- South Korea

- /

- Electrical

- /

- KOSE:A298040

Global Growth Stocks With Insiders Owning 43% Earnings Growth

Reviewed by Simply Wall St

As global markets grapple with trade policy uncertainties and inflationary pressures, investors are closely monitoring economic indicators and central bank actions. Amidst this backdrop, companies with strong growth potential and substantial insider ownership can offer unique opportunities, as they often signal confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 34.3% |

| Vow (OB:VOW) | 13.1% | 120.9% |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 43.7% |

| CD Projekt (WSE:CDR) | 29.7% | 41.3% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 56.3% |

| Ascentage Pharma Group International (SEHK:6855) | 17.9% | 60.9% |

| Synspective (TSE:290A) | 13.2% | 37.4% |

Here we highlight a subset of our preferred stocks from the screener.

Hyosung Heavy Industries (KOSE:A298040)

Simply Wall St Growth Rating: ★★★★★☆

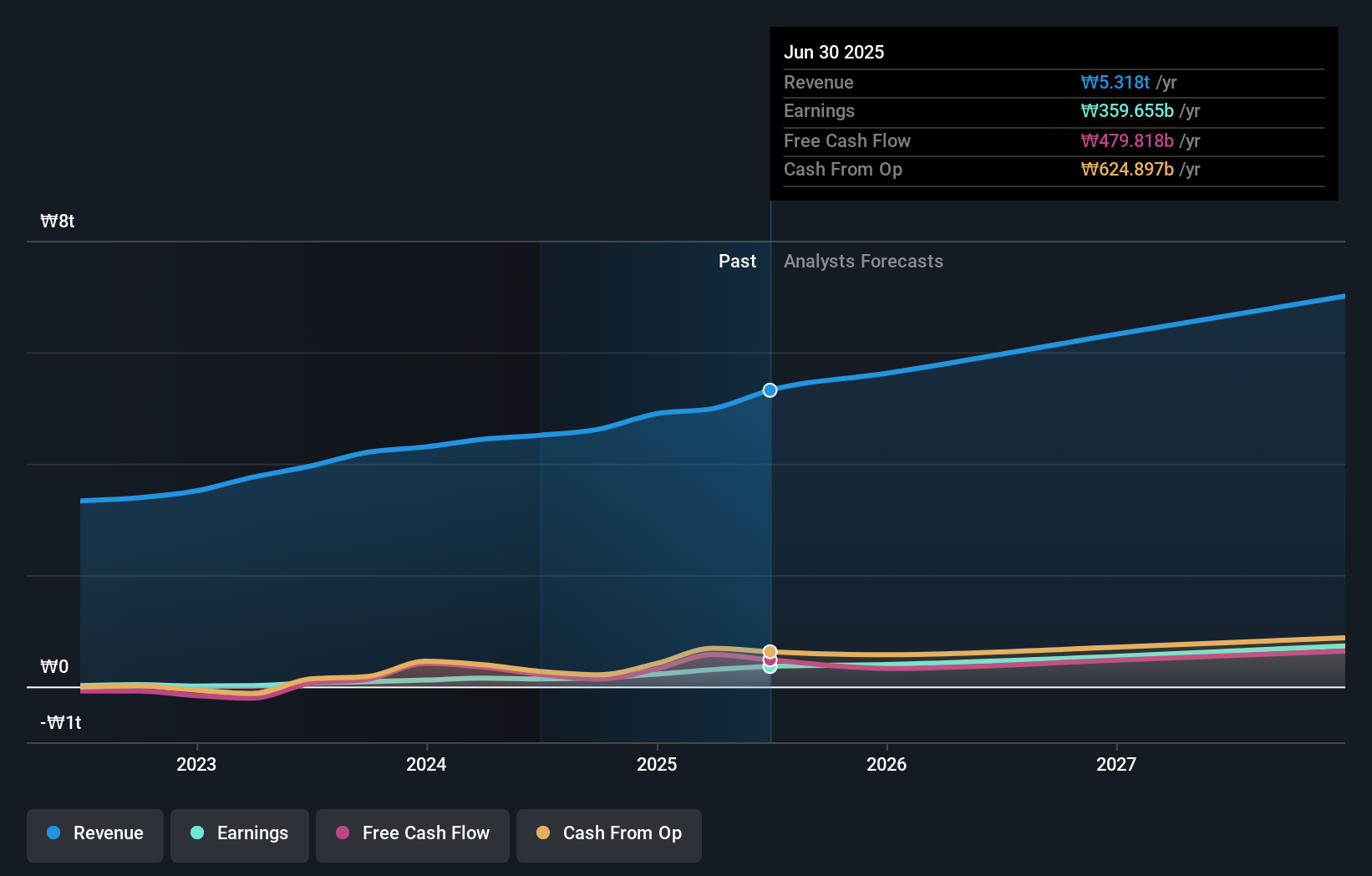

Overview: Hyosung Heavy Industries Corporation manufactures and sells heavy electrical equipment both in South Korea and internationally, with a market cap of approximately ₩3.99 trillion.

Operations: The company's revenue segments include Heavy Industry at ₩3.47 trillion and Construction at ₩1.76 trillion.

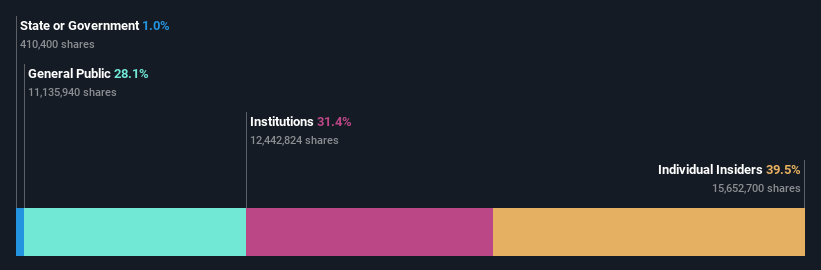

Insider Ownership: 16.4%

Earnings Growth Forecast: 43% p.a.

Hyosung Heavy Industries demonstrates promising growth potential with earnings expected to grow significantly at 43% annually, outpacing the Korean market. Despite high volatility in its share price recently, the stock is trading at 46.4% below estimated fair value and analysts agree on a potential rise of 22.1%. The company's revenue is projected to grow faster than the market, though not exceeding 20% annually. Recent presentations at industry conferences indicate active engagement with investors.

- Click to explore a detailed breakdown of our findings in Hyosung Heavy Industries' earnings growth report.

- Our valuation report unveils the possibility Hyosung Heavy Industries' shares may be trading at a discount.

Beijing Enlight Media (SZSE:300251)

Simply Wall St Growth Rating: ★★★★☆☆

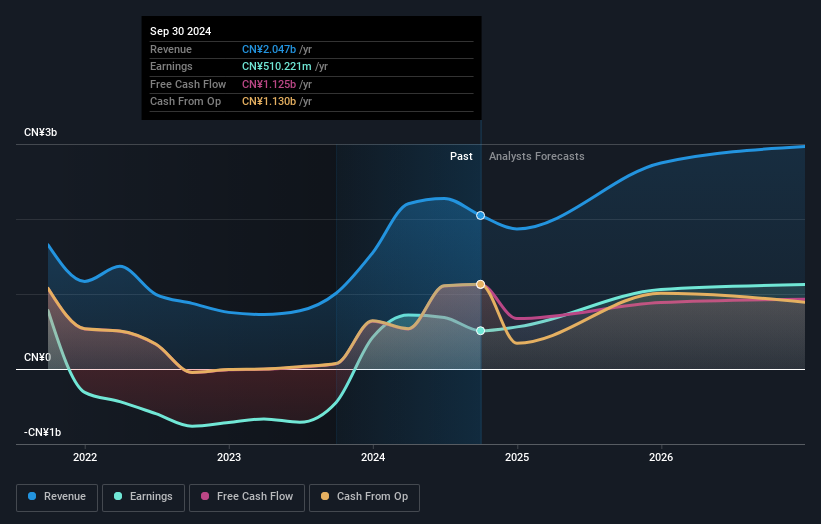

Overview: Beijing Enlight Media Co., Ltd. is involved in the investment, production, and distribution of film and television projects in China with a market cap of CN¥67.66 billion.

Operations: Beijing Enlight Media generates revenue primarily through its activities in film and television project investment, production, and distribution within China.

Insider Ownership: 12.1%

Earnings Growth Forecast: 39.4% p.a.

Beijing Enlight Media's earnings are forecast to grow significantly at 39.4% annually, surpassing the Chinese market's growth rate. Revenue is expected to increase at 19.5% per year, slightly below the high-growth threshold but still above market averages. Despite a highly volatile share price recently and a low projected return on equity of 10.8%, there has been no substantial insider trading activity in the past three months, indicating stability in insider sentiment.

- Get an in-depth perspective on Beijing Enlight Media's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Beijing Enlight Media's shares may be trading at a premium.

Visional (TSE:4194)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Visional, Inc., along with its subsidiaries, offers human resources platform solutions in Japan and has a market cap of ¥270.32 billion.

Operations: The company generates revenue from its human resources platform solutions in Japan.

Insider Ownership: 39.2%

Earnings Growth Forecast: 15% p.a.

Visional's earnings are projected to grow at 15% annually, outpacing the JP market. Revenue growth is expected at 12.2% per year, exceeding the market average but below high-growth benchmarks. The stock trades significantly below its estimated fair value and analysts anticipate a price increase of 24.8%. With no recent insider trading activity, stability in insider sentiment is suggested, though revenue growth remains moderate compared to top-tier growth companies.

- Unlock comprehensive insights into our analysis of Visional stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Visional shares in the market.

Make It Happen

- Click this link to deep-dive into the 881 companies within our Fast Growing Global Companies With High Insider Ownership screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Hyosung Heavy Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hyosung Heavy Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A298040

Hyosung Heavy Industries

Manufactures and sells heavy electrical equipment in South Korea and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives