Amid a turbulent week for global markets, Japan's stock indices saw significant declines, with the Nikkei 225 Index dropping 4.7% and the broader TOPIX Index falling by 6.0%. These movements come on the heels of a hawkish turn from the Bank of Japan and disappointing U.S. economic data, which have collectively dampened investor sentiment. In this environment, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate market volatility. Here are three Japanese dividend stocks to watch that provide yields of up to 5.7%.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.47% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.12% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.97% | ★★★★★★ |

| Globeride (TSE:7990) | 4.19% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.97% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.25% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.04% | ★★★★★★ |

| Innotech (TSE:9880) | 5.14% | ★★★★★★ |

Click here to see the full list of 500 stocks from our Top Japanese Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Sankyo (TSE:6417)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sankyo Co., Ltd. manufactures and sells game machines and ball bearing supply systems in Japan, with a market cap of ¥379.80 billion.

Operations: Sankyo Co., Ltd. generates revenue primarily from its Pachinko-Related Segment at ¥147.04 billion, followed by the Pachislo-Related Segment at ¥32.14 billion and the Supplementary Equipment-Related Segment at ¥19.50 billion.

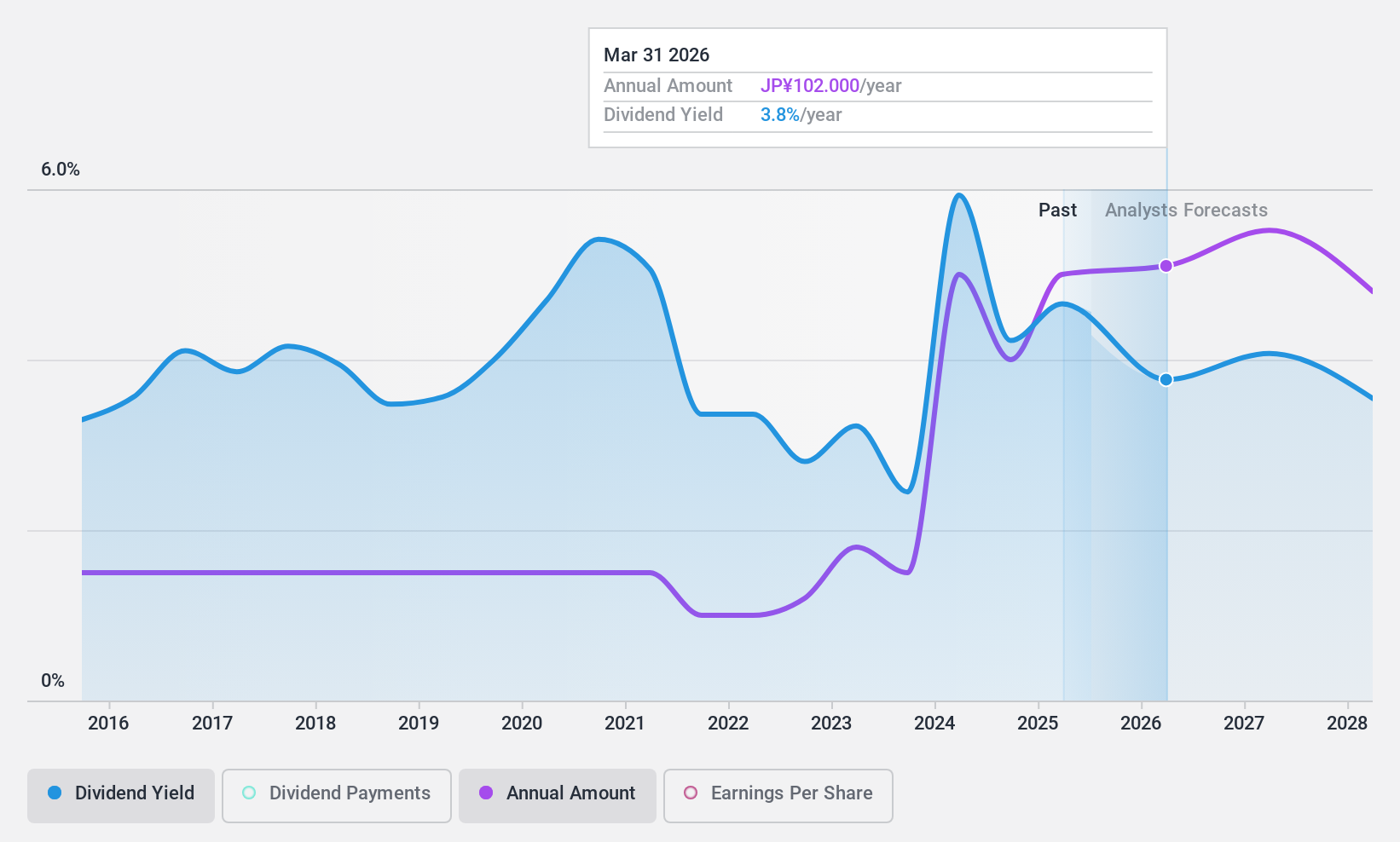

Dividend Yield: 5.8%

Sankyo Co., Ltd. has a mixed dividend profile. The company announced a reduced dividend of ¥50 per share for the year ending March 31, 2024, down from ¥90 the previous year but expects to increase it to ¥80 for the next fiscal year. Despite its high payout ratio and cash flow coverage, Sankyo's dividends have been volatile over the past decade. Recent governance changes aim to enhance managerial efficiency and flexibility in dividend policies.

- Dive into the specifics of Sankyo here with our thorough dividend report.

- Our valuation report here indicates Sankyo may be undervalued.

Takashima (TSE:8007)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Takashima & Co., Ltd. and its subsidiaries operate in Japan, focusing on the design, proposal, processing, material sale, and distribution of construction and building products with a market cap of ¥17.41 billion.

Operations: Takashima & Co., Ltd. generates revenue through the design, proposal, processing, material sale, and distribution of construction and building products in Japan.

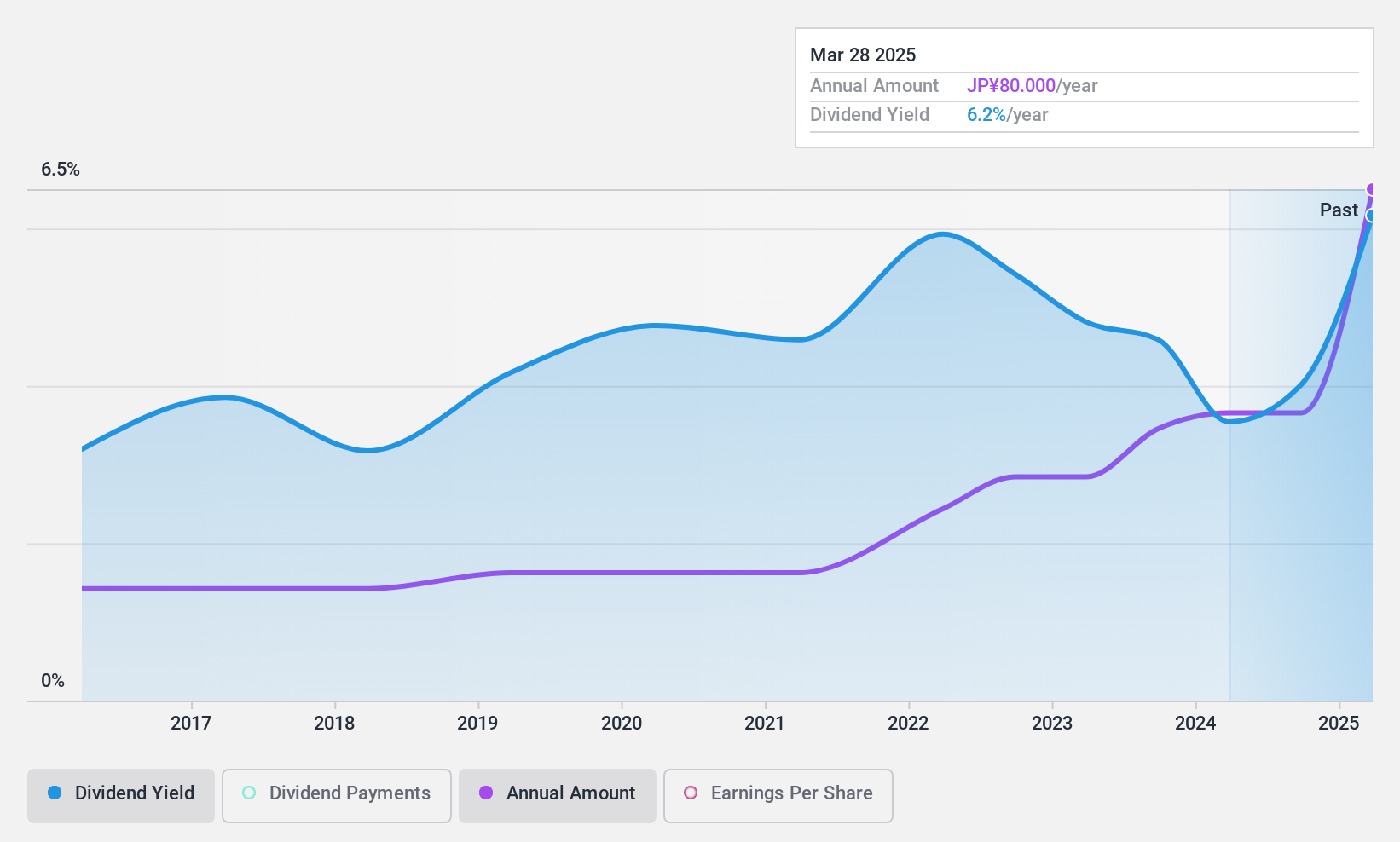

Dividend Yield: 4.4%

Takashima & Co., Ltd. has a solid dividend coverage with a low payout ratio of 16.5% and cash payout ratio of 14.6%, ensuring dividends are well supported by earnings and cash flows. However, the company's dividend history has been volatile over the past decade despite recent increases. The strategic alliance with DG Power System Co., Ltd. to promote digital grid technology could enhance future business performance, potentially impacting dividend sustainability positively in the long term.

- Click here to discover the nuances of Takashima with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Takashima is priced higher than what may be justified by its financials.

Nippo (TSE:9913)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippo Ltd. and its subsidiaries manufacture and trade industrial materials and plastic molded products in Japan and internationally, with a market cap of ¥15.18 billion.

Operations: Nippo Ltd. generates revenue through the manufacturing and trading of industrial materials and plastic molded products both domestically in Japan and internationally.

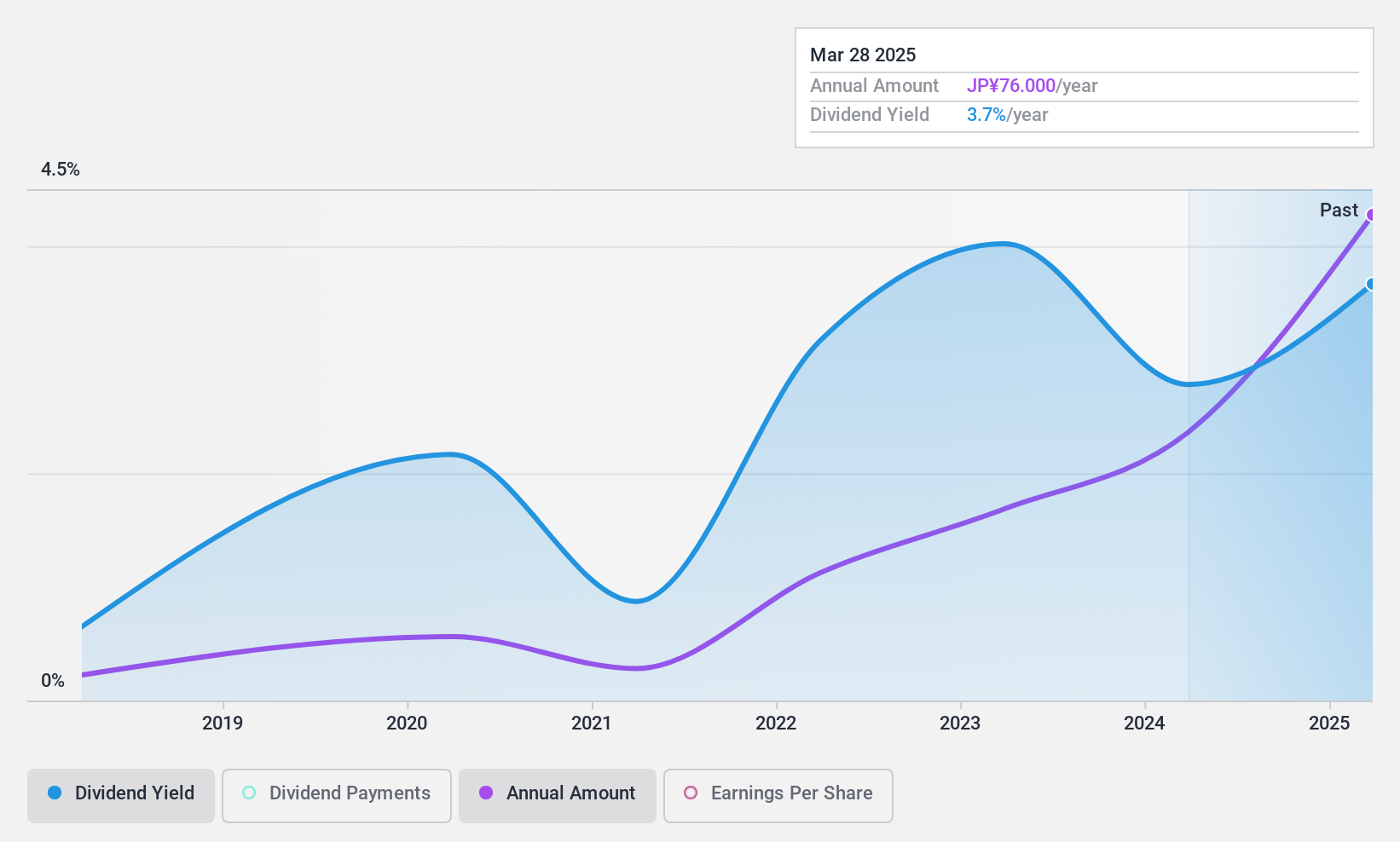

Dividend Yield: 4.5%

Nippo Ltd. offers a compelling dividend profile with dividends well-covered by earnings (47.2% payout ratio) and cash flows (28.8% cash payout ratio). Despite a history of volatility, recent increases to JPY 74 per share for the fiscal year ended March 2024 and guidance of JPY 76 for the next fiscal year show commitment to shareholder returns. However, ongoing investor activism highlights potential governance challenges that could impact future dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Nippo.

- Insights from our recent valuation report point to the potential undervaluation of Nippo shares in the market.

Make It Happen

- Gain an insight into the universe of 500 Top Japanese Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6417

Sankyo

Manufactures and sells game machines and ball bearing supply systems in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives