- Japan

- /

- Professional Services

- /

- TSE:2170

Undiscovered Gems Three Promising Small Caps with Strong Potential

Reviewed by Simply Wall St

In the midst of global market volatility, with U.S. stocks ending lower due to tariff uncertainties and mixed economic indicators, small-cap stocks present a unique opportunity for investors seeking growth potential. As the S&P 600 index navigates these challenges, identifying promising small-cap companies that demonstrate resilience and adaptability can be key to uncovering hidden gems in today's dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Taiyo KagakuLtd | 0.73% | 4.83% | -2.64% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Nestlé Pakistan | 40.95% | 14.04% | 17.18% | ★★★★★☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Guangdong AVCiT Technology Holding (SZSE:001229)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong AVCiT Technology Holding Co., Ltd. operates in the technology sector and has a market capitalization of CN¥3.79 billion.

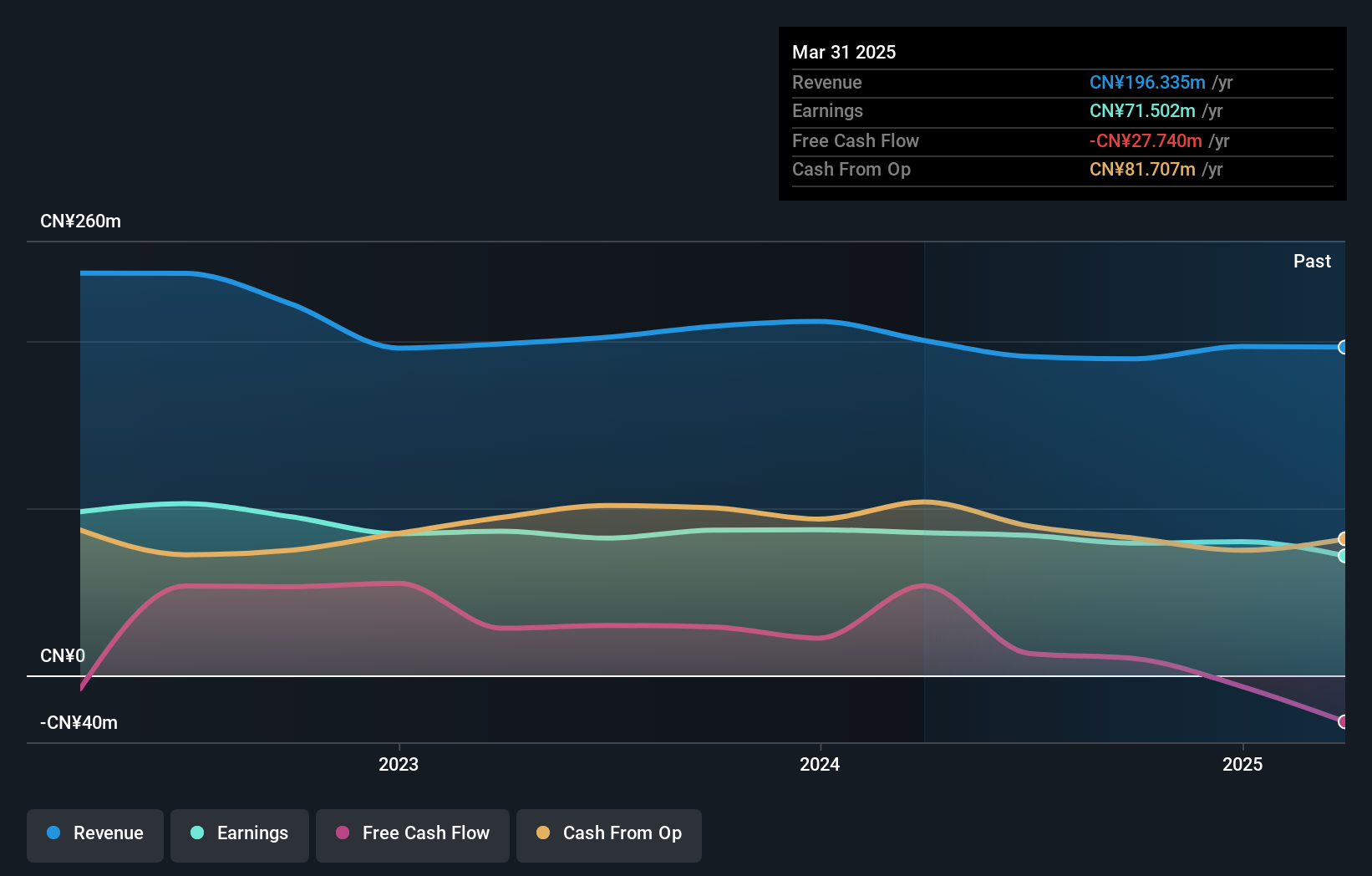

Operations: Guangdong AVCiT Technology Holding generates revenue primarily from its technology-related operations. The company's financial performance is highlighted by a net profit margin of 15.6%.

Guangdong AVCiT Technology Holding, a nimble player in the tech sector, boasts a debt-free balance sheet and maintains positive free cash flow. Despite its high-quality earnings, the company experienced negative earnings growth of 9% over the past year, which is steeper than the Communications industry average of 3%. With a price-to-earnings ratio at 49.8x, it remains attractively valued compared to its industry peers averaging 73.4x. Recent volatility in share price might concern some investors but could also present opportunities for those with an appetite for risk. The upcoming shareholder meeting may bring strategic updates worth monitoring closely.

- Delve into the full analysis health report here for a deeper understanding of Guangdong AVCiT Technology Holding.

Understand Guangdong AVCiT Technology Holding's track record by examining our Past report.

All Ring Tech (TPEX:6187)

Simply Wall St Value Rating: ★★★★★☆

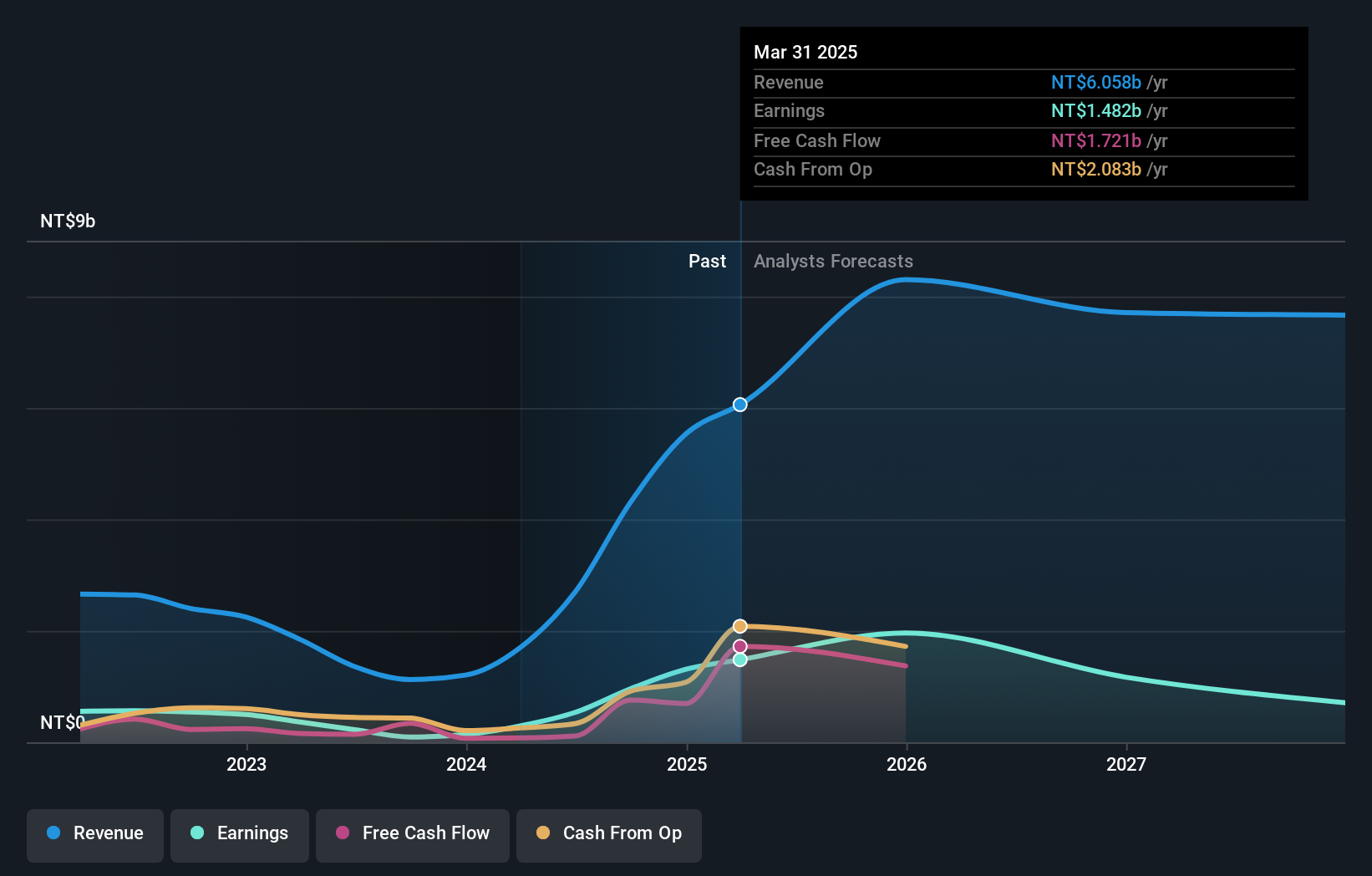

Overview: All Ring Tech Co., Ltd. specializes in the design, manufacture, and assembly of automation machines in Taiwan and China, with a market cap of NT$38.15 billion.

Operations: All Ring Tech generates revenue primarily from All Ring Technology Co., Ltd. and WAN Run Jing Ji Co., Ltd., contributing NT$4.40 billion and NT$684.53 million, respectively. The company's financial performance is influenced by internal segment transactions amounting to -NT$852.20 million, impacting its overall revenue structure.

All Ring Tech, a smaller player in the electronics space, has caught attention with its remarkable earnings growth of 906% over the past year, outpacing the industry's 6.6%. Despite recent share price volatility, it trades at a significant discount of 40.6% below estimated fair value. The company is profitable and covers interest payments comfortably, indicating financial stability. However, shareholders faced dilution last year while debt to equity rose to 7.6% over five years. Upcoming presentations at major conferences suggest proactive engagement with investors and potential for future visibility improvements in this dynamic sector.

- Click to explore a detailed breakdown of our findings in All Ring Tech's health report.

Gain insights into All Ring Tech's historical performance by reviewing our past performance report.

Link and Motivation (TSE:2170)

Simply Wall St Value Rating: ★★★★★★

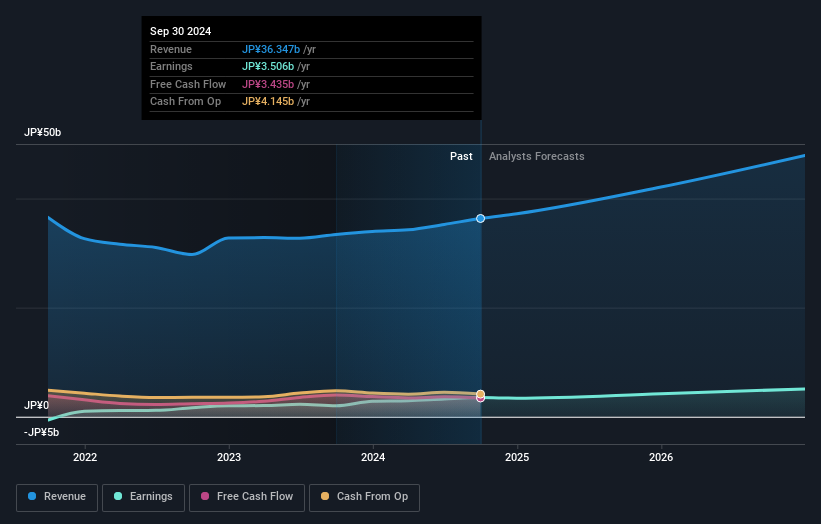

Overview: Link and Motivation Inc. offers consulting and cloud services in Japan, with a market capitalization of ¥54.38 billion.

Operations: Link and Motivation generates revenue primarily from its Matching Division, contributing ¥16.35 billion, followed by the Organization Development Division at ¥14.16 billion. The Individual Development Division adds ¥6.48 billion to the total revenue stream.

Link and Motivation, a consulting and cloud services provider in Japan, is eyeing growth through its Motivation Cloud series and strategic alliances aimed at Southeast Asia expansion. With earnings growing by 73.9% over the past year, they outpaced the Professional Services industry’s 10.8% growth. The company has a satisfactory net debt to equity ratio of 15.7%, reflecting strong financial health alongside high-quality past earnings. Analysts anticipate revenue growth of 12.9% annually over three years with profit margins increasing from 9.6% to 11%. However, rising personnel costs and competitive pressures could pose challenges to these projections.

Next Steps

- Investigate our full lineup of 4710 Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2170

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)