Key Takeaways

- Substantial cash flow and low leverage give Mitsubishi significant flexibility to boost shareholder returns through buybacks, dividends, acquisitions, and growth initiatives.

- Strategic moves in global supply chains, vertical integration, and digital innovation are set to drive sustainable growth and margin expansion beyond current expectations.

- Heavy commodity exposure, complex conglomerate structure, and fossil fuel focus expose Mitsubishi to market volatility, decarbonization risks, integration challenges, and margin pressure from industry disruptions.

Catalysts

About Mitsubishi- Engages in the global environment and energy, material solutions, metal resources, social infrastructure, mobility, food industry, SLC, and power solutions businesses in Japan and internationally.

- While analyst consensus expects strong shareholder returns from the buyback program, the current pace and substantial cash flow generation suggest Mitsubishi could deploy even greater capital to buybacks and dividends than forecast, providing significant outperformance in earnings per share and investor returns over the next several years.

- Analysts broadly agree that Mitsubishi's expansion in LNG, renewables, and food supply chains positions it for steady growth, yet the company's aggressive global investments and vertical integration moves such as full control of Mitsubishi Shokuhin and the Cermaq/Thai Union Group buildup could accelerate top-line growth and drive sustainable margin expansion well beyond current projections.

- The company's disciplined use of financial leverage, with net debt-to-equity far below target levels, allows for substantial upside optionality: rapid acceleration of strategic acquisitions or organic growth investments may deliver outsized gains to both revenue and net income, especially if market conditions improve.

- As global trade patterns shift from just-in-time to just-in-case inventory models, Mitsubishi's dominant trading and logistics platform is set to capture outsize market share in commodity and consumer supply chains, potentially supporting higher long-term recurring revenue and boosting group net margins.

- Pioneering the integration of advanced digital supply chain solutions within its legacy resource and trading businesses, Mitsubishi is uniquely positioned to unlock new high-margin revenue streams from data-driven logistics, automated trading, and AI-optimized resource allocation, accelerating both profit margins and long-term earnings growth.

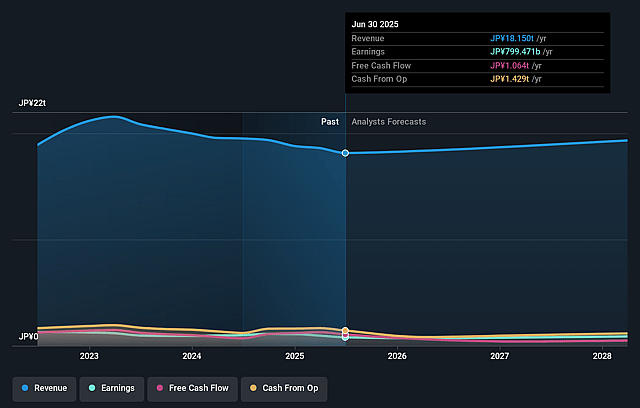

Mitsubishi Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Mitsubishi compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Mitsubishi's revenue will grow by 4.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.4% today to 5.2% in 3 years time.

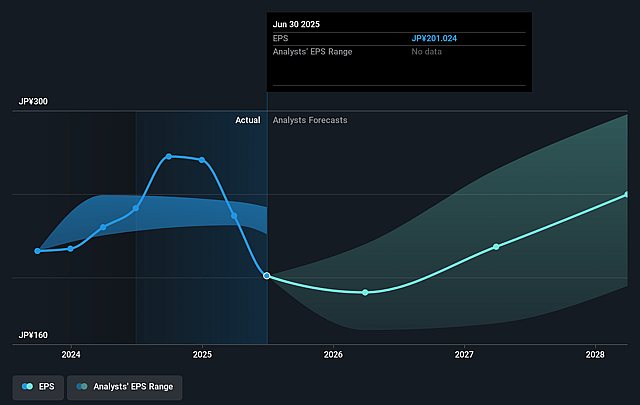

- The bullish analysts expect earnings to reach ¥1077.3 billion (and earnings per share of ¥309.14) by about September 2028, up from ¥799.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.4x on those 2028 earnings, which is the same as it is today today. This future PE is greater than the current PE for the GB Trade Distributors industry at 10.0x.

- Analysts expect the number of shares outstanding to decline by 3.48% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.08%, as per the Simply Wall St company report.

Mitsubishi Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Declining dividends and market prices in key resource segments, such as lower dividend income from LNG and iron ore, and decreasing prices in the Australian coal business, highlight the risks of Mitsubishi's high exposure to volatile commodities, which can significantly reduce both revenue and net margins during downturns.

- The company's capital is still being heavily allocated toward the LNG business and fossil fuel projects, such as the Malaysia LNG Dua and LNG Canada projects, leaving Mitsubishi vulnerable to long-term global decarbonization efforts that may diminish asset values and impair future earnings.

- Mitsubishi's conglomerate structure creates complexity in integrating and realizing value from new acquisitions and business pillars, such as the salmon farming and seafood affiliate investments, which could limit long-term earnings-per-share growth and reduce return on invested capital.

- Rising geopolitical tensions and protectionist trends threaten the stability of Mitsubishi's international trading and supply chain operations, which could result in higher operational costs and disruption of group revenues.

- Industry-wide shifts toward direct-to-consumer business models and increasing technological disruption, notably the automation of distribution, could compress Mitsubishi's margins in core trading businesses, further eroding group revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Mitsubishi is ¥4200.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Mitsubishi's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥4200.0, and the most bearish reporting a price target of just ¥2500.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ¥20683.0 billion, earnings will come to ¥1077.3 billion, and it would be trading on a PE ratio of 16.4x, assuming you use a discount rate of 7.1%.

- Given the current share price of ¥3453.0, the bullish analyst price target of ¥4200.0 is 17.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.