- Japan

- /

- Professional Services

- /

- TSE:6098

Recruit Holdings (TSE:6098) Leverages HR Innovations and U.S. Growth Despite Japan Market Challenges

Reviewed by Simply Wall St

Navigate through the intricacies of Recruit Holdings with our comprehensive report here.

Competitive Advantages That Elevate Recruit Holdings

Recruit Holdings has demonstrated a strong financial performance, highlighted by a high return on equity of 22%, which underscores its profitability. The company's net profit margins have improved to 10.3% from 9.2% last year, reflecting efficient cost management and operational effectiveness. Junichi Arai, Senior Vice President, Corporate Strategy and Investor Relations, noted that U.S. revenue in HR Technology exceeded expectations due to strategic innovations, which have driven revenue growth despite a decrease in job postings. This success in the U.S. market showcases Recruit Holdings' ability to adapt and thrive in challenging conditions. Furthermore, the effective execution of share buybacks, with 80% of the JPY 600 billion budget utilized, highlights the company's commitment to returning value to shareholders and optimizing capital allocation.

Critical Issues Affecting the Performance of Recruit Holdings and Areas for Growth

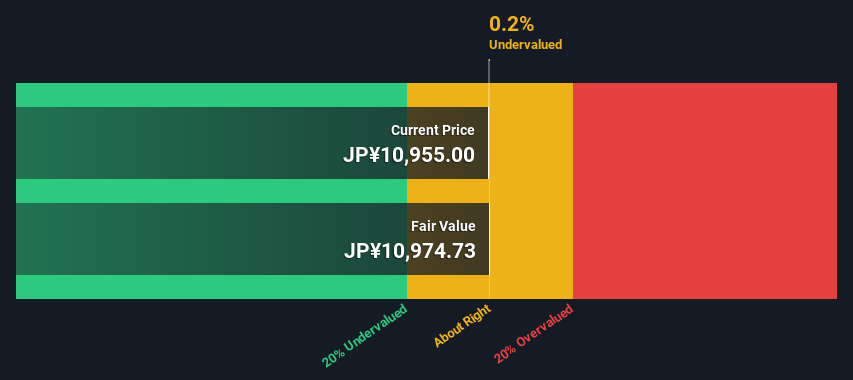

While Recruit Holdings has seen earnings growth of 16% over the past year, this is below its five-year average of 18.4%, indicating a potential slowdown in growth momentum. The transition to Indeed PLUS in Japan has been slower than anticipated, suggesting challenges in market adaptation. Additionally, the company faces cost management concerns, as indicated by the reduction in headcount and payroll discontinuation. These factors point to operational inefficiencies that need addressing. The company's valuation, with a Price-To-Earnings Ratio of 44.4x, is significantly higher than the industry average of 15.1x, suggesting that the current market price may not align with its growth metrics.

Areas for Expansion and Innovation for Recruit Holdings

Recruit Holdings is poised for growth, with earnings forecasted to increase by 10.1% annually, outpacing the JP market's 7.8%. The integration of HR Solutions into HR Technology presents an opportunity to streamline operations and leverage technological advancements. This strategic realignment could enhance efficiency and drive performance across HR services. Additionally, the expansion of Indeed PLUS, shifting from Pay Per Post to Pay Per Click models, is expected to improve revenue streams and competitiveness in Japan. These initiatives position Recruit Holdings to capitalize on emerging opportunities and strengthen its market position.

Key Risks and Challenges That Could Impact Recruit Holdings's Success

The company faces significant risks from market volatility and economic headwinds, particularly in the U.S. market, where job openings are expected to decrease for another 18 to 24 months. This prolonged decline poses a threat to revenue stability and growth. Regulatory and competitive pressures further complicate the situation, as fluctuating supply and demand dynamics could impact pricing strategies and market positioning. These external factors require careful navigation to mitigate potential adverse effects on Recruit Holdings' long-term success.

Conclusion

Recruit Holdings' strong financial performance, underscored by a 22% return on equity and improved profit margins, highlights its ability to manage costs effectively and capitalize on strategic innovations, particularly in the U.S. HR Technology sector. However, the company faces challenges with slower-than-expected growth in Japan and operational inefficiencies that need resolution. Despite these hurdles, Recruit Holdings is positioned for future growth through strategic realignments and innovations such as the integration of HR Solutions and the expansion of Indeed PLUS. Yet, the company's high Price-To-Earnings Ratio of 44.4x, significantly above industry and peer averages, suggests that its current market price may not fully reflect these growth prospects, posing a risk to investor expectations if growth does not accelerate as anticipated.

Where To Now?

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6098

Recruit Holdings

Provides HR technology and business solutions that transforms the world of work.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives