- Japan

- /

- Hospitality

- /

- TSE:2705

Undiscovered Gems in Japan Top Stock Picks for August 2024

Reviewed by Simply Wall St

Japan's stock markets have experienced significant volatility recently, with the Nikkei 225 Index falling 4.7% and the broader TOPIX Index down 6.0%, partly due to a hawkish turn from the Bank of Japan and disappointing U.S. economic data dampening investor sentiment. Despite these challenges, this environment can present unique opportunities for discerning investors to uncover hidden gems within Japan's market. In such fluctuating conditions, identifying stocks with strong fundamentals, robust growth potential, and resilience against broader market trends becomes crucial for successful investing.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Business Brain Showa-Ota | 0.05% | 7.50% | 59.43% | ★★★★★★ |

| Central Forest Group | NA | 5.16% | 12.45% | ★★★★★★ |

| Intelligent Wave | NA | 6.39% | 15.16% | ★★★★★★ |

| KurimotoLtd | 20.73% | 3.34% | 18.64% | ★★★★★★ |

| Uoriki | NA | 3.90% | 6.15% | ★★★★★★ |

| Yashima Denki | 2.93% | -2.38% | 13.99% | ★★★★★★ |

| Toho | 82.16% | 1.83% | 47.38% | ★★★★★☆ |

| Techno Ryowa | 0.25% | 0.34% | 0.12% | ★★★★★☆ |

| Hakuto | 56.93% | 8.02% | 27.72% | ★★★★☆☆ |

| GENOVA | 6.23% | 24.87% | 31.14% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

OOTOYA Holdings (TSE:2705)

Simply Wall St Value Rating: ★★★★★★

Overview: OOTOYA Holdings Co., Ltd., together with its subsidiaries, plans, manages, and operates a chain of restaurants in Japan and internationally with a market cap of ¥37.06 billion.

Operations: OOTOYA Holdings generates revenue primarily from its Domestic Directly Managed Business (¥16.51 billion) and Domestic Franchise Business (¥7.62 billion). The Abroad Directly Managed Business contributes ¥3.04 billion, while the Overseas Franchise Business adds ¥0.27 billion to the revenue stream.

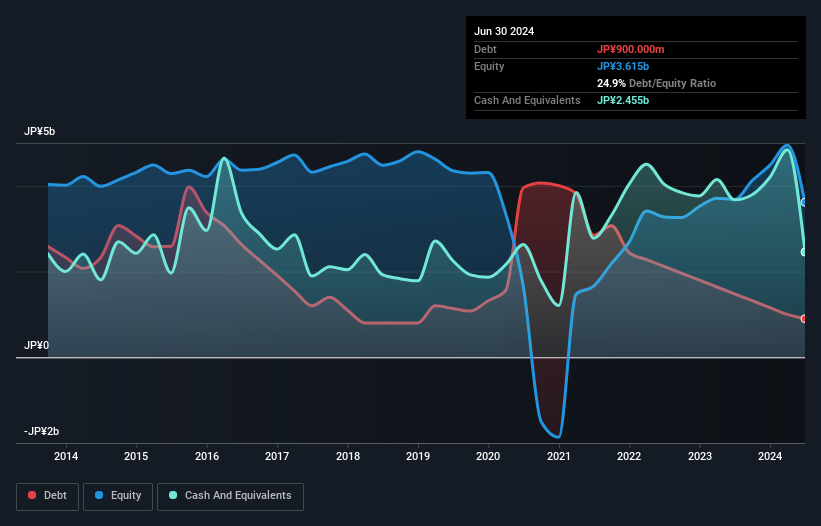

OOTOYA Holdings has demonstrated remarkable earnings growth of 658.5% over the past year, significantly outpacing the Hospitality industry’s 37.7%. The company is profitable and boasts high-quality earnings, with EBIT covering interest payments 109.8 times. Over the past five years, OOTOYA's debt to equity ratio improved from 26% to 20.2%, reflecting prudent financial management. Additionally, it has more cash than total debt, indicating strong liquidity and financial stability moving forward.

- Delve into the full analysis health report here for a deeper understanding of OOTOYA Holdings.

Gain insights into OOTOYA Holdings' past trends and performance with our Past report.

Kurabo Industries (TSE:3106)

Simply Wall St Value Rating: ★★★★★★

Overview: Kurabo Industries Ltd. engages in textile, chemical, technology, food and service, and real estate businesses in Japan and internationally with a market cap of ¥74.47 billion.

Operations: Kurabo Industries Ltd. generates revenue primarily from its Chemical Products (¥61.34 billion) and Textile Business (¥51.15 billion) segments, followed by Environmental Mechatronics (¥25.85 billion), Food and Services (¥9.60 billion), and Real Estate (¥4.23 billion).

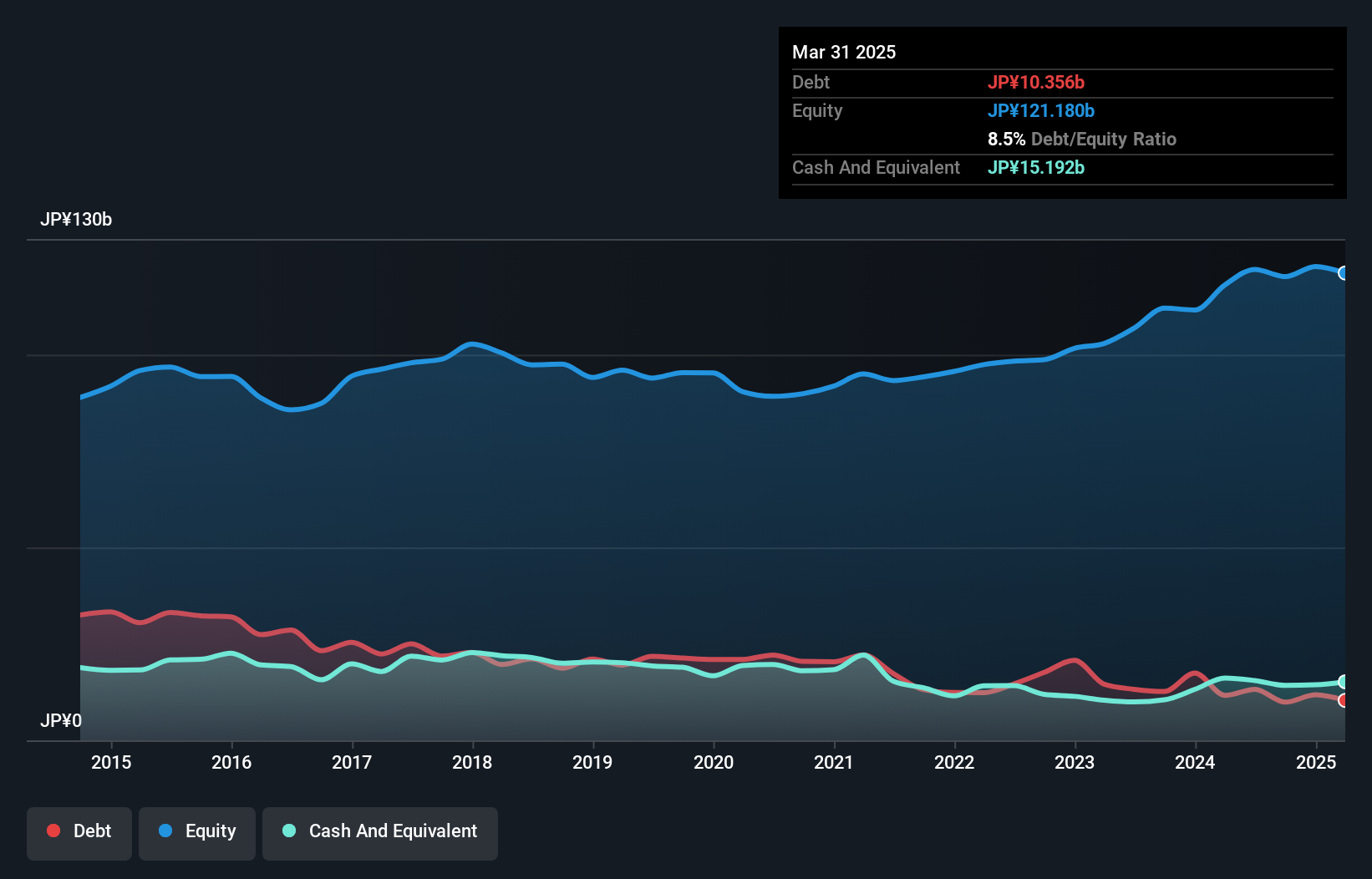

Kurabo Industries, a noteworthy player in Japan's textile and chemical sectors, has been making strides recently. The company reported an earnings growth of 22% over the past year, outpacing the luxury industry’s 9.5%. Trading at 71% below its estimated fair value, Kurabo appears undervalued. Debt to equity ratio improved from 20% to 10% over five years. Additionally, Kurabo repurchased over one million shares this year for ¥3.13 billion and announced dividends of ¥60 per share for FY2024.

- Click here to discover the nuances of Kurabo Industries with our detailed analytical health report.

Explore historical data to track Kurabo Industries' performance over time in our Past section.

MCJ (TSE:6670)

Simply Wall St Value Rating: ★★★★★★

Overview: MCJ Co., Ltd. operates in the PC-related and entertainment sectors in Japan with a market cap of ¥129.51 billion.

Operations: MCJ generates revenue primarily from its PC-related and entertainment businesses. The company's cost structure includes significant expenditures related to production and operational activities. Its net profit margin has shown variability over recent periods, reflecting fluctuations in both revenue streams and costs.

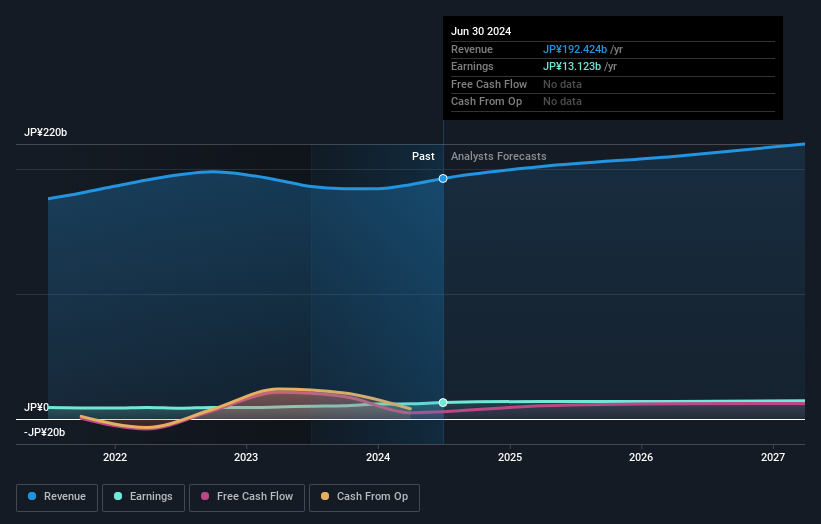

MCJ, a tech company, has shown impressive performance with earnings growth of 28% over the past year, outpacing the Tech industry’s -4.2%. Trading at 45% below its estimated fair value and having reduced its debt to equity ratio from 38.3% to 20.1% over five years, it appears undervalued compared to peers. The firm is also set to report Q1 2025 results on August 5, providing a potential catalyst for further evaluation.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 711 Japanese Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2705

OOTOYA Holdings

Plans, manages, and operates a chain of restaurants in Japan and internationally.

Outstanding track record with flawless balance sheet.