- Japan

- /

- Semiconductors

- /

- TSE:6920

3 Japanese Growth Stocks With High Insider Ownership And Up To 16% Revenue Growth

Reviewed by Simply Wall St

Japan's stock markets have recently faced significant declines, with the Nikkei 225 Index dropping 4.7% and the broader TOPIX Index down by 6.0%, influenced by a hawkish turn from the Bank of Japan and a rebounding yen affecting export-oriented companies. Despite these challenges, growth companies with high insider ownership can present compelling opportunities for investors, as such ownership often aligns management's interests with those of shareholders and can drive substantial revenue growth even in turbulent market conditions.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Hottolink (TSE:3680) | 27% | 59.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 43.3% |

| Micronics Japan (TSE:6871) | 15.3% | 39.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| Medley (TSE:4480) | 34% | 28.7% |

| SHIFT (TSE:3697) | 35.4% | 32.8% |

| ExaWizards (TSE:4259) | 21.8% | 91.1% |

| Money Forward (TSE:3994) | 21.4% | 66.9% |

| Astroscale Holdings (TSE:186A) | 20.9% | 90% |

| freee K.K (TSE:4478) | 32.8% | 72.9% |

Let's take a closer look at a couple of our picks from the screened companies.

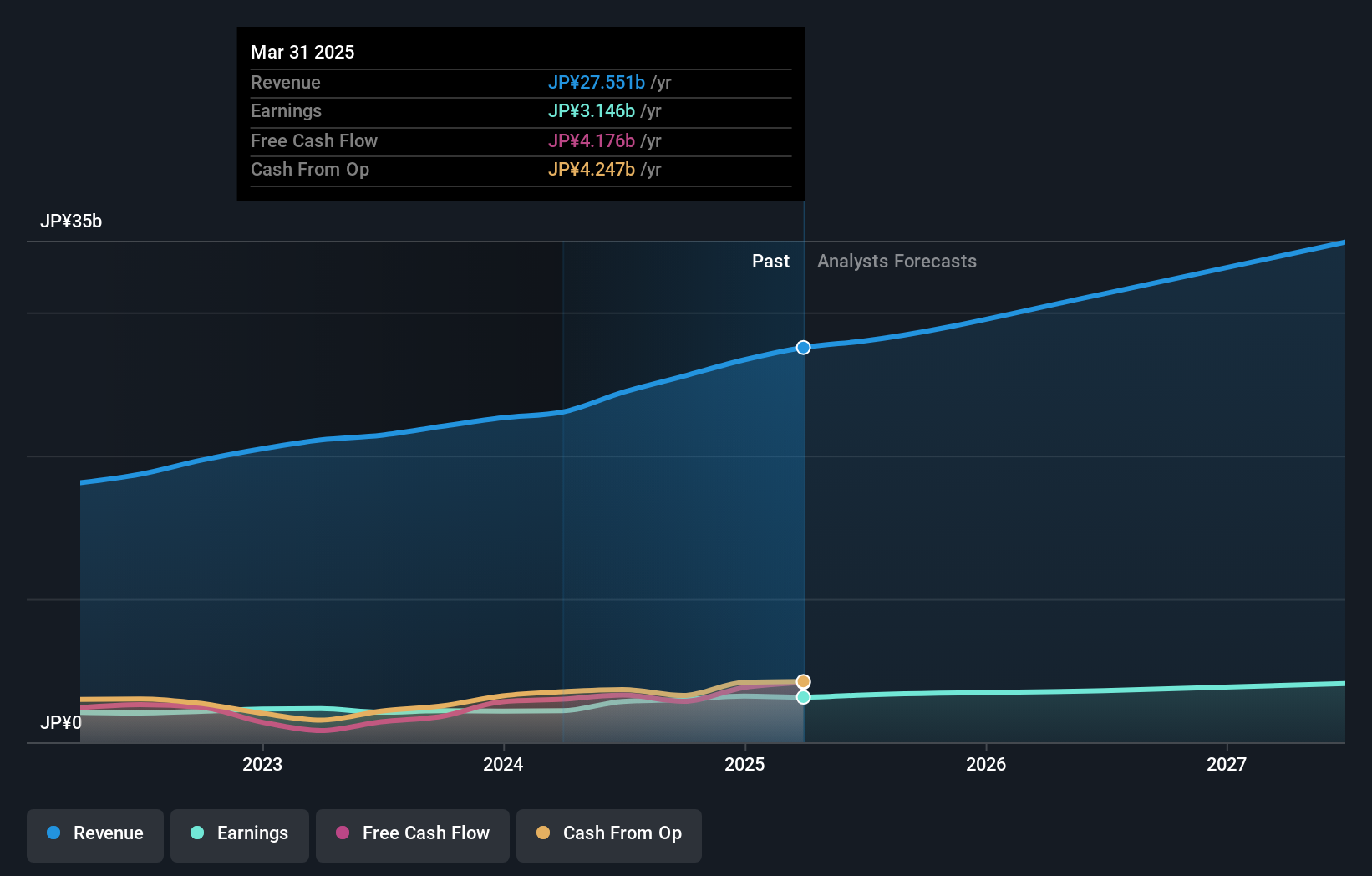

Avant Group (TSE:3836)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Avant Group Corporation, with a market cap of ¥60.52 billion, operates through its subsidiaries to offer accounting, business intelligence, and outsourcing services.

Operations: The company's revenue segments include accounting services, business intelligence solutions, and outsourcing services.

Insider Ownership: 33.9%

Revenue Growth Forecast: 16.9% p.a.

Avant Group, a growth company with high insider ownership in Japan, is forecast to see revenue grow 16.9% annually and earnings by 18.92%, outpacing the JP market. The company trades at 58.8% below its estimated fair value and expects a return on equity of 25% in three years. Recent events include a dividend increase to ¥19 per share, guidance for fiscal year 2025 with net sales of ¥28.80 billion, and completion of a share buyback worth ¥477.64 million.

- Click here and access our complete growth analysis report to understand the dynamics of Avant Group.

- The valuation report we've compiled suggests that Avant Group's current price could be quite moderate.

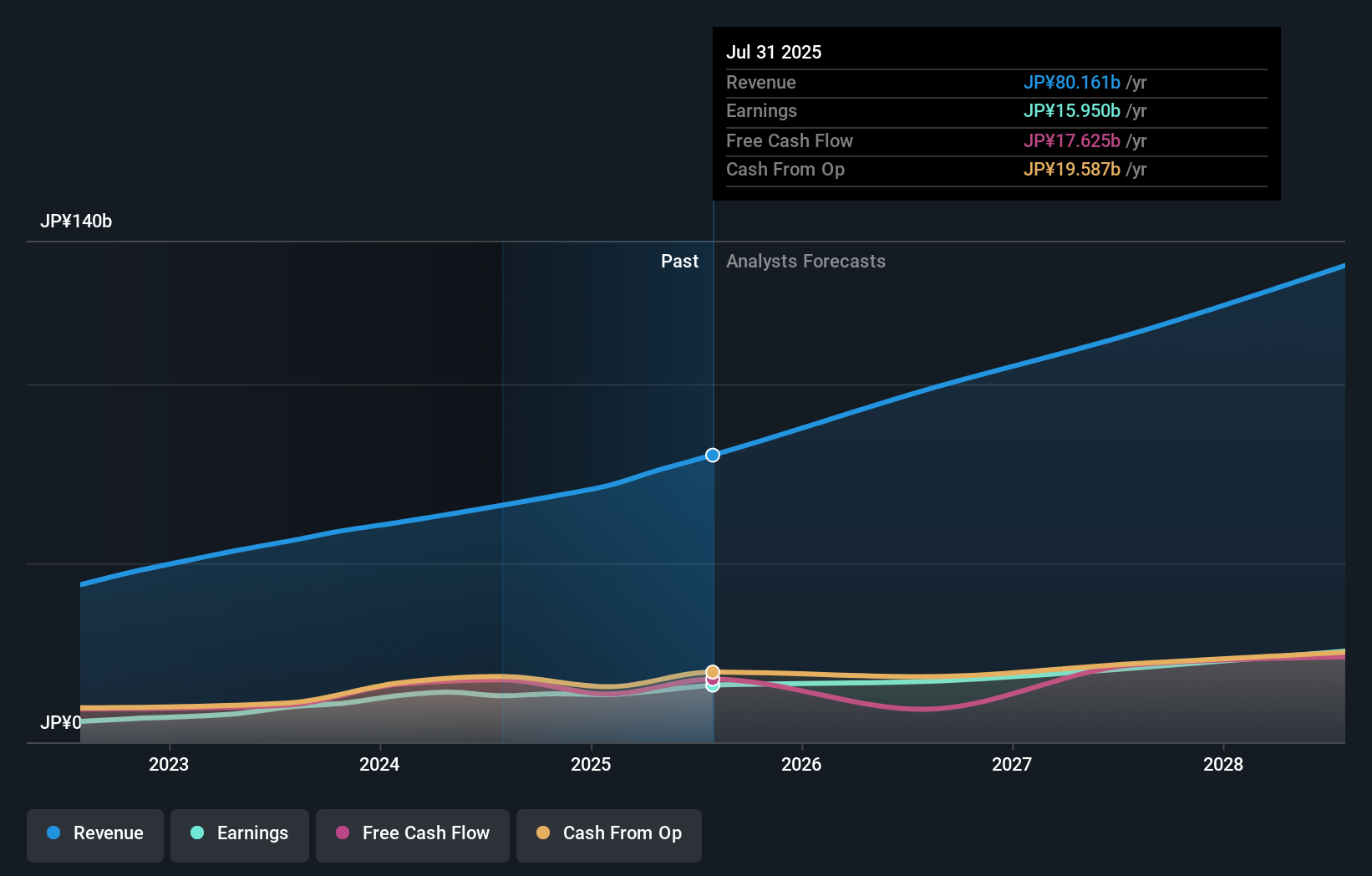

Visional (TSE:4194)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Visional, Inc., along with its subsidiaries, offers human resources platform solutions in Japan and has a market cap of ¥308.34 billion.

Operations: Visional's revenue segments include human resources platform solutions in Japan.

Insider Ownership: 39.5%

Revenue Growth Forecast: 12.5% p.a.

Visional's revenue is projected to grow 12.5% annually, faster than the JP market. Earnings are expected to rise by 11.2% per year, with a return on equity forecasted at 25.4% in three years. The stock trades at 54.8% below its estimated fair value, and analysts agree on a potential price increase of 20.2%. Recent board meeting discussed revising consolidated earnings forecasts, reflecting ongoing strategic adjustments.

- Dive into the specifics of Visional here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Visional is trading behind its estimated value.

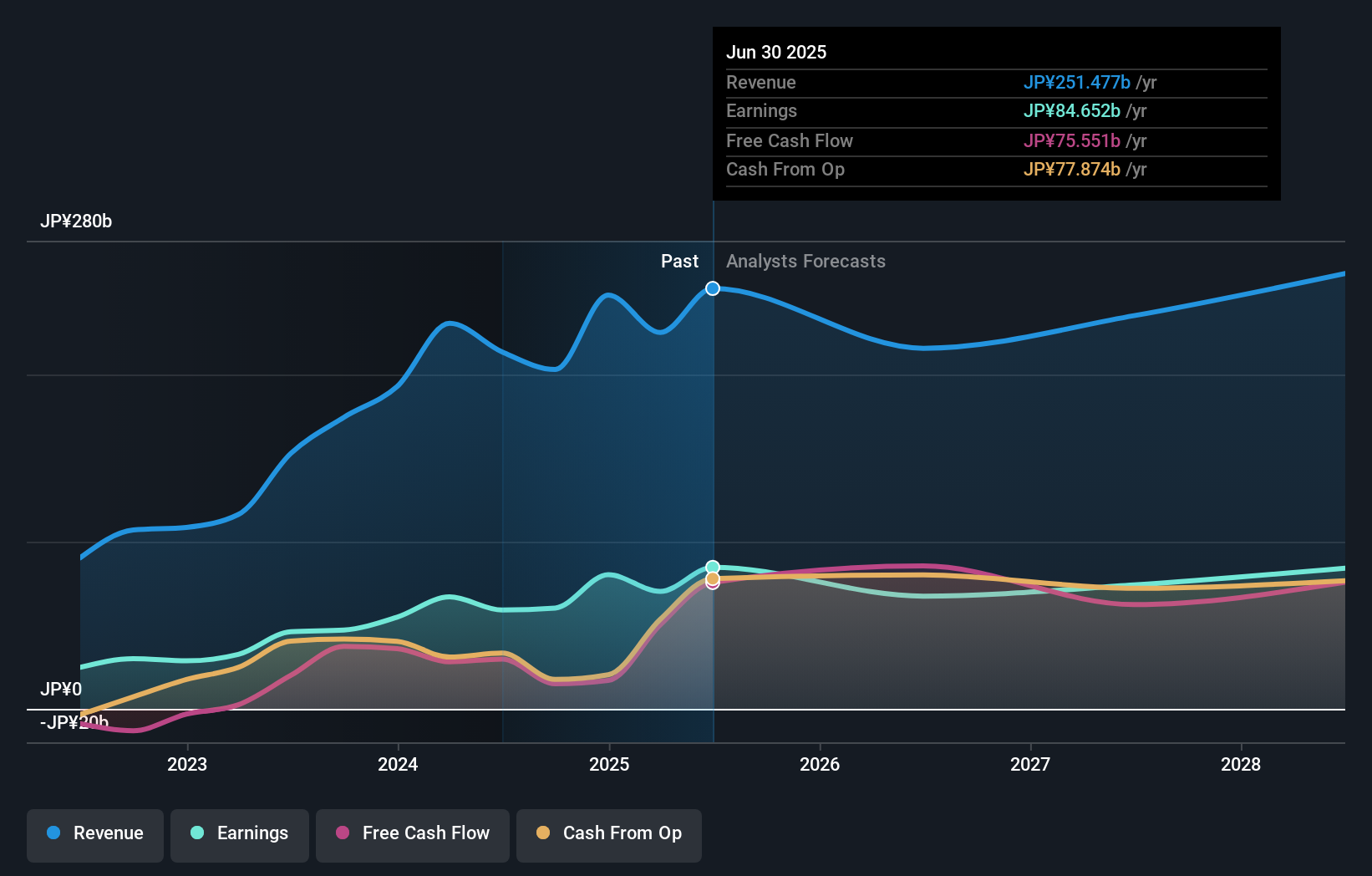

Lasertec (TSE:6920)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lasertec Corporation designs, manufactures, and sells inspection and measurement equipment both in Japan and internationally, with a market cap of ¥2.45 trillion.

Operations: The company generates revenue primarily through the sale of inspection and measurement equipment in both domestic and international markets.

Insider Ownership: 12.1%

Revenue Growth Forecast: 15.4% p.a.

Lasertec's earnings are forecast to grow 19.1% annually, outpacing the JP market's 9%. Revenue is expected to increase by 15.4% per year, also surpassing market growth rates. The return on equity is projected at a robust 39.1% in three years. Recent sales figures show significant growth, with JPY157.20 billion reported for the first three quarters of fiscal year ending June 2024, driven largely by the ACTIS Series' strong performance (JPY76.56 billion).

- Delve into the full analysis future growth report here for a deeper understanding of Lasertec.

- Insights from our recent valuation report point to the potential overvaluation of Lasertec shares in the market.

Make It Happen

- Get an in-depth perspective on all 99 Fast Growing Japanese Companies With High Insider Ownership by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6920

Lasertec

Engages in the designing, manufacturing, and sale of inspection and measurement equipment in Japan and internationally.

Flawless balance sheet with reasonable growth potential.