Key Takeaways

- Ongoing reliance on fossil fuels and commodities risks impairments and exposes earnings to regulatory, technological, and market transitions toward renewables.

- Heightened geopolitical tensions, protectionism, and digital disruption threaten the stability and growth of Mitsubishi's global trading and supply chain operations.

- Aggressive capital allocation, energy transition investments, portfolio optimization, and diversification strategies underpin Mitsubishi's long-term financial resilience, growth, and ability to capture emerging market opportunities.

Catalysts

About Mitsubishi- Engages in the global environment and energy, material solutions, metal resources, social infrastructure, mobility, food industry, SLC, and power solutions businesses in Japan and internationally.

- Heavy legacy exposure to fossil fuel assets, including recent reinvestments such as the Malaysia LNG project and the launch of LNG Canada, risks significant asset write-downs as the world rapidly accelerates towards renewables; this could drive future impairments and compress net margins.

- Intensifying global decarbonization efforts, including mounting regulatory penalties for carbon-intensive investments and tougher financing conditions, threaten profit sustainability across Mitsubishi's core mineral resources and energy segments, directly pressuring long-term earnings and revenue stability.

- Rising protectionism and escalating geopolitical frictions in critical regions such as Asia-Pacific and North America put Mitsubishi's global trading and supply chain operations at risk, increasing the chances of operational disruptions and slumping trade volumes, which are likely to stymie top-line growth.

- Accelerating digital transformation and adoption of blockchain-enabled trading platforms threaten to disintermediate traditional trading houses, including Mitsubishi, eroding their intermediary role and shrinking transactional revenue streams over the long term.

- Slower reallocation away from cyclical, volatile commodity businesses toward higher-return and less exposed areas could leave Mitsubishi's future cash flows exposed to ongoing commodity price downturns, further suppressing group net earnings and weakening free cash flow outlook.

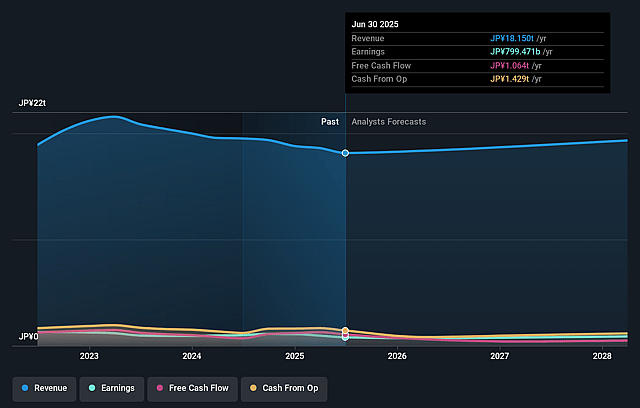

Mitsubishi Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Mitsubishi compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Mitsubishi's revenue will decrease by 0.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 4.4% today to 4.3% in 3 years time.

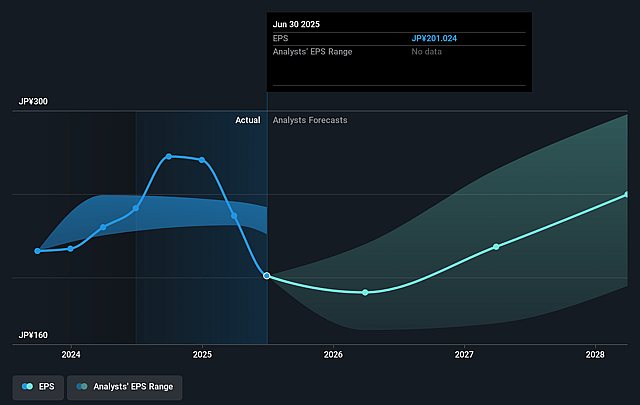

- The bearish analysts expect earnings to reach ¥788.0 billion (and earnings per share of ¥202.33) by about September 2028, down from ¥799.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.3x on those 2028 earnings, down from 16.4x today. This future PE is greater than the current PE for the GB Trade Distributors industry at 10.0x.

- Analysts expect the number of shares outstanding to decline by 3.48% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.08%, as per the Simply Wall St company report.

Mitsubishi Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Mitsubishi's continuation of aggressive capital allocation, including a share buyback program up to ¥1 trillion and total shareholder returns projected at ¥1.5 trillion for FY 2025, demonstrates management's commitment to enhancing shareholder value, which can support share price stability or growth through improved earnings per share and investor sentiment.

- The company's successful launch of the LNG Canada project and expanded investments in renewable fuels and green energy initiatives, such as the partnership with ENEOS in Hawaii, position Mitsubishi to capitalize on global decarbonization and energy transition trends, supporting long-term revenue and margin expansion as demand for sustainable solutions rises.

- Strategic acquisitions in food and seafood sectors, including Cermaq's expansion and the intended equity stake in Thai Union Group, diversify Mitsubishi's earnings streams and support resilience against cyclical downturns in commodity and energy markets, underpinning robust top-line growth over time.

- The implementation of the Enhance, Reshape, and Create corporate strategy, with a focus on portfolio optimization, capital recycling, and leveraging synergies among core business units, is likely to improve operating cash flow and net margins through more efficient asset deployment and higher-return investments.

- Strong balance sheet discipline, as evidenced by a low net debt-to-equity ratio of 0.38 times compared to a ceiling of 0.6 times, ensures Mitsubishi has ample leverage capacity, enabling it to seize new investment opportunities and navigate adverse market conditions, thereby safeguarding long-term earnings and financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Mitsubishi is ¥2500.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Mitsubishi's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥4200.0, and the most bearish reporting a price target of just ¥2500.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ¥18444.8 billion, earnings will come to ¥788.0 billion, and it would be trading on a PE ratio of 13.3x, assuming you use a discount rate of 7.1%.

- Given the current share price of ¥3453.0, the bearish analyst price target of ¥2500.0 is 38.1% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.