- Japan

- /

- Commercial Services

- /

- TSE:2185

Bouvet And 2 Reliable Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with major indices reflecting both gains and challenges, investors continue to seek stability amid economic fluctuations. In this environment, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for those looking to enhance their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.13% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.57% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.29% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.02% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.01% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

Click here to see the full list of 2014 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Bouvet (OB:BOUV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bouvet ASA offers IT and digital communication consultancy services to public and private sector companies in Norway, Sweden, and internationally, with a market cap of NOK7.99 billion.

Operations: Bouvet ASA generates revenue primarily from IT Consultancy Services, amounting to NOK3.87 billion.

Dividend Yield: 3.3%

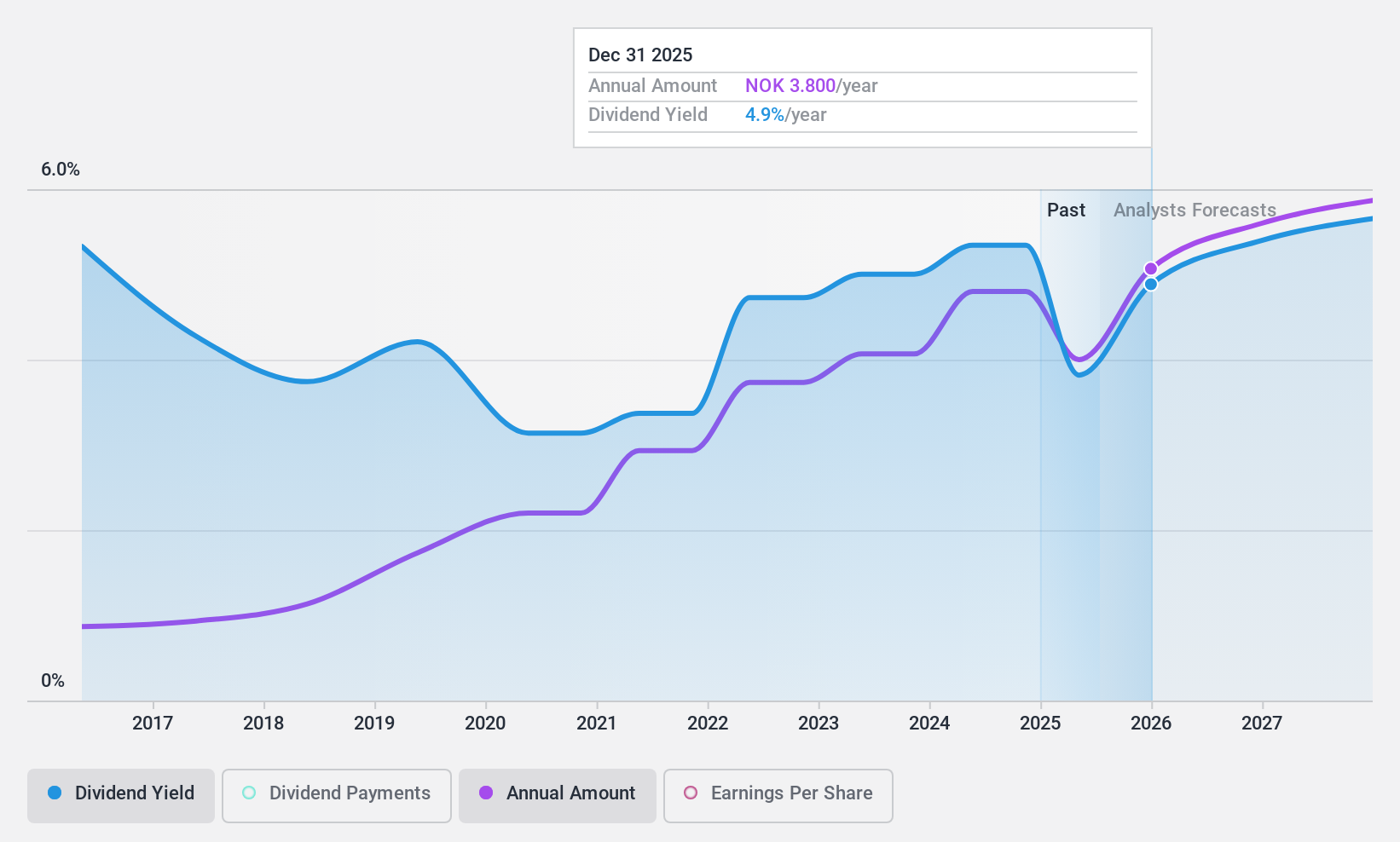

Bouvet's dividend payments have shown consistent growth and stability over the past decade, supported by a modest cash payout ratio of 41.7%, indicating strong coverage by cash flows. With a payout ratio of 71.3%, dividends are also well-covered by earnings. Despite a lower yield of 3.34% compared to top Norwegian dividend payers, Bouvet remains reliable in its payouts, recently increasing its dividend with an additional NOK 1 per share for FY2023.

- Unlock comprehensive insights into our analysis of Bouvet stock in this dividend report.

- Our expertly prepared valuation report Bouvet implies its share price may be too high.

CMC (TSE:2185)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CMC Corporation, along with its subsidiaries, offers services in manual creation, business process management, training, translation, and interpretation in Japan and has a market cap of ¥19.96 billion.

Operations: CMC Corporation's revenue segments include manual creation, business process management, training, translation, and interpretation services in Japan.

Dividend Yield: 3.5%

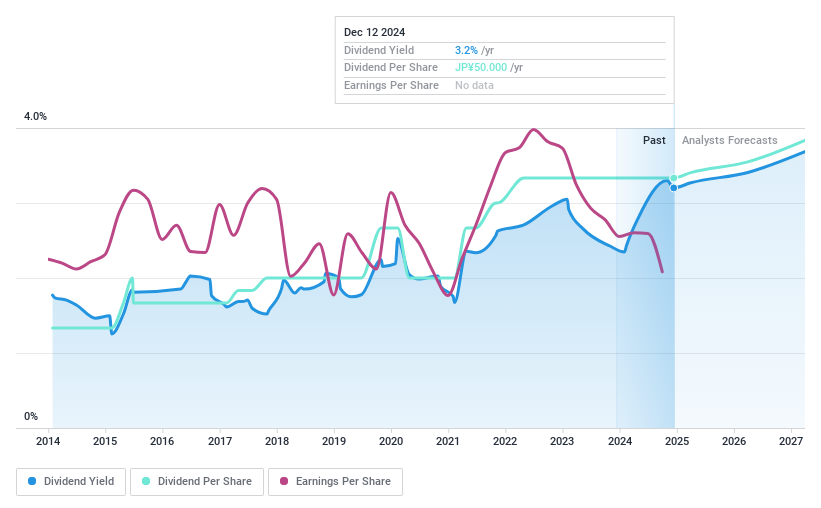

CMC's dividend yield of 3.46% is lower than the top tier in Japan, and while dividends have grown over a decade with stability, they are not covered by free cash flows. The payout ratio of 28.1% suggests earnings coverage is strong despite high non-cash earnings. Recent share buybacks aim to enhance shareholder returns, but the company has reduced its fiscal year dividend guidance to ¥28 per share from ¥44 for the previous year.

- Navigate through the intricacies of CMC with our comprehensive dividend report here.

- Our valuation report here indicates CMC may be overvalued.

Kyocera (TSE:6971)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kyocera Corporation develops, produces, and distributes products based on fine ceramic technologies across Japan, the rest of Asia, Europe, the United States, and internationally with a market cap of approximately ¥2.25 trillion.

Operations: Kyocera's revenue segments include Electronic Components Business at ¥358.44 billion, Solutions Business - Machine Tools at ¥311.93 billion, Solutions Business - Communications Unit at ¥224.84 billion, Solutions Business - Document Solutions Unit at ¥471.49 billion, Core Components Business - Semiconductor Components Unit at ¥307.47 billion, and Core Components Business - Industrial & Automotive Components Unit at ¥229.27 billion.

Dividend Yield: 3.1%

Kyocera's dividend yield of 3.13% is below the top tier in Japan, with a history of volatility over the past decade. The dividends are covered by earnings and cash flows, with payout ratios at 87.3% and 65.4%, respectively, but their sustainability remains uncertain due to an unstable track record. Despite recent innovations showcased at CES 2025 and expansion plans for lithium-ion battery production, financial guidance has been lowered amid demand challenges in key business areas.

- Click to explore a detailed breakdown of our findings in Kyocera's dividend report.

- Our comprehensive valuation report raises the possibility that Kyocera is priced higher than what may be justified by its financials.

Taking Advantage

- Unlock our comprehensive list of 2014 Top Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade CMC, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2185

CMC

Provides manual creation, business process management, training, translation, and interpretation services in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives