- Japan

- /

- Professional Services

- /

- TSE:6098

Does Recruit Holdings' (TSE:6098) Buyback Focus Hint at a Deeper Capital Allocation Shift?

Reviewed by Sasha Jovanovic

- Recruit Holdings Co., Ltd. held a board meeting on October 16, 2025, to decide on the status of its share repurchase program.

- This focus on buybacks highlights how management’s capital allocation choices may influence shareholder returns and the company’s financial profile.

- We’ll now explore how the board’s focus on potential share repurchases could reshape Recruit Holdings’ broader investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Recruit Holdings Investment Narrative Recap

To own Recruit Holdings, you generally need to believe in its ability to compound earnings through HR technology, data driven services and disciplined capital management despite a softer global hiring backdrop. The October 16 board meeting on the share repurchase status does not appear to alter the near term demand risk in U.S. and European staffing, but it could modestly influence how quickly per share metrics respond if end markets stay weak.

The recent authorization of a new buyback program of up to 38,000,000 shares, or about 2.68% of shares outstanding, is most relevant here, as it sets the framework within which this October board decision will be made. Combined with a modest dividend increase to ¥12.50 per share for the second quarter, these actions sit alongside the key catalyst of ongoing automation and AI driven efficiency gains that could support earnings even if job postings remain subdued.

Yet, against this backdrop of capital returns and efficiency gains, investors should still be aware of the risk that competitors more aggressively deploying advanced AI could...

Read the full narrative on Recruit Holdings (it's free!)

Recruit Holdings' narrative projects ¥4042.8 billion revenue and ¥580.9 billion earnings by 2028. This requires 4.6% yearly revenue growth and a ¥157.9 billion earnings increase from ¥423.0 billion today.

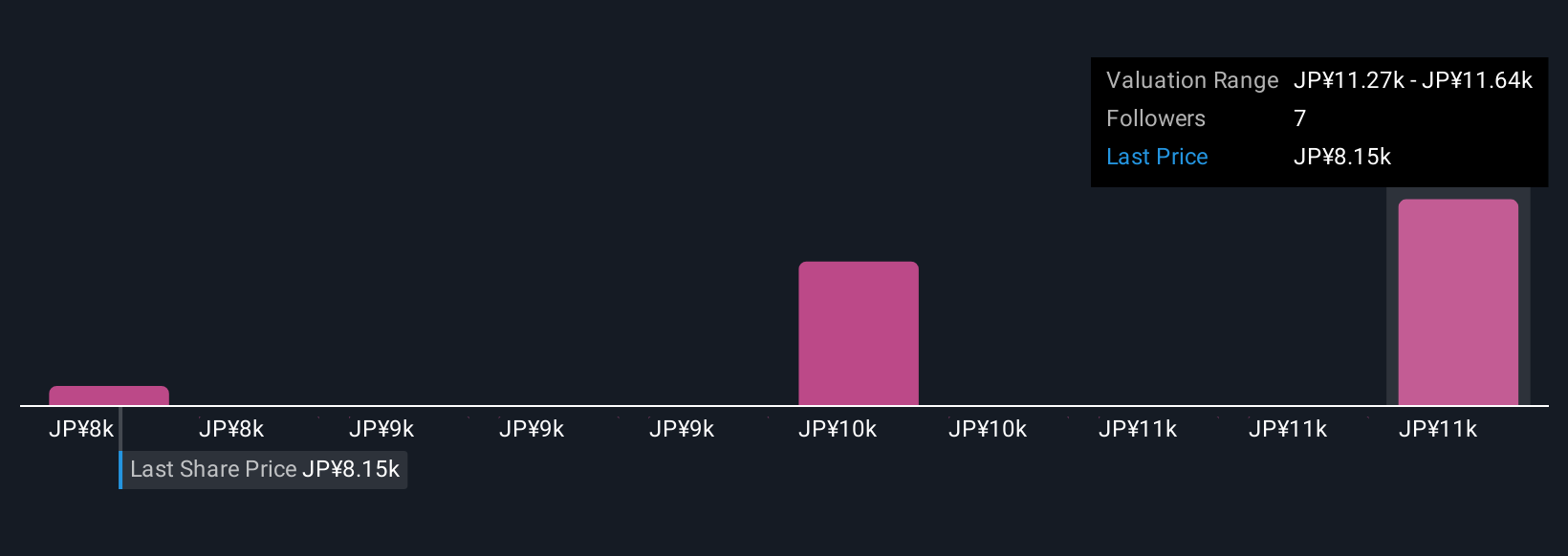

Uncover how Recruit Holdings' forecasts yield a ¥9868 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly ¥7,900 to ¥12,842, underscoring how far apart individual views can be. Set this against the catalyst of Recruit’s push into automation and AI driven HR solutions, which could meaningfully influence how the company performs over time and is worth comparing with those community assumptions.

Explore 4 other fair value estimates on Recruit Holdings - why the stock might be worth as much as 57% more than the current price!

Build Your Own Recruit Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Recruit Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Recruit Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Recruit Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6098

Recruit Holdings

Provides HR technology and business solutions that transforms the world of work.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026