- Taiwan

- /

- Semiconductors

- /

- TPEX:3633

Top Asian Dividend Stocks To Consider In March 2025

Reviewed by Simply Wall St

As global markets grapple with economic uncertainty and inflation concerns, the Asian market is also feeling the impact of these challenges. With consumer sentiment at a low and trade tensions affecting key sectors, investors are increasingly looking towards dividend stocks as a potential source of steady income amidst volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.87% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.03% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.68% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.06% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.37% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.17% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.68% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.69% | ★★★★★★ |

Click here to see the full list of 1140 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

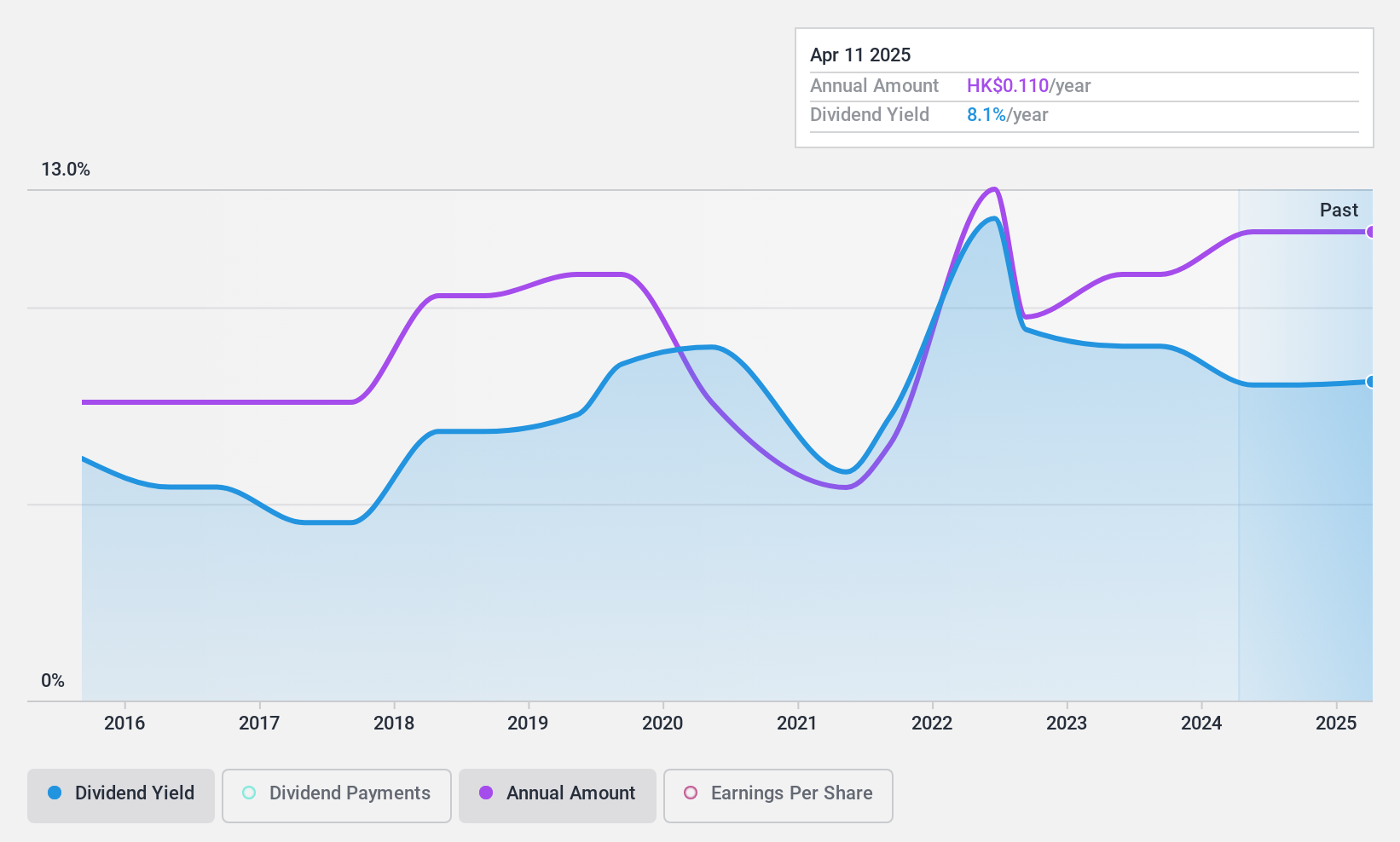

Lion Rock Group (SEHK:1127)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lion Rock Group Limited is an investment holding company that offers printing services to international book publishers and media companies, with a market cap of HK$1.12 billion.

Operations: Lion Rock Group Limited generates revenue from providing printing services to international book publishers, trade, professional and educational publishing conglomerates, and print media companies.

Dividend Yield: 7.6%

Lion Rock Group's recent earnings report shows a solid increase in net income to HK$214.41 million, supporting its dividend sustainability with a low payout ratio of 25.7% and cash payout ratio of 38.7%. Despite this, the company's dividend track record is unstable with volatility over the past decade, although it remains competitive in yield within Hong Kong's top 25%. The stock trades significantly below estimated fair value, potentially offering attractive entry points for investors seeking dividends.

- Unlock comprehensive insights into our analysis of Lion Rock Group stock in this dividend report.

- The valuation report we've compiled suggests that Lion Rock Group's current price could be quite moderate.

Epoch Chemtronics (TPEX:3633)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Epoch Chemtronics Corp. operates in Taiwan, focusing on the manufacture and sale of LED backlight modules, LGP, and LED lighting equipment, with a market cap of NT$3.33 billion.

Operations: Epoch Chemtronics Corp. generates revenue of NT$6.23 billion from its processing and manufacturing of optical instruments and electronic components business.

Dividend Yield: 5.6%

Epoch Chemtronics' dividend payments are well-covered by cash flows with a low cash payout ratio of 41%, and earnings coverage at 65.8%. Despite a top-tier yield of 5.62% in Taiwan, its dividends have been volatile over the past decade, reflecting an unstable track record. The stock trades at a significant discount to its estimated fair value, but investors should be cautious due to outdated financial data and inconsistent dividend reliability.

- Take a closer look at Epoch Chemtronics' potential here in our dividend report.

- Our valuation report here indicates Epoch Chemtronics may be undervalued.

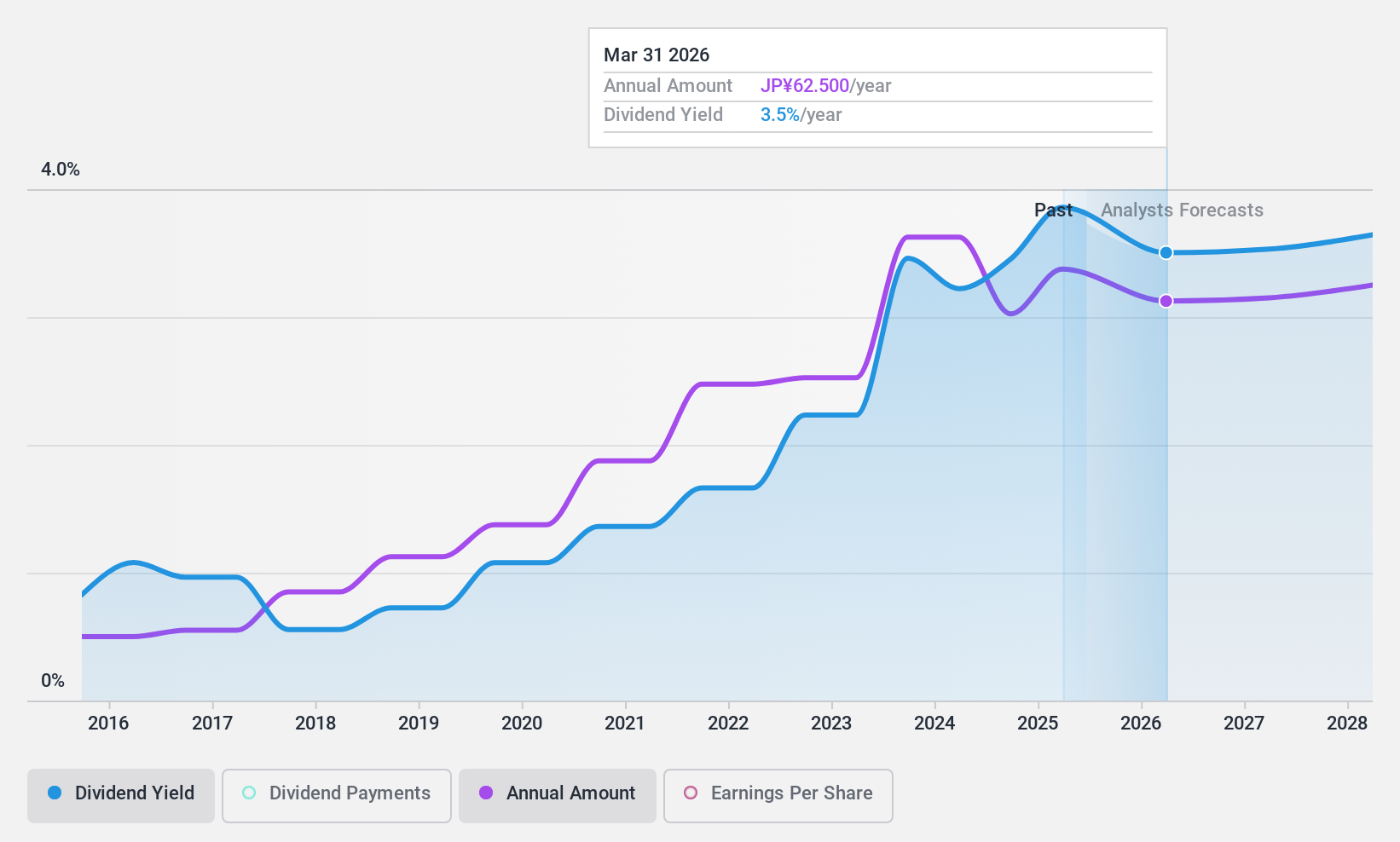

WDB Holdings (TSE:2475)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WDB Holdings Co., Ltd. operates in Japan, focusing on human resources, contract research organization (CRO) services, and platform businesses with a market cap of ¥37.26 billion.

Operations: WDB Holdings Co., Ltd. generates revenue primarily from its Human Resource Services Business, which accounts for ¥42.88 billion, and its CRO Business, contributing ¥8.00 billion.

Dividend Yield: 3.6%

WDB Holdings' dividend is supported by a low payout ratio of 41.4% and a cash payout ratio of 61.8%, indicating coverage by earnings and cash flows. While dividends have grown over the last decade, they have been unstable, with significant annual drops exceeding 20%. The yield of 3.56% is slightly below Japan's top quartile payers, yet the stock trades at a notable discount to its fair value estimate.

- Click here and access our complete dividend analysis report to understand the dynamics of WDB Holdings.

- According our valuation report, there's an indication that WDB Holdings' share price might be on the cheaper side.

Key Takeaways

- Discover the full array of 1140 Top Asian Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Epoch Chemtronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3633

Epoch Chemtronics

Manufactures and sells LED backlight modules, LGP, and LED lighting equipment in Taiwan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)