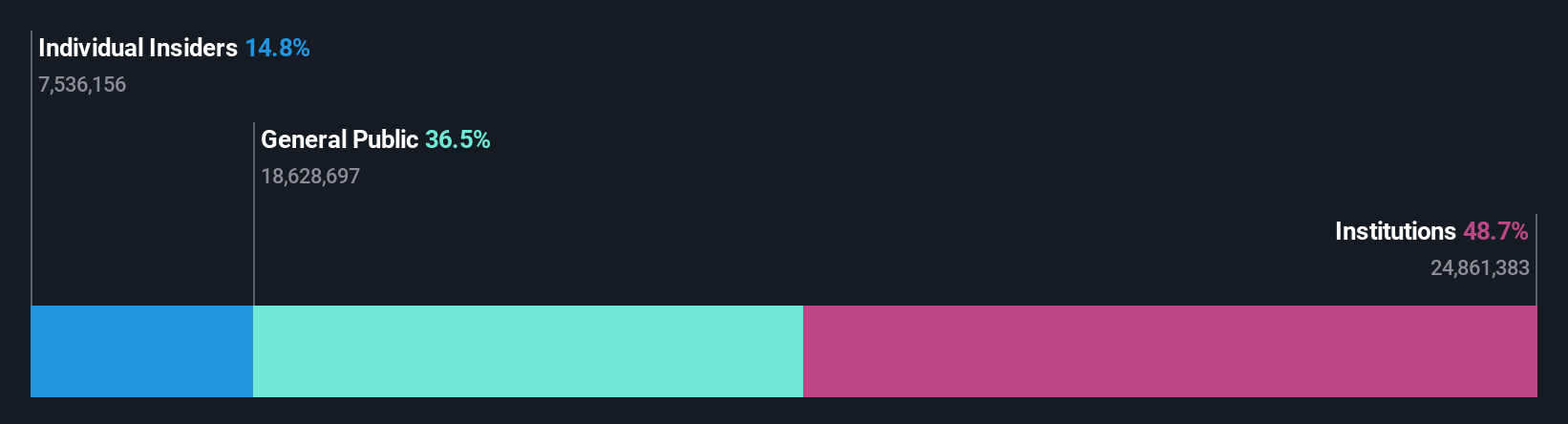

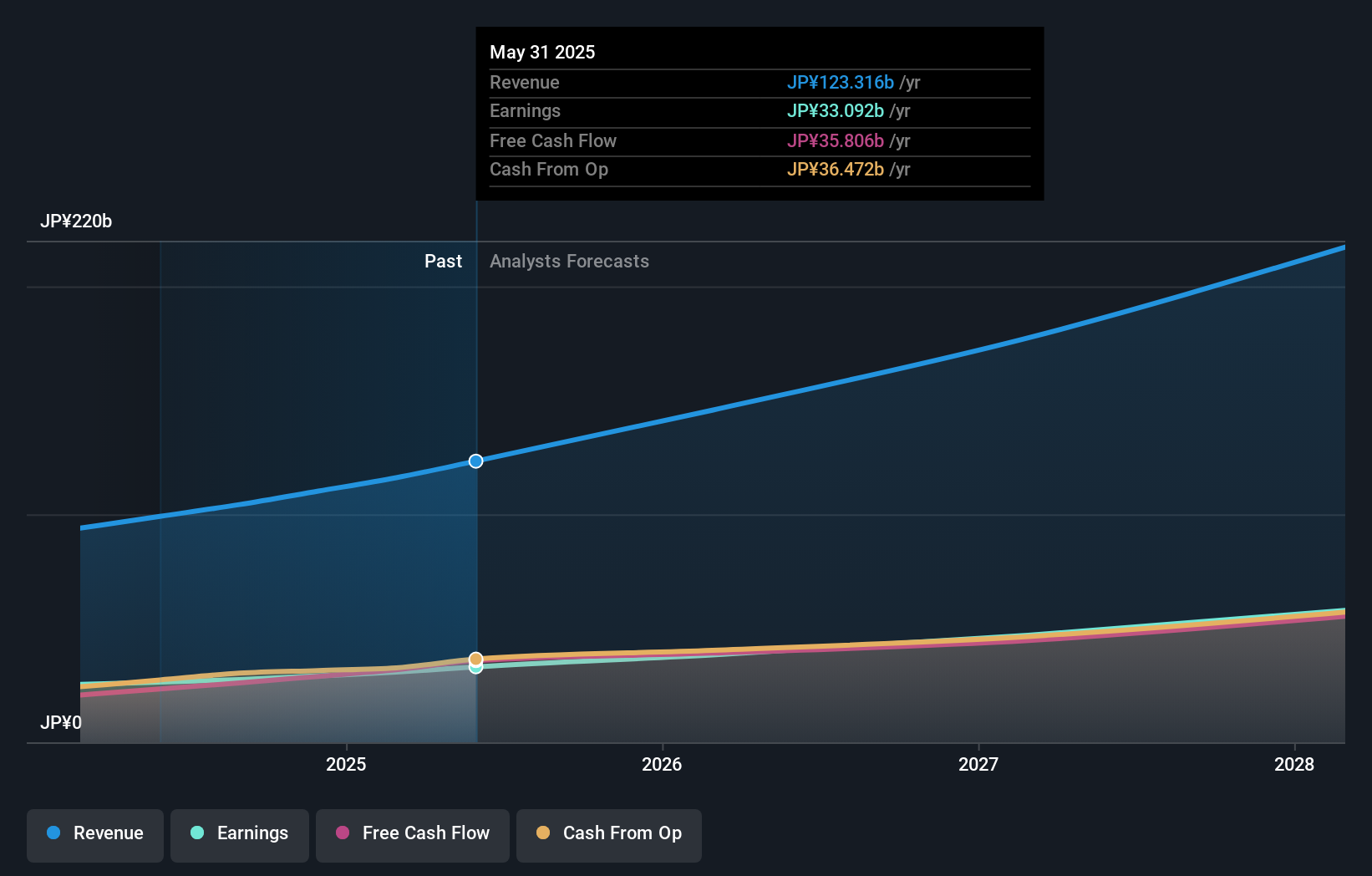

BayCurrent Consulting (TSE:6532)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BayCurrent Consulting, Inc. offers consulting services in Japan and has a market cap of ¥857.61 billion.

Operations: BayCurrent Consulting, Inc. generates revenue primarily through its consulting services in Japan.

Insider Ownership: 13.9%

Revenue Growth Forecast: 18.3% p.a.

BayCurrent Consulting is positioned for robust growth, with earnings expected to rise 19.1% annually, outpacing the JP market's 8% rate. Revenue is projected to grow at 18.3% per year but below the 20% threshold considered significant. The stock trades at a notable discount of 40.1% below its fair value estimate, suggesting potential undervaluation despite no recent insider trading activity reported over the past three months.

- Dive into the specifics of BayCurrent Consulting here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that BayCurrent Consulting is priced higher than what may be justified by its financials.

Key Takeaways

- Navigate through the entire inventory of 1538 Fast Growing Companies With High Insider Ownership here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Baycurrent, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Baycurrent might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6532

Solid track record with excellent balance sheet.

Market Insights

Community Narratives