- Japan

- /

- Professional Services

- /

- TSE:7088

August 2024's Japanese Stock Picks Estimated Below Fair Value

Reviewed by Simply Wall St

As Japan’s stock markets recently experienced significant declines, with the Nikkei 225 Index falling 4.7% and the TOPIX Index down 6.0%, investors are increasingly looking for opportunities that may be trading below their fair value. In this context, identifying undervalued stocks can provide a strategic advantage, especially in a market environment characterized by volatility and shifting economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Strike CompanyLimited (TSE:6196) | ¥3565.00 | ¥6659.62 | 46.5% |

| Suzumo Machinery (TSE:6405) | ¥1323.00 | ¥2452.52 | 46.1% |

| NittoseikoLtd (TSE:5957) | ¥520.00 | ¥1019.08 | 49% |

| Insource (TSE:6200) | ¥833.00 | ¥1617.20 | 48.5% |

| KATITAS (TSE:8919) | ¥1700.00 | ¥3221.74 | 47.2% |

| ServerworksLtd (TSE:4434) | ¥2275.00 | ¥4342.55 | 47.6% |

| Members (TSE:2130) | ¥717.00 | ¥1416.25 | 49.4% |

| Infomart (TSE:2492) | ¥239.00 | ¥441.35 | 45.8% |

| Premium Group (TSE:7199) | ¥1798.00 | ¥3349.59 | 46.3% |

| TORIDOLL Holdings (TSE:3397) | ¥3798.00 | ¥7245.07 | 47.6% |

Let's explore several standout options from the results in the screener.

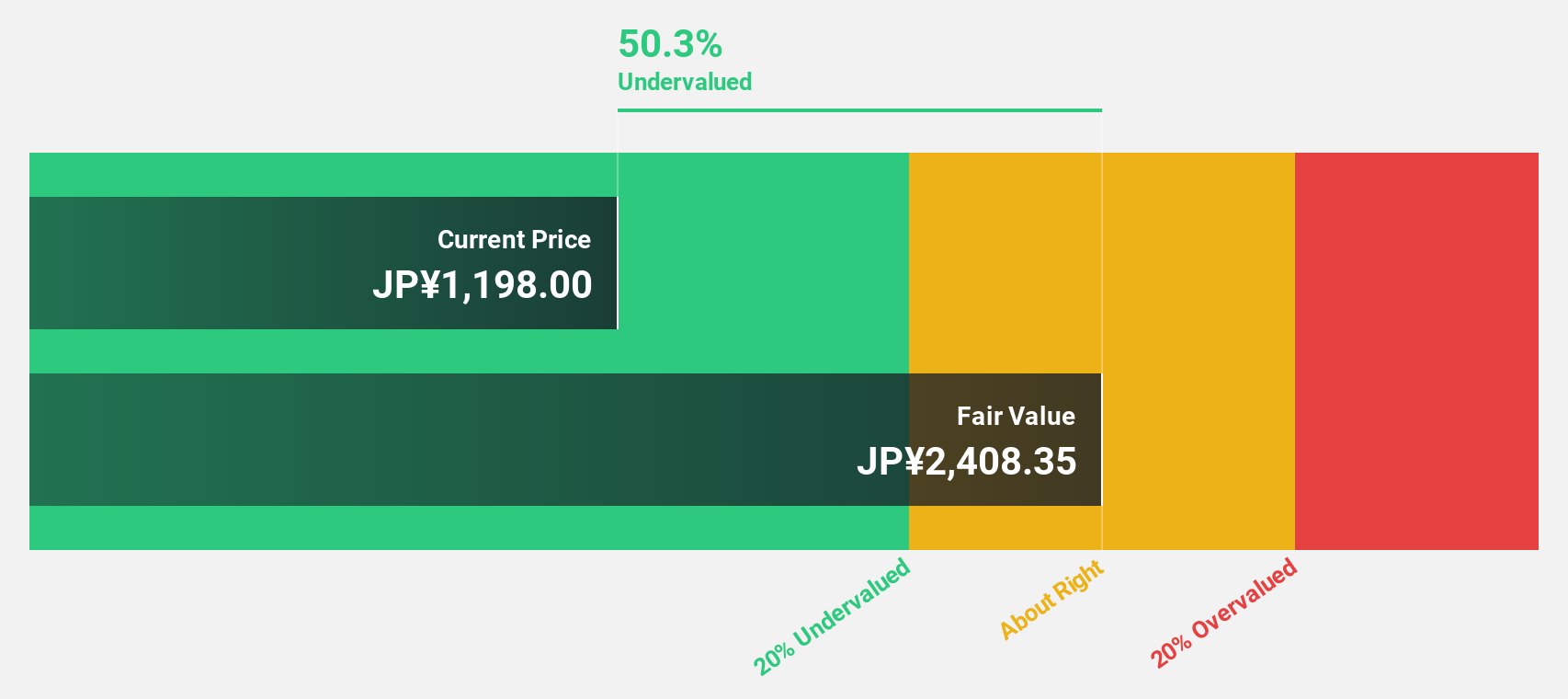

Japan Business Systems (TSE:5036)

Overview: Japan Business Systems, Inc. (TSE:5036) provides cloud integration and related services with a market cap of ¥38.33 billion.

Operations: Revenue Segments (in millions of ¥): Cloud Integration Services: ¥15,000; IT Consulting: ¥8,500; Software Development: ¥6,200; Hardware Sales: ¥4,300.

Estimated Discount To Fair Value: 43.4%

Japan Business Systems is currently trading at ¥841, significantly below its estimated fair value of ¥1487.02, indicating it may be undervalued based on cash flows. Despite high volatility in its share price over the past three months, the company's earnings are forecast to grow 38.7% per year, outpacing the Japanese market's 9% growth rate. However, its dividend yield of 2.85% is not well covered by free cash flows and there is less than three years of financial data available for comprehensive analysis.

- The growth report we've compiled suggests that Japan Business Systems' future prospects could be on the up.

- Dive into the specifics of Japan Business Systems here with our thorough financial health report.

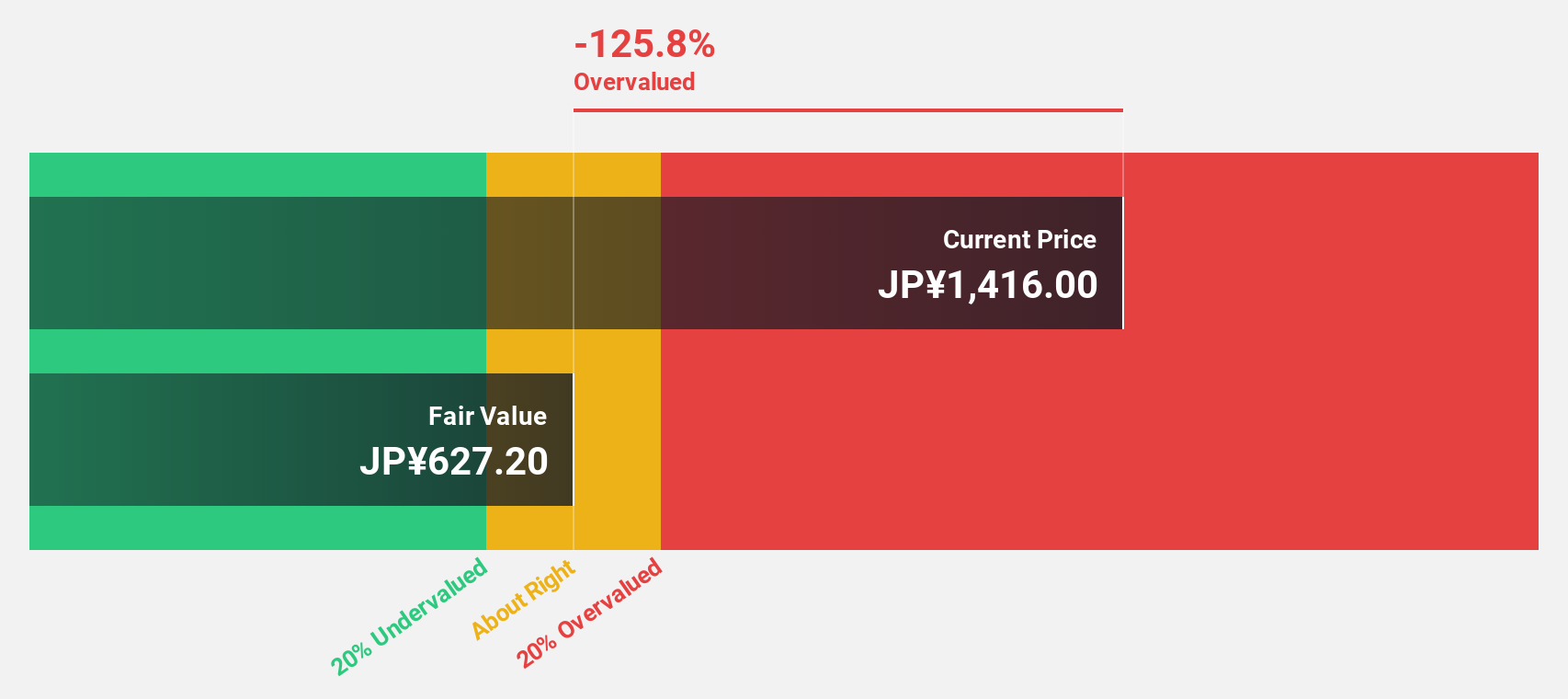

Forum Engineering (TSE:7088)

Overview: Forum Engineering Inc. provides personnel management services for mechanical and electrical engineers in Japan and has a market cap of ¥47.85 billion.

Operations: Forum Engineering Inc. generates revenue by offering personnel management services specifically for mechanical and electrical engineers in Japan.

Estimated Discount To Fair Value: 44.3%

Forum Engineering is trading at ¥916, well below its estimated fair value of ¥1644.11, suggesting it is undervalued based on cash flows. The company's earnings are forecast to grow 13.16% annually, faster than the JP market's 9% growth rate. However, its dividend yield of 4.64% is not well covered by earnings and there is less than three years of financial data available for comprehensive analysis.

- The analysis detailed in our Forum Engineering growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Forum Engineering's balance sheet health report.

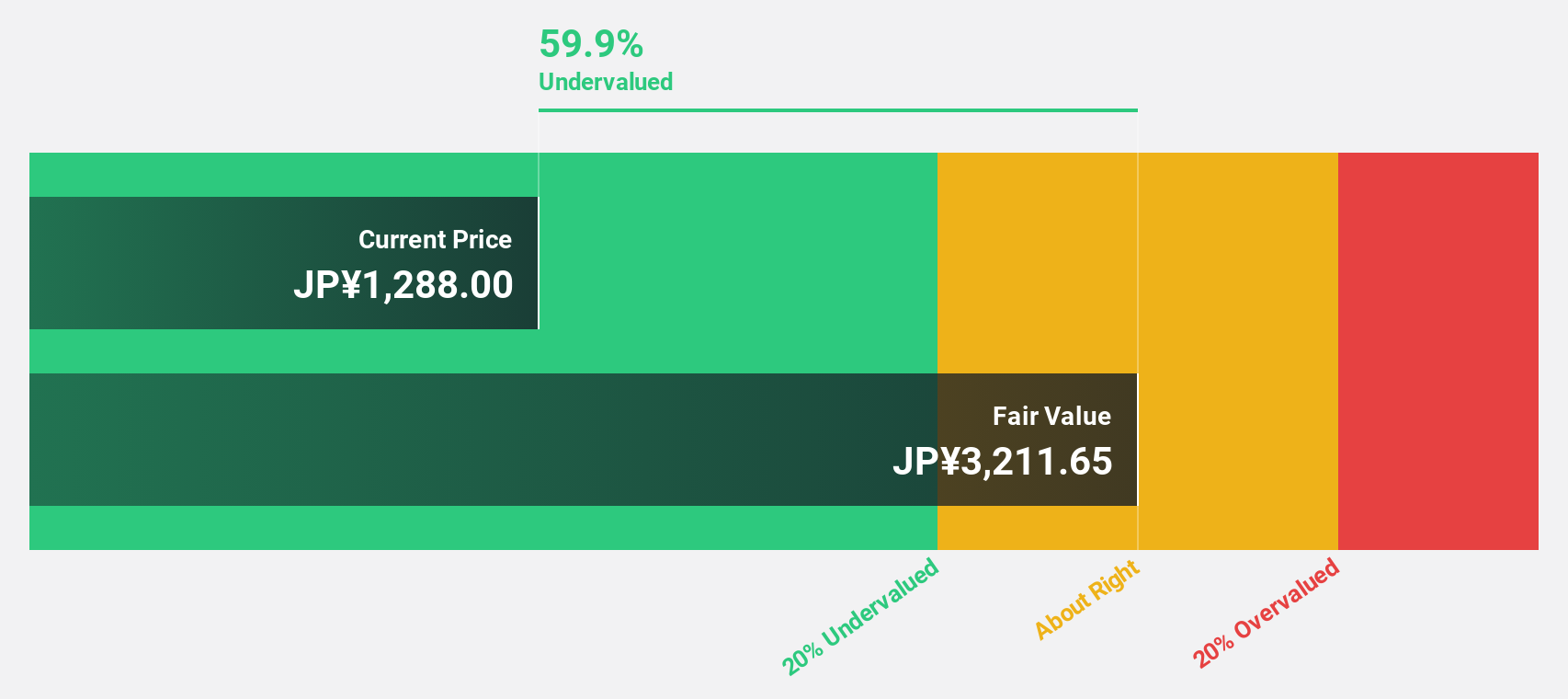

LITALICO (TSE:7366)

Overview: LITALICO Inc. operates schools for learning and preschools in Japan, with a market cap of ¥38.21 billion.

Operations: The company's revenue segments include operating schools for learning and preschools in Japan.

Estimated Discount To Fair Value: 42%

LITALICO Inc. is trading at ¥1,070, significantly below its estimated fair value of ¥1,845.27, indicating it is undervalued based on cash flows. The company's earnings are forecast to grow 16.82% annually, surpassing the JP market's 9% growth rate. Despite a high level of debt and recent volatility in share price, LITALICO's Return on Equity is expected to reach 22.7% in three years and revenue growth outpaces the market at 13.9%.

- According our earnings growth report, there's an indication that LITALICO might be ready to expand.

- Unlock comprehensive insights into our analysis of LITALICO stock in this financial health report.

Taking Advantage

- Unlock our comprehensive list of 72 Undervalued Japanese Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7088

Forum Engineering

Provides personnel management services for mechanical and electrical engineers in Japan.

Flawless balance sheet with reasonable growth potential.