- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6850

Asian Dividend Stocks To Consider Now

Reviewed by Simply Wall St

As global markets react positively to the recent U.S.-China tariff suspension, Asian equities have shown resilience, with Chinese and Japanese indices experiencing notable gains. In this environment, dividend stocks in Asia can be an attractive consideration for investors seeking income stability amid fluctuating trade dynamics.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| en-japan (TSE:4849) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.90% | ★★★★★★ |

| Daicel (TSE:4202) | 5.07% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.93% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.09% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.70% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.11% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.98% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.47% | ★★★★★★ |

Click here to see the full list of 1248 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

JAC Recruitment (TSE:2124)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: JAC Recruitment Co., Ltd. offers recruitment consultancy services in Japan and has a market cap of ¥142.79 billion.

Operations: JAC Recruitment Co., Ltd.'s revenue primarily comes from its recruitment consultancy services in Japan.

Dividend Yield: 3.5%

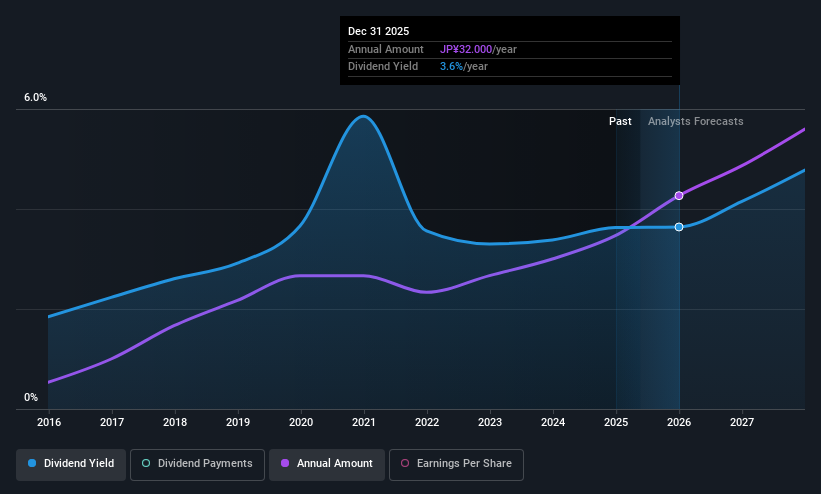

JAC Recruitment has demonstrated reliable and stable dividend growth over the past decade, with recent guidance indicating a further increase to ¥32.00 per share from ¥26.00 last year. The company's dividends are well-covered by both earnings and cash flows, boasting payout ratios of 64.1% and 65.9%, respectively. Despite its current dividend yield of 3.54% being slightly below Japan's top quartile, JAC is trading at a notable discount to its estimated fair value, enhancing its attractiveness for dividend investors seeking stability in Asia's markets.

- Delve into the full analysis dividend report here for a deeper understanding of JAC Recruitment.

- Our valuation report unveils the possibility JAC Recruitment's shares may be trading at a discount.

Chino (TSE:6850)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chino Corporation manufactures and sells instrumentation and control equipment, with a market cap of ¥19.01 billion.

Operations: Chino Corporation's revenue is primarily derived from its instrumentation and control equipment business.

Dividend Yield: 3.1%

Chino Corporation's dividend payments have shown volatility over the past decade, yet recent announcements indicate a positive trend with an increase to ¥55.00 per share for fiscal 2025 and a forecasted rise to ¥60.00 for fiscal 2026. Despite its low dividend yield of 3.13% compared to Japan's top quartile, Chino offers good value trading at a significant discount below its estimated fair value, with dividends well-covered by earnings and cash flows due to low payout ratios around 34%.

- Navigate through the intricacies of Chino with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Chino is priced lower than what may be justified by its financials.

Evergreen International Storage & Transport (TWSE:2607)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Evergreen International Storage & Transport Corporation, along with its subsidiaries, offers inland container transport and container terminal operations in Taiwan, America, and internationally, with a market cap of NT$36.18 billion.

Operations: Evergreen International Storage & Transport Corporation generates revenue through its inland container transport and container terminal operations across Taiwan, America, and various international markets.

Dividend Yield: 3.8%

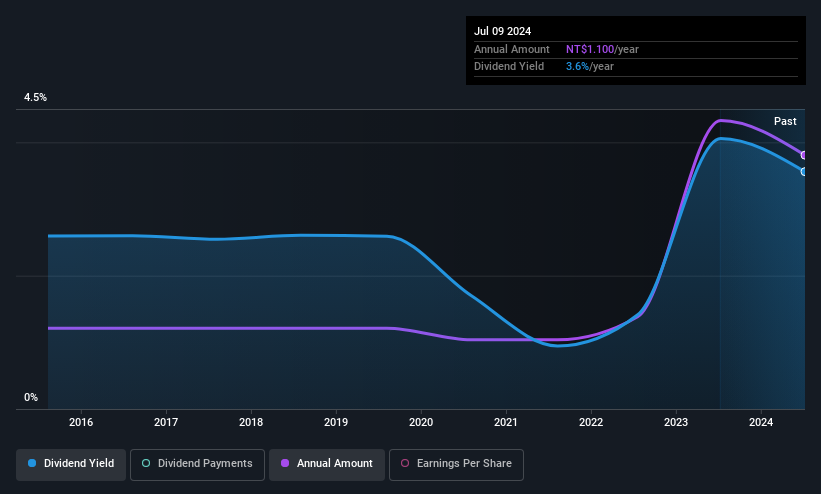

Evergreen International Storage & Transport's dividends are well-supported, with a payout ratio of 44.3% and a cash payout ratio of 37.7%, ensuring coverage by both earnings and cash flows. While its dividend yield of 3.83% is below Taiwan's top quartile, the company consistently delivers stable and growing dividends over the past decade. Recent earnings growth, with Q1 net income rising to TWD 919.88 million, further underpins its dividend reliability amidst trading at a discount to fair value estimates.

- Click here and access our complete dividend analysis report to understand the dynamics of Evergreen International Storage & Transport.

- The valuation report we've compiled suggests that Evergreen International Storage & Transport's current price could be quite moderate.

Where To Now?

- Reveal the 1248 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6850

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives