- Japan

- /

- Trade Distributors

- /

- TSE:8058

What Mitsubishi (TSE:8058)'s Completion of Its Major Share Buyback Means for Shareholders

Reviewed by Sasha Jovanovic

- Between July 1 and September 30, 2025, Mitsubishi completed its previously announced share buyback, repurchasing 73,862,500 shares, or 1.92% of outstanding shares, for ¥230,846 million, bringing the total under the program to 213,749,711 shares bought for ¥578.16 billion.

- This sizeable buyback, equal to 5.44% of the company’s shares, represents a substantial capital allocation toward shareholder returns and may signal management’s confidence in future earnings.

- Now, we'll explore how Mitsubishi's completed buyback informs its outlook for capital allocation and shareholder value creation.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Mitsubishi Investment Narrative Recap

To be a Mitsubishi shareholder, I believe in the company's ability to balance robust capital returns with disciplined long-term portfolio management, especially amid cyclical headwinds in global resource markets. The just-completed buyback should support near-term per-share metrics but does not, by itself, meaningfully offset the most significant short-term risk, continued earnings volatility tied to commodity prices and slower growth in core industrial segments.

The company’s recent decision to increase its dividend for the fiscal year ending March 2026 directly complements its large buyback program, reinforcing a consistent focus on shareholder returns. This aligns with management’s ongoing efforts to generate value through capital allocation, though underlying profit trends and sector exposures remain key catalysts for future performance.

In contrast, the real test for investor confidence is how Mitsubishi manages persistent margin pressure from weak resource prices...

Read the full narrative on Mitsubishi (it's free!)

Mitsubishi's outlook anticipates ¥19,785.2 billion in revenue and ¥915.4 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 2.9% and an increase in earnings of ¥115.9 billion from the current ¥799.5 billion.

Uncover how Mitsubishi's forecasts yield a ¥3405 fair value, a 5% downside to its current price.

Exploring Other Perspectives

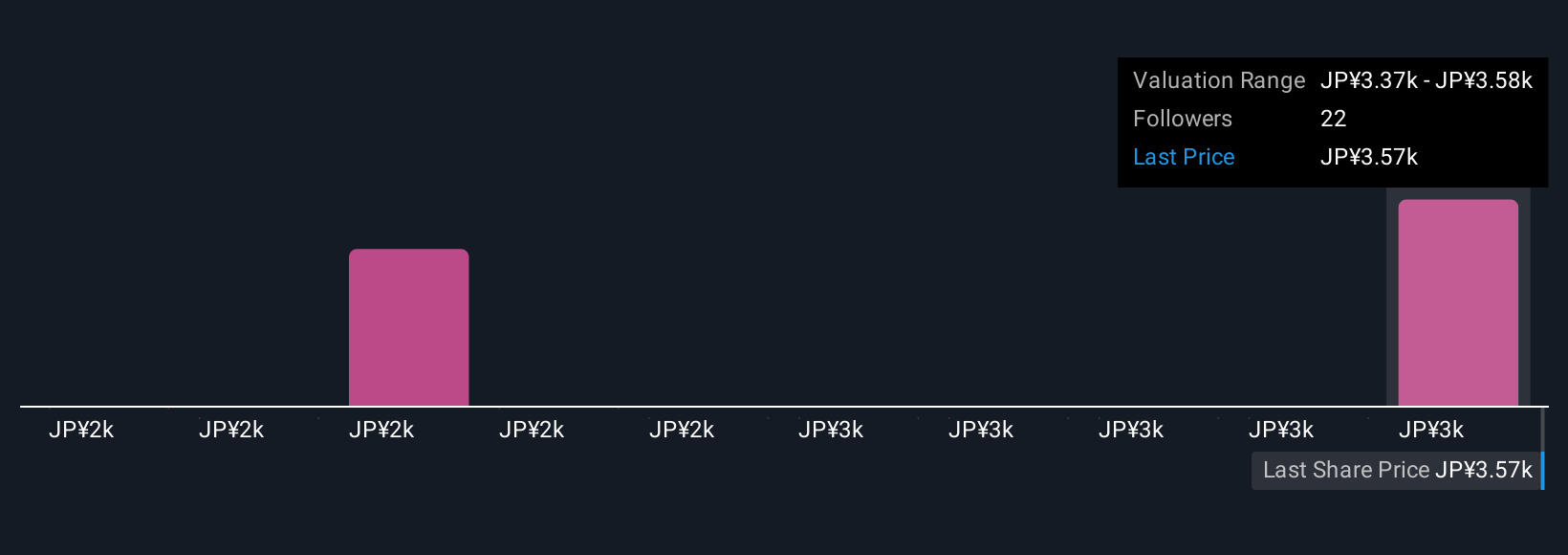

Five members of the Simply Wall St Community placed Mitsubishi’s fair value between ¥1,520 and ¥3,578 per share, spanning a wide valuation spectrum. While many see capital allocation as a key catalyst, cash flow exposure to commodity cycles could weigh on sustained performance, so exploring other perspectives is essential.

Explore 5 other fair value estimates on Mitsubishi - why the stock might be worth less than half the current price!

Build Your Own Mitsubishi Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Mitsubishi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8058

Mitsubishi

Engages in the global environment and energy, material solutions, metal resources, social infrastructure, mobility, food industry, SLC, and power solutions businesses in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives