As global markets react to the recent U.S. election results and a Federal Reserve rate cut, major indices like the S&P 500 and Nasdaq Composite have reached record highs, driven by optimism over potential growth-friendly policies. In this dynamic environment, dividend stocks can offer investors a blend of income and stability, making them an attractive option for those looking to navigate market fluctuations while benefiting from regular payouts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.63% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Globeride (TSE:7990) | 4.05% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.19% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.49% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.06% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.43% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

CMC (TSE:2185)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CMC Corporation, along with its subsidiaries, offers manual creation, business process management, training, translation, and interpretation services in Japan and has a market cap of ¥15.82 billion.

Operations: CMC Corporation generates revenue primarily through its Manuals & Knowledge Business, which accounted for ¥18.78 billion.

Dividend Yield: 2.9%

CMC offers a stable dividend history over the past decade, with payments growing steadily and covered by both earnings (31.7% payout ratio) and cash flows (46.3% cash payout ratio). Despite a reliable 2.95% yield, it is below the top tier in Japan's market. Trading significantly below estimated fair value, CMC's recent private placement raised VND 844.56 billion, potentially impacting future capital structure and dividend sustainability considerations.

- Delve into the full analysis dividend report here for a deeper understanding of CMC.

- Our expertly prepared valuation report CMC implies its share price may be lower than expected.

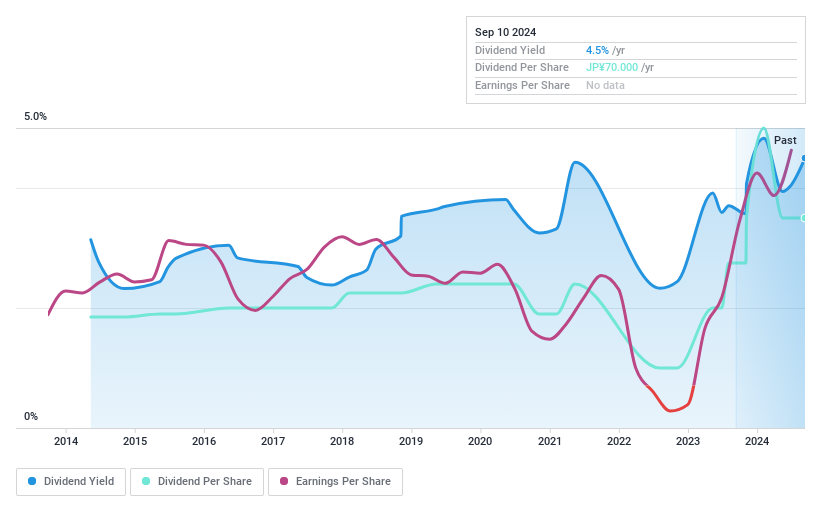

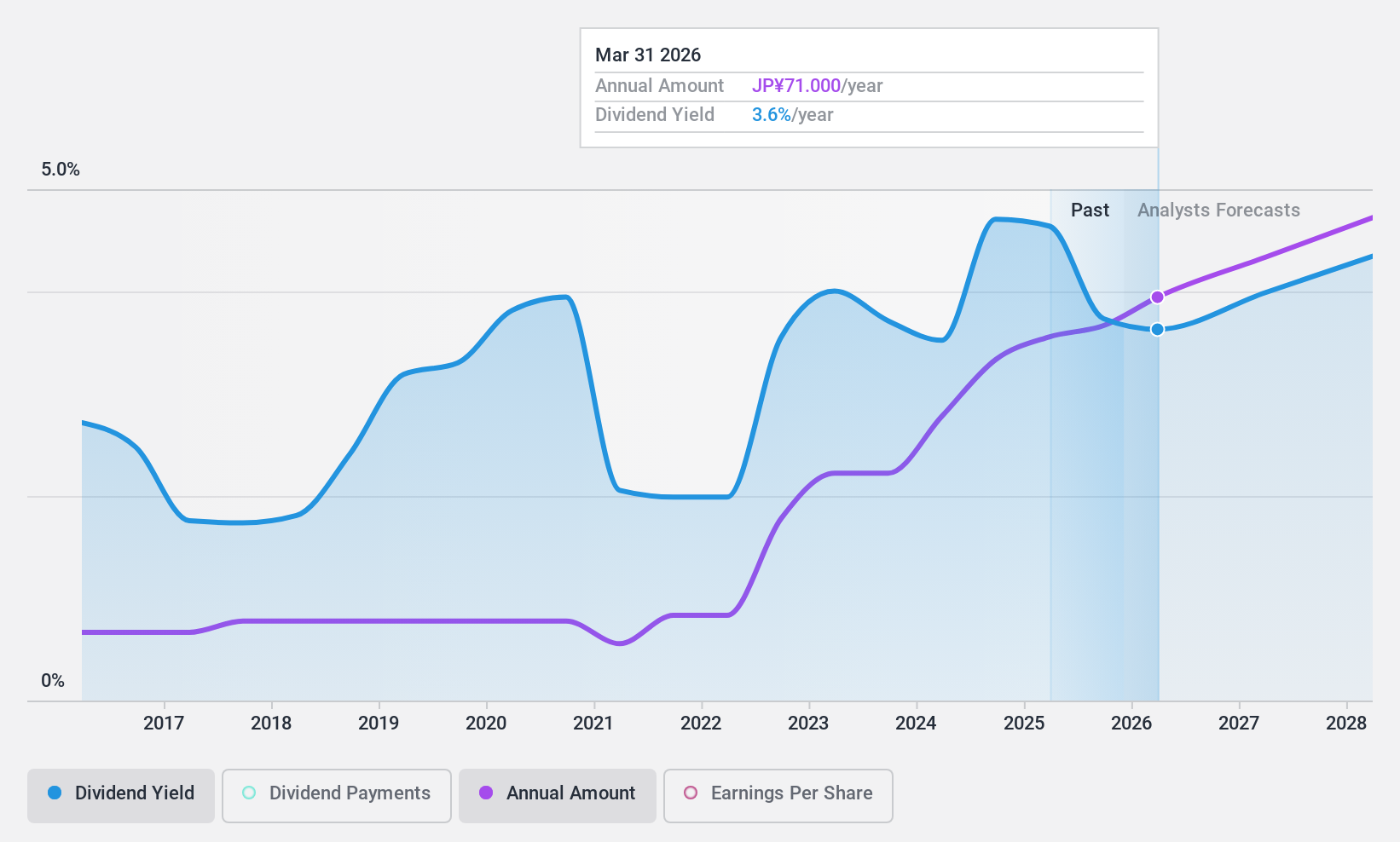

Yushiro Chemical Industry (TSE:5013)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yushiro Chemical Industry Co., Ltd., along with its subsidiaries, manufactures and sells metalworking oils, fluids, and building maintenance chemicals globally, with a market cap of ¥21.05 billion.

Operations: Yushiro Chemical Industry Co., Ltd.'s revenue segments include the manufacture and sale of metalworking oils and fluids, as well as chemicals for building maintenance on a global scale.

Dividend Yield: 3.6%

Yushiro Chemical Industry's dividend payments have been volatile and unreliable over the past decade, yet they are well covered by earnings (18.4% payout ratio) and cash flows (26.4% cash payout ratio). Despite a recent 42% earnings growth, its 3.6% yield is below Japan's top tier. Trading at 66% below estimated fair value, Yushiro was recently added to the S&P Global BMI Index, potentially enhancing its market visibility.

- Dive into the specifics of Yushiro Chemical Industry here with our thorough dividend report.

- According our valuation report, there's an indication that Yushiro Chemical Industry's share price might be on the cheaper side.

FUJIKURA COMPOSITES (TSE:5121)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FUJIKURA COMPOSITES Inc. produces and sells industrial rubber components in Japan, with a market cap of ¥23.96 billion.

Operations: FUJIKURA COMPOSITES Inc. generates revenue through its industrial rubber components segment in Japan.

Dividend Yield: 4.3%

Fujikura Composites' dividends are well covered by earnings (16.6% payout ratio) and cash flows (26.6% cash payout ratio), but have been volatile and unreliable over the past decade. Despite a top-tier yield of 4.26% in Japan, recent guidance indicates a decrease in dividends to JPY 30 per share for the fiscal year ending March 31, 2025, down from JPY 35 previously. The stock trades at approximately 68.4% below its estimated fair value.

- Click here to discover the nuances of FUJIKURA COMPOSITES with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of FUJIKURA COMPOSITES shares in the market.

Taking Advantage

- Navigate through the entire inventory of 1940 Top Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5013

Yushiro Chemical Industry

Engages in the manufacture and sale of metalworking oils and fluids, and chemicals for building maintenance worldwide.

Flawless balance sheet with solid track record and pays a dividend.