- Japan

- /

- Consumer Durables

- /

- TSE:3271

3 Reliable Dividend Stocks Offering Up To 5.9% Yield

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results and a Federal Reserve rate cut, investors are witnessing record highs in major benchmarks like the S&P 500, driven by optimism surrounding potential economic growth and tax reforms. In this environment of fluctuating yields and evolving fiscal policies, dividend stocks present an appealing option for those seeking steady income; they offer not only potential returns through dividends but also a measure of stability amid market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.21% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.81% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.52% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.15% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.43% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

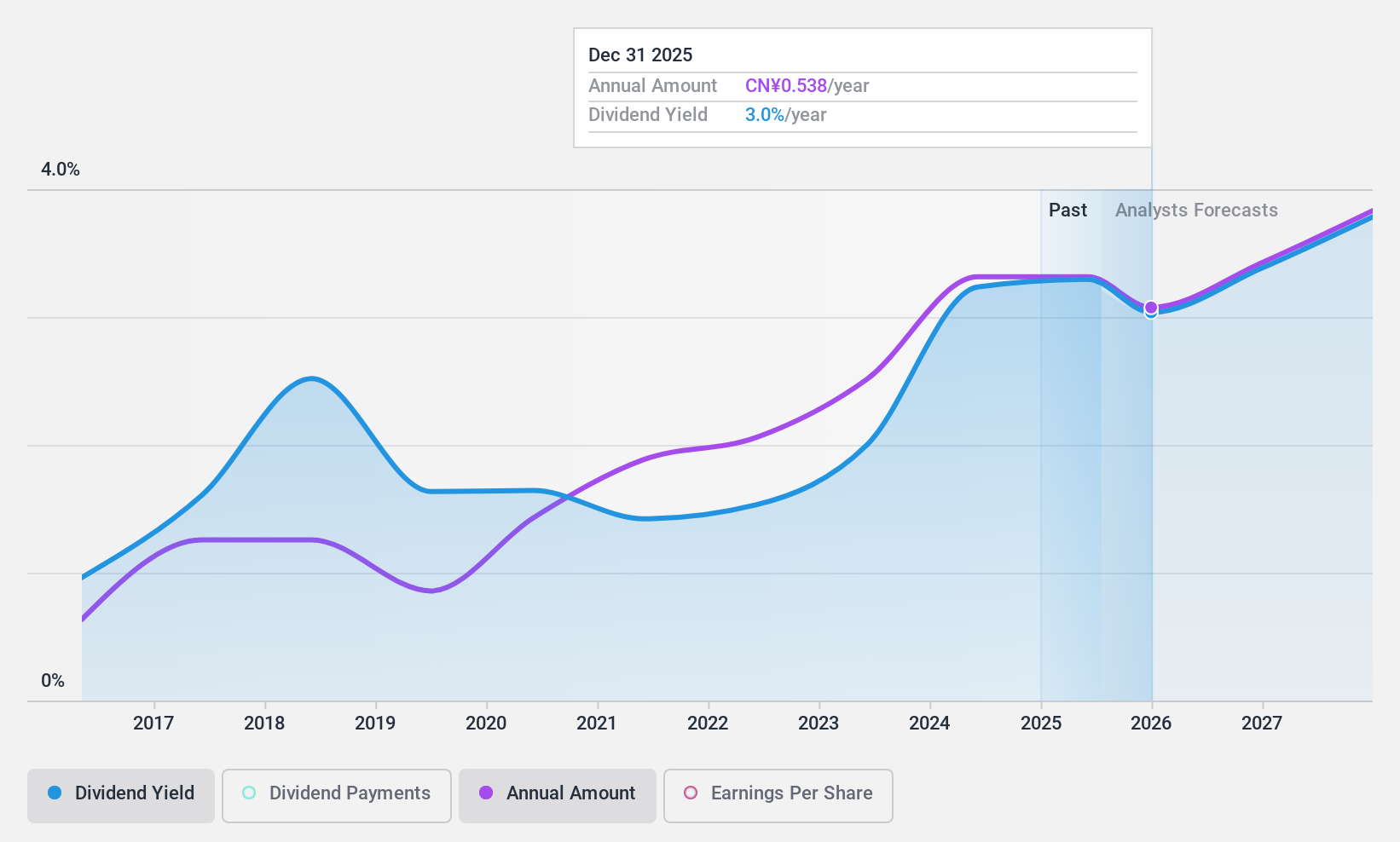

Shanghai Hanbell Precise Machinery (SZSE:002158)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shanghai Hanbell Precise Machinery Co., Ltd. (SZSE:002158) operates in the manufacturing sector, specializing in the production of compressors and related machinery, with a market cap of CN¥10.31 billion.

Operations: Unfortunately, the Business operations text provided does not contain detailed information about Shanghai Hanbell Precise Machinery's revenue segments.

Dividend Yield: 3%

Shanghai Hanbell Precise Machinery's dividends are well-covered by earnings with a payout ratio of 34.2%, and cash flows cover the dividend with a 51% cash payout ratio, suggesting sustainability. Despite its attractive valuation, trading at 66% below estimated fair value, the company has an unreliable dividend history due to past volatility. However, its current yield is in the top 25% of CN market payers and recent earnings growth supports future payouts.

- Navigate through the intricacies of Shanghai Hanbell Precise Machinery with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Shanghai Hanbell Precise Machinery shares in the market.

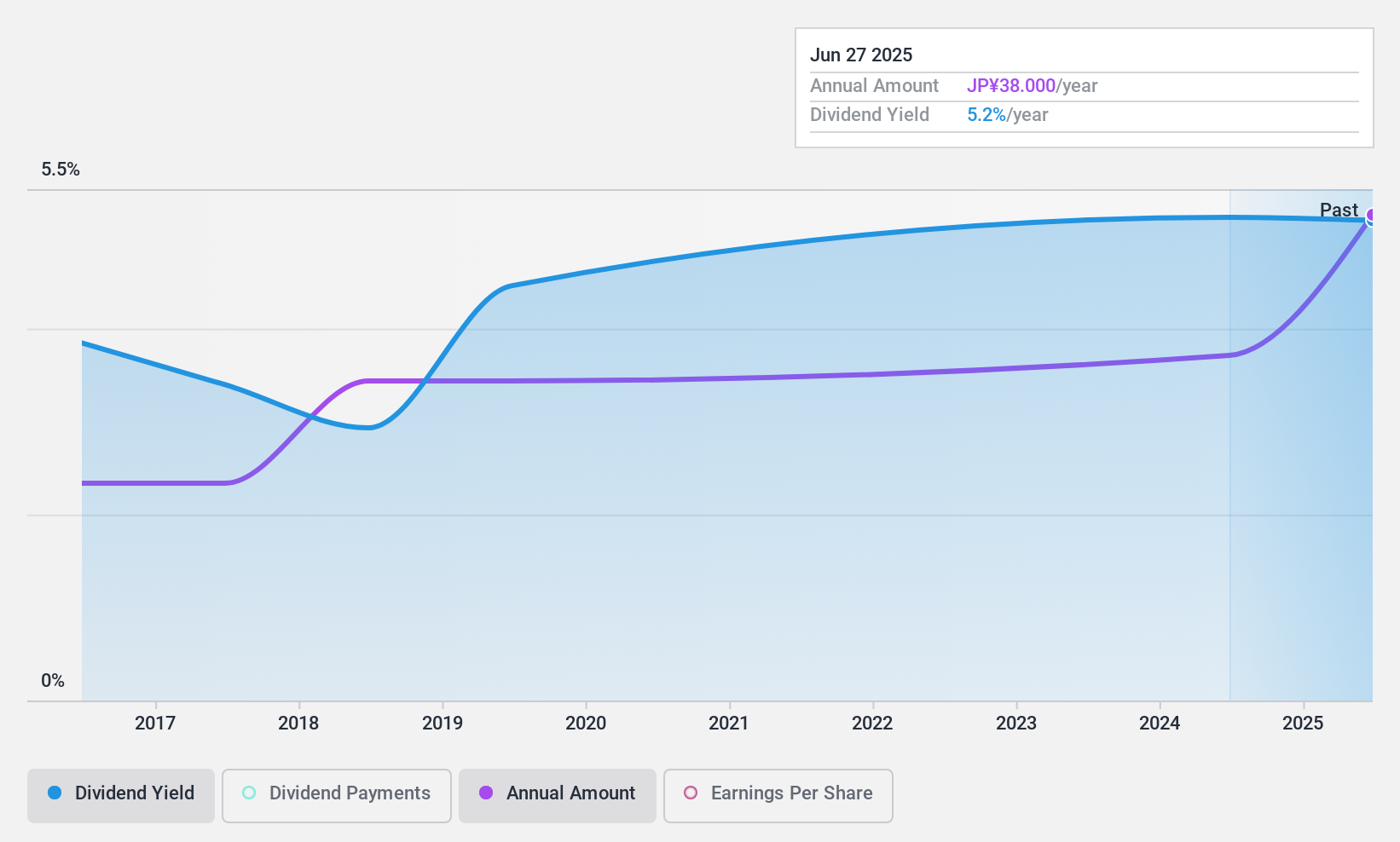

Global (TSE:3271)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Global Ltd., with a market cap of ¥18.06 billion, operates through its subsidiaries in Japan, focusing on the development of condominiums, apartment complexes, earning properties, commercial facilities, hotels, and various other properties.

Operations: Global Ltd.'s revenue segments include the development of condominiums, apartment complexes, earning properties, commercial facilities, and hotels in Japan.

Dividend Yield: 6%

Global's dividend yield of 5.96% ranks in the top 25% of the JP market, yet its sustainability is questionable due to a lack of free cash flows covering payouts. Although earnings grew by 48.6% last year and the payout ratio is a low 27.1%, past dividend volatility and an unstable share price present risks for investors seeking reliable income. The stock's attractive valuation with a P/E ratio of 6x may appeal despite these concerns.

- Delve into the full analysis dividend report here for a deeper understanding of Global.

- Our comprehensive valuation report raises the possibility that Global is priced higher than what may be justified by its financials.

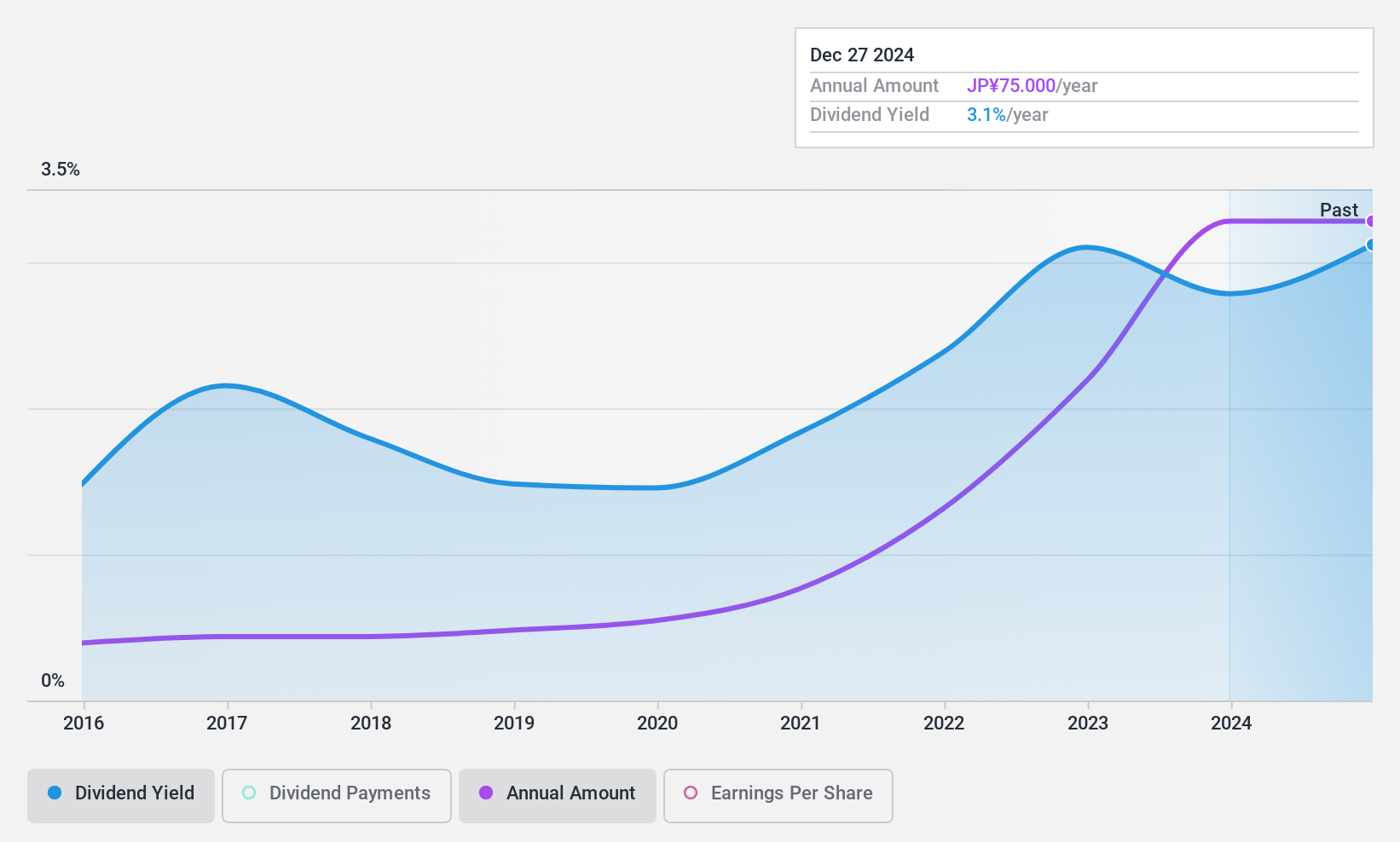

CTI Engineering (TSE:9621)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CTI Engineering Co., Ltd. is a consulting engineering company that operates both in Japan and internationally, with a market cap of ¥65.65 billion.

Operations: CTI Engineering Co., Ltd. generates revenue from its Domestic Consulting Engineering Business, amounting to ¥65.95 billion, and its Overseas Consulting Engineering Business, contributing ¥30.33 billion.

Dividend Yield: 3.2%

CTI Engineering's dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 29.2%. However, the lack of free cash flow raises concerns about sustainability despite reliable earnings coverage. The company's P/E ratio of 9.2x suggests it is undervalued compared to the JP market average. Recent board discussions on acquiring Hiroken consultants could impact future financials and dividend strategies.

- Unlock comprehensive insights into our analysis of CTI Engineering stock in this dividend report.

- The valuation report we've compiled suggests that CTI Engineering's current price could be inflated.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1940 Top Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3271

Global

Through its subsidiaries, engages in the development of condominiums, apartment complexes, earning properties, commercial facilities, hotels, and various other properties in Japan.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives