Last Update 30 Nov 25

Fair value Increased 0.50%8058: Recent Buyback And Expanding Partnerships Will Shape Future Outlook

Analysts have slightly raised their price target for Mitsubishi, moving it from ¥3,462.20 to ¥3,479.34. They cite modest improvements in profit margins and updated valuation metrics.

What's in the News

- Mitsubishi, through its subsidiary Japan Entertainment One Inc., is launching the "Gacha & Catch" pop-up arcade experience with TOMY and SEGA in Santa Monica, California. The event will feature over 100 gacha machines, more than 300 exclusive prizes, and special launch events on November 22-23, 2025 (Key Developments).

- Wheeler Bio has entered a strategic partnership with Mitsubishi Corporation to expand business development across the Asia-Pacific. Mitsubishi is investing in Wheeler's Series A-1 financing and will serve as Wheeler's exclusive commercialization partner in the region (Key Developments).

- Between July 1 and September 30, 2025, Mitsubishi completed a buyback of 73,862,500 shares, representing 1.92% of shares outstanding and totaling ¥230,846 million. This marks the completion of a broader repurchase initiative (Key Developments).

Valuation Changes

- Consensus analyst price target has risen slightly, moving from ¥3,462.20 to ¥3,479.34.

- Discount rate increased marginally from 6.83% to approximately 6.85%.

- Revenue growth estimate dipped slightly, changing from 4.48% to 4.46%.

- Net profit margin improved modestly, rising from 4.71% to 4.73%.

- Future P/E ratio declined, moving from 14.68x to 14.06x.

Key Takeaways

- Strategic investments in energy transition, food sectors, and digital transformation position Mitsubishi for recurring revenue growth and improved margins.

- Active portfolio optimization and capital allocation support stronger earnings, enhanced operational efficiency, and higher returns to shareholders.

- Exposure to volatile commodity markets, underperforming legacy assets, and slow diversification threaten profitability, cash flow, and long-term shareholder value.

Catalysts

About Mitsubishi- Engages in the global environment and energy, material solutions, metal resources, social infrastructure, mobility, food industry, SLC, and power solutions businesses in Japan and internationally.

- Significant strategic investments and first shipments in LNG, renewable fuels, and expansion in seafood/farming position Mitsubishi to benefit from global energy transition and rising food demand, supporting future revenue and earnings growth.

- Active capital recycling and selective divestitures of lower-margin businesses align the portfolio toward higher-margin and recurring revenue streams, likely to enhance net margins and improve return on equity over the medium term.

- Expansion into international food and consumer supply chains (e.g., Cermaq and Thai Union Group) utilizes Mitsubishi's global distribution strength to build stable, recurring revenue, countering cyclical downturns and supporting long-term revenue growth.

- Comprehensive digital transformation efforts across business lines are expected to streamline operations and facilitate the creation of new data-driven business opportunities, driving cost efficiencies and margin improvement.

- Rapid progress on capital allocation plans, robust financial flexibility, and a large share buyback program indicate confidence in sustained earnings and cash flow growth, which will likely support stronger earnings per share and investor returns.

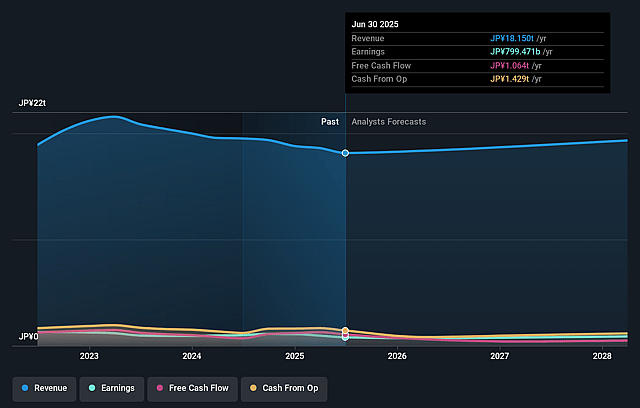

Mitsubishi Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Mitsubishi's revenue will grow by 2.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.4% today to 4.6% in 3 years time.

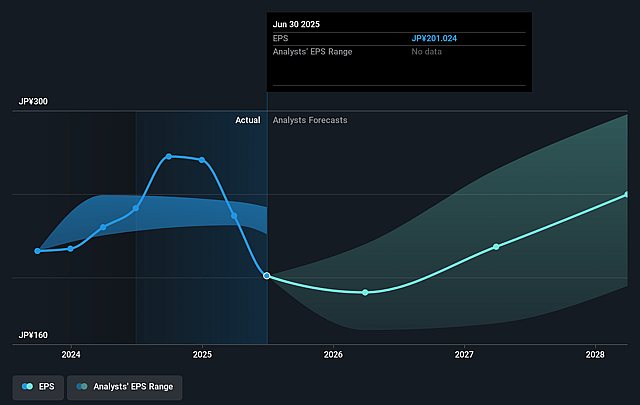

- Analysts expect earnings to reach ¥915.4 billion (and earnings per share of ¥260.51) by about September 2028, up from ¥799.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥1050.0 billion in earnings, and the most bearish expecting ¥768.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.1x on those 2028 earnings, down from 16.0x today. This future PE is greater than the current PE for the GB Trade Distributors industry at 9.8x.

- Analysts expect the number of shares outstanding to decline by 3.48% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.11%, as per the Simply Wall St company report.

Mitsubishi Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Declining commodity market prices, particularly in the Australian steelmaking coal, iron ore, and copper businesses, resulted in substantial year-on-year decreases in both underlying operating cash flow and net income, highlighting Mitsubishi's vulnerability to downtrends in global resource and energy markets, which could depress future revenues and earnings.

- Mitsubishi's continued reliance on cyclical, capital-intensive sectors such as LNG and mineral resources exposes the company to pronounced earnings volatility and pressure on net margins during commodity price downturns, as evidenced by significant declines in segment results this quarter.

- Despite new investments and acquisitions to diversify, slow or lower-than-expected returns from expansion into renewable energy, seafood, and overseas infrastructure could limit medium

- to long-term improvement in earnings and return on equity, particularly as legacy business lines underperform.

- Ongoing decreases in dividend income from core segments (such as Asia Pacific LNG and North American real estate and energy infrastructure) signal weaker profitability and cash flow generation from existing assets, potentially undermining Mitsubishi's ability to sustain shareholder returns and fund future growth.

- The complex conglomerate structure and active capital reallocation (including large share buybacks and frequent reinvestment/divestment cycles) increase the risk of inefficient capital allocation and persistent conglomerate discount, which can weigh on long-term share price multiples and investor confidence.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥3079.288 for Mitsubishi based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥3700.0, and the most bearish reporting a price target of just ¥2500.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥19785.2 billion, earnings will come to ¥915.4 billion, and it would be trading on a PE ratio of 14.1x, assuming you use a discount rate of 7.1%.

- Given the current share price of ¥3359.0, the analyst price target of ¥3079.29 is 9.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.