- Japan

- /

- Commercial Services

- /

- TSE:2185

Asian Dividend Stocks To Consider

Reviewed by Simply Wall St

In recent weeks, Asian markets have experienced a mix of volatility and cautious optimism as global economic uncertainties and trade tensions continue to influence investor sentiment. Amidst these fluctuations, dividend stocks in Asia present an appealing option for investors seeking steady income streams, especially in times of market instability.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.95% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.49% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.91% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.75% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.37% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.36% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.02% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.04% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.03% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.25% | ★★★★★★ |

Click here to see the full list of 1251 stocks from our Top Asian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Youngone Holdings (KOSE:A009970)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Youngone Holdings Co., Ltd. is a company that manufactures and sells apparel, footwear, gear, sportswear, and jackets both in South Korea and internationally, with a market cap of ₩1.33 trillion.

Operations: Youngone Holdings Co., Ltd. generates revenue from several segments, including SCOTT at ₩953.66 million, Domestic Retail at ₩1.02 billion, and Manufacture OEM at ₩4.41 billion.

Dividend Yield: 4.7%

Youngone Holdings offers a compelling dividend profile with a payout ratio of 18.6%, ensuring dividends are well-covered by earnings. Its cash payout ratio is just 10%, indicating strong coverage by cash flows. The company’s dividend yield of 4.66% ranks in the top 25% within the KR market, though its dividend history spans less than ten years, suggesting room for growth but also limited historical reliability.

- Navigate through the intricacies of Youngone Holdings with our comprehensive dividend report here.

- Our expertly prepared valuation report Youngone Holdings implies its share price may be lower than expected.

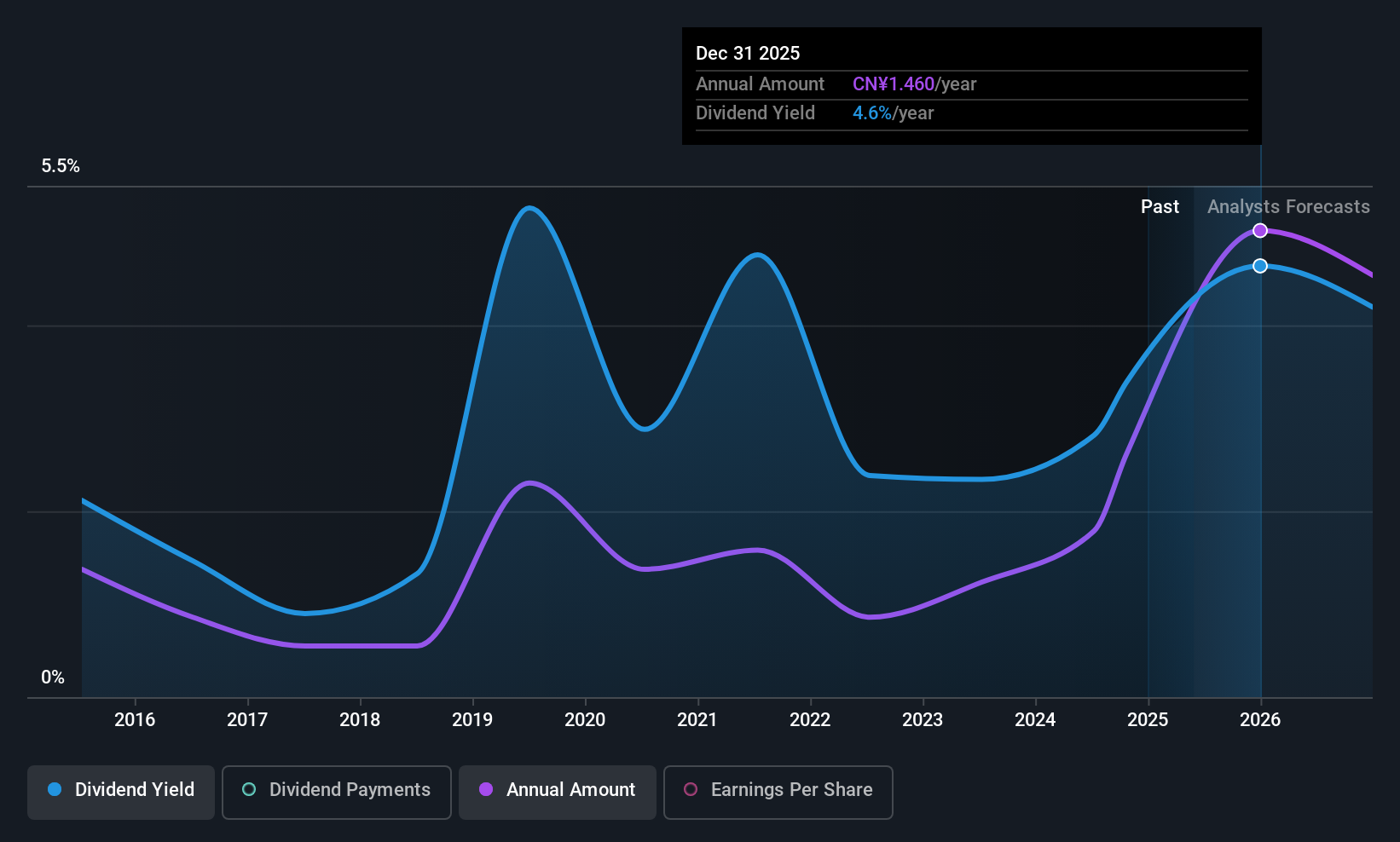

Neway Valve (Suzhou) (SHSE:603699)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Neway Valve (Suzhou) Co., Ltd. focuses on the research, development, production, and sale of industrial valves both within China and internationally, with a market cap of CN¥23 billion.

Operations: Neway Valve (Suzhou) Co., Ltd. generates revenue primarily from its valve industry segment, amounting to CN¥6.43 billion.

Dividend Yield: 5.1%

Neway Valve (Suzhou) reported strong earnings growth, with net income rising to CNY 262.69 million in Q1 2025 from CNY 196.75 million a year prior. Despite this, its high payout ratio of 95.1% indicates dividends are not well covered by earnings, though cash flows provide some coverage with an 85.7% cash payout ratio. The dividend yield of 5.08% is among the top in China but has been volatile over the past decade, impacting reliability for investors seeking stable income streams.

- Take a closer look at Neway Valve (Suzhou)'s potential here in our dividend report.

- The analysis detailed in our Neway Valve (Suzhou) valuation report hints at an deflated share price compared to its estimated value.

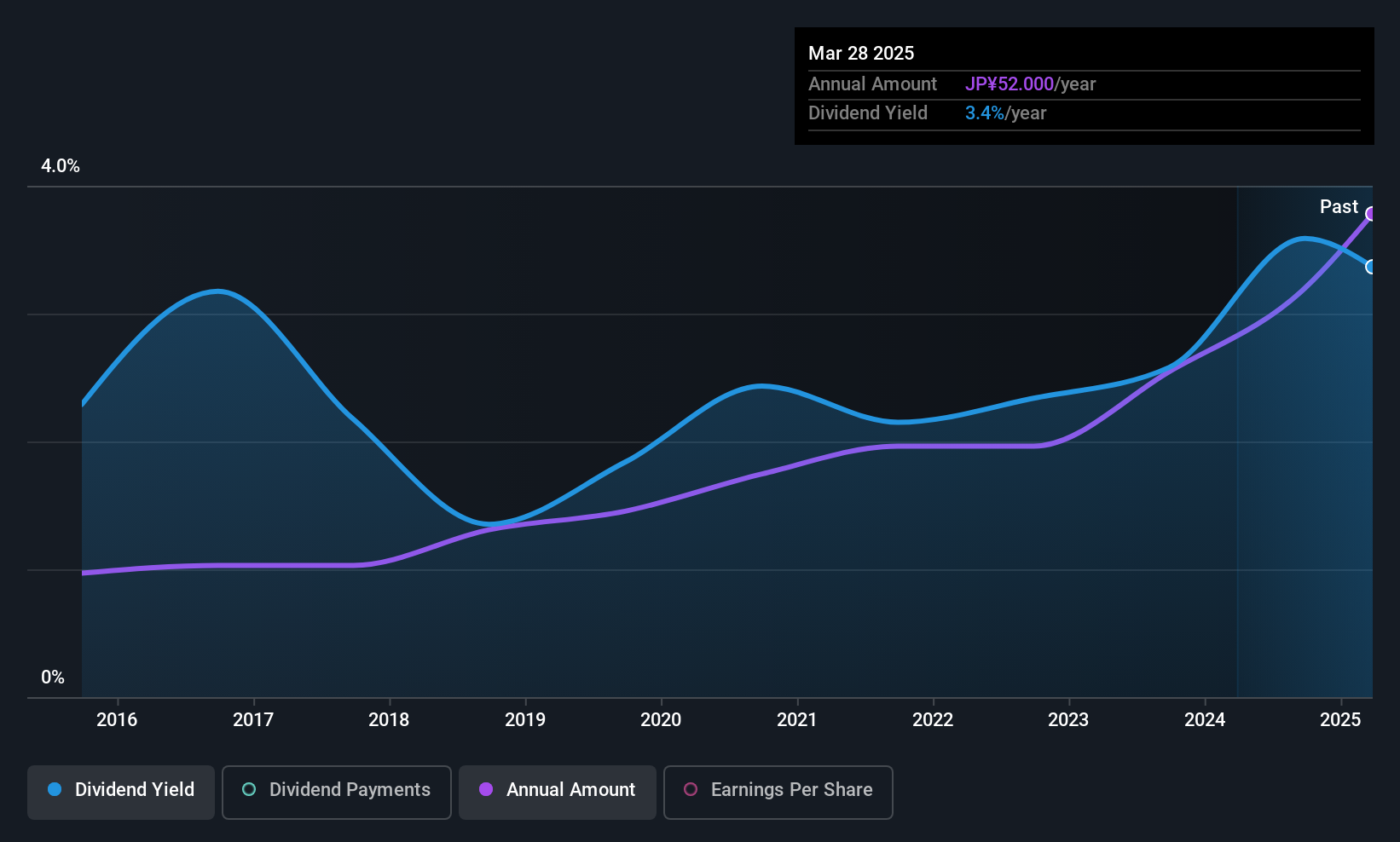

CMC (TSE:2185)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CMC Corporation, along with its subsidiaries, offers manual creation, business process management, training, translation, and interpretation services in Japan and has a market cap of ¥18.50 billion.

Operations: CMC Corporation generates revenue through its core services of manual creation, business process management, training, translation, and interpretation within Japan.

Dividend Yield: 4%

CMC Corporation's dividend yield of 3.95% is below the top tier in Japan, and while dividends have been stable over the past decade, they are not covered by free cash flows. Despite a low payout ratio of 27.7%, reliance on non-cash earnings raises concerns about sustainability. Recent guidance projects robust earnings growth with JPY 1,850 million profit expected for fiscal year ending September 2025, alongside a confirmed JPY 24 per share dividend for Q2 scheduled for June payment.

- Delve into the full analysis dividend report here for a deeper understanding of CMC.

- Our expertly prepared valuation report CMC implies its share price may be too high.

Seize The Opportunity

- Take a closer look at our Top Asian Dividend Stocks list of 1251 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2185

CMC

Provides manual creation, business process management, training, translation, and interpretation services in Japan.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives